Navy Federal Credit Union 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union • 2013 Financial Section

29

2013 ANNUAL REPORT

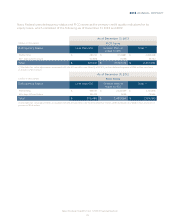

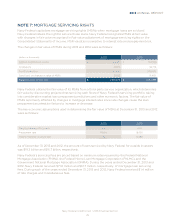

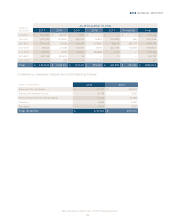

The following table provides a summary of the cash flows exchanged between Navy Federal and

transferees on all loans previously transferred with recourse during the years ended December 31, 2013

and 2012:

(dollars in thousands)

Cash from sale of mortgage loans and

mortgage-backed securities $ 6,435,728 $ 5,167,415

Repurchase of previously transferred loans 13,697 19,106

Contractual servicing fees received 71,824 61,753

Total $ $

NOTE 9:

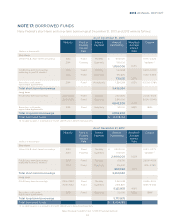

Navy Federal obtains real estate owned (REO) through foreclosure proceedings or when a delinquent

borrower chooses to transfer a mortgaged property in lieu of foreclosure. Navy Federal recognizes

foreclosure expenses as incurred.

REO is initially recorded at fair value less estimated costs to sell (e.g., brokers’ commissions, legal

expenses, title transfer fees, and closing costs) and classified as held-for-sale. Navy Federal utilizes Broker

Price Opinions (BPOs) to estimate the fair market value of REOs. A BPO considers the value of similar

surrounding properties, sales trends in the neighborhood, an estimate of any of the costs associated

with getting the property ready for sale, and/or the cost of any needed repairs. Navy Federal evaluates

reasonableness by obtaining multiple BPOs on REO properties. After acquisition, REO is carried at lower

of cost or fair value less costs to sell. Holding costs such as insurance, maintenance, taxes, and utility

costs are expensed as incurred. Holding gains and losses are included in Other non-interest expense in

the Consolidated Statements of Income.

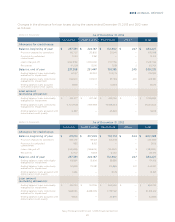

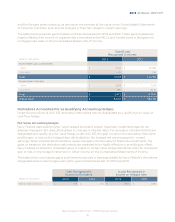

The cumulative total balances of REO at December 31, 2013 and 2012 were as follows:

(dollars in thousands)

Real estate owned (REO) $ 29,932 $ 32,187

Holding period losses (8,529) (16,943)

REO balance, end of period $ $