Navy Federal Credit Union 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

48

2013 ANNUAL REPORT

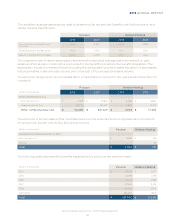

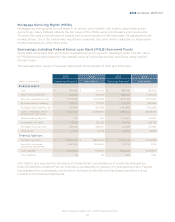

fluctuations on a period-by-period basis. Fair value less costs to sell is an estimated value based on

relevant recent historical data that are considered unobservable inputs, and as such, REO is classified

as Level 3 in the fair value hierarchy and valued on a non-recurring basis.

During the holding period, BPOs are updated to reflect changes in fair value, and the REO is carried at

the lower of the amount recorded at acquisition date or estimated fair value less costs to sell. Holding

costs such as insurance, maintenance, taxes, and utility costs are expensed as incurred. Navy Federal

markets the REO properties for sale to the public and generally does not hold properties for longer than

one year. Valuation adjustments on these assets as well as gains or losses realized from disposition of

such properties are reflected in Other non-interest expense on the Consolidated Statements of Income.

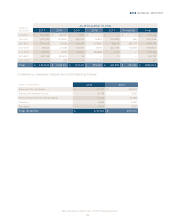

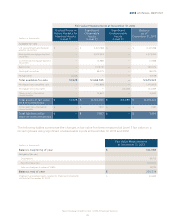

The tables below present the items recognized at fair value on the Consolidated Statements of Financial

Condition on a recurring basis at December 31, 2013 and 2012:

(dollars in thousands)

Active Markets for

Identical Assets

Observable

Unobservable

as of

Available-for-sale

U.S. government and federal

agency securities $ — $ 5,069,920 $ — $ 5,069,920

Residential mortgage-backed

securities — 5,058,468 — 5,058,468

Commercial mortgage-backed

securities — 14,461 — 14,461

Bank notes — 1,561,730 — 1,561,730

Municipal securities — 187,776 — 187,776

Mutual funds 10,880 — — 10,880

Total available-for-sale —

Mortgage loans awaiting sale — 507,948 — 507,948

Mortgage servicing rights — — 236,579 236,579

Other assets—Derivative

commitments — 32,506 — 32,506

$ $ $ $

Other liabilities—Derivative

commitments $ — $ 131 $ — $ 131

Total liabilities at fair

$ — $ $ — $