Navy Federal Credit Union 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

39

2013 ANNUAL REPORT

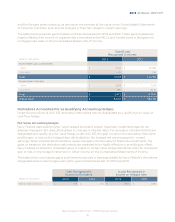

NOTE 17:

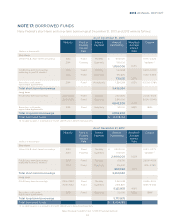

Navy Federal’s short-term and long-term borrowings at December 31, 2013 and 2012 were as follows:

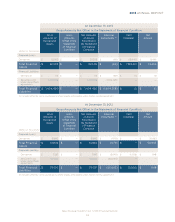

(dollars in thousands)

Maturity Fixed or

Floating

Interest

Rate

Interest

Payment

Amount

Outstanding

Weighted-

Average

Interest

Rate

Coupon

Other FHLB short-term borrowings 2014 Fixed Monthly $ 600,000 0.17%–0.22%

2014 Floating Quarterly 750,000 Variable (1)

0.21%

FHLB long-term borrowings

maturing in next 12 months 2014 Fixed Monthly 540,835 0.63%–5.05%

2014 Fixed Quarterly 190,800 1.65%–5.59%

3.87%

Securities sold under

repurchase agreements 2014 Fixed At maturity 1,354,299 0.15% (0.15)%–0.18%

Total short-term borrowings

Long term

FHLB long-term borrowings 2015–2033 Fixed Monthly 2,301,200 2.04%–5.10%

2015–2033 Fixed Quarterly 2,541,000 3.09%–6.04%

4.21%

Securities sold under

repurchase agreements 2019 Fixed Quarterly 50,000 1.88% 1.88%

Total long-term borrowings

$

(1) Variable coupon is a spread to 3-month LIBOR and is determined quarterly.

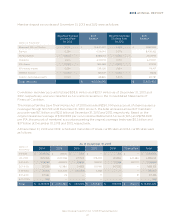

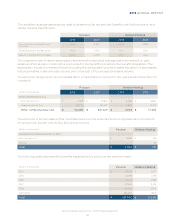

(dollars in thousands)

Maturity Fixed or

Floating

Interest

Rate

Interest

Payment

Amount

Outstanding

Weighted-

Average

Interest

Rate

Coupon

Other FHLB short-term borrowings 2013 Fixed Monthly $ 2,300,000 0.19%–0.27%

2013 Floating Quarterly 100,000 Variable (1)

0.22%

FHLB long-term borrowings

maturing in next 12 months 2013 Fixed Monthly 613,750 2.63%–4.91%

2013 Fixed Quarterly 216,600 1.21%–5.78%

4.11%

Total short-term borrowings

Long term

FHLB long-term borrowings 2014–2032 Fixed Monthly 2,592,035 0.63%–5.10%

2014–2032 Fixed Quarterly 2,531,800 1.65%–6.04%

4.19%

Securities sold under

repurchase agreements 2019 Fixed Quarterly 50,000 1.88% 1.88%

Total long-term borrowings

$

(1) Variable coupon is a spread to 3-month LIBOR and is determined quarterly.