Navy Federal Credit Union 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union • 2013 Financial Section

28

2013 ANNUAL REPORT

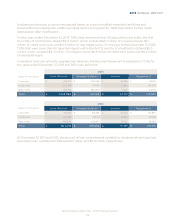

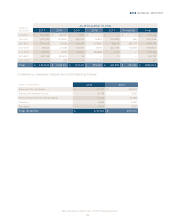

Of that total, $1 million was initially set aside by NFFG as non-current restricted cash with a designated

financial institution. For the remaining $7.5 million exposure, Navy Federal issued an irrevocable,

transferable standby letter of credit to Charlie Mac as part of the initial agreement. In 2004, the

aggregate amount of credit-enhanced mortgage loans purchased by Charlie Mac had reached the

$200 million limit. All loans purchased pursuant to the agreement had better FICO credit scores,

loan-to-value (LTV) ratios, and debt-to-income ratios than required by the agreement at the time of

origination. In 2009, NCUA placed U.S. Central Credit Union into conservatorship. NCUA’s Oce of

Asset Management and Assistance Center has assumed the management of U.S. Central’s remaining

assets, including its credit-enhanced mortgage loans.

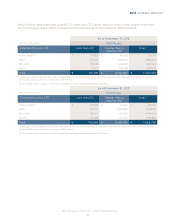

As of December 31, 2013, NFFG had $2.8 million of non-current restricted cash at a designated financial

institution and a remaining maximum total exposure of $7.8 million. As of December 31, 2013 and 2012,

the remaining UPB of these loans was $17.1 million and $28.7 million, respectively. Navy Federal had

an accrued estimated loss of $0.2 million as of December 31, 2013 related to these credit-enhanced

mortgage loans, representing a liability it considers probable and reasonably estimable. Any further

liability that could be reasonably expected to result from this agreement is not expected to be material

to Navy Federal.

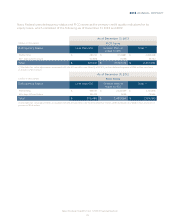

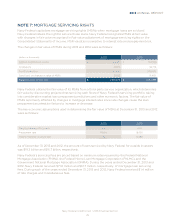

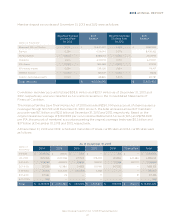

FHLMC Loss Sharing Agreement: Navy Federal sold mortgage loans to FHLMC under an August

2008 loss-sharing agreement, whereby Navy Federal must indemnify FHLMC for losses related to

loans with higher LTV ratios and no private mortgage insurance. Under this agreement, Navy Federal

received proceeds of $775.0 million and $618.9 million from the sale of mortgage loans during the years

ended December 31, 2013 and 2012, respectively. As of December 31, 2013 and 2012, the UPB of these

loans was $749.5 million and $595.7 million, respectively. Under this contract, Navy Federal paid

FHLMC $0.2 million and $0.3 million in 2013 and 2012, respectively, for losses incurred on these loans.

As of December 31, 2013 and 2012, Navy Federal had recognized a liability for estimated losses of

$0.6 million and $2.6 million, respectively. This liability is included in Other liabilities on the Consolidated

Statements of Financial Condition. On the Consolidated Statements of Income, the related provision

expense is included as an oset to Net gains on mortgage loan sales for new loans sold during the

period, or in Loan servicing expenses for any re-measurement of the liability related to loans sold in a

prior period. Navy Federal’s estimated maximum future exposure to FHLMC as of December 31, 2013

and 2012 was approximately $29.0 million and $23.1 million, respectively.

FNMA Loss Sharing Agreement: Navy Federal sold mortgage loans to FNMA under an August 2008

loss-sharing agreement, whereby Navy Federal agreed to indemnify FNMA for loans having high LTV

ratios. The balance of these loans as of December 31, 2013 and 2012 was $2.2 billion and $3.8 billion,

respectively. Under this contract, Navy Federal paid FNMA $23.4 million and $20.3 million in 2013 and

2012, respectively. As of December 31, 2013 and 2012, Navy Federal recognized a liability for estimated

losses of $33.1 million and $25.3 million, respectively. This liability is included in Other liabilities on the

Consolidated Statements of Financial Condition. In the Consolidated Statements of Income, the related

provision expense is included as an oset to Net gains on mortgage loan sales for new loans sold during

the period, or in Loan servicing expenses for any re-measurement of the liability on loans sold in a prior

period. Navy Federal’s estimated maximum future exposure to FNMA as of December 31, 2013 and 2012

was approximately $387.3 million and $559.1 million, respectively.