Mitsubishi 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Mitsubishi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 mitsubishi motors corporation annual report 2008

supply passenger and commercial-use minicars to Nissan Motor

Co., Ltd. on an OEM basis, and we plan to start supplying the

company with the mini SUV model

Pajero Mini

on an OEM

basis in autumn 2008. In addition, we have started to consider

cooperation with Nissan on the development and OEM supply

of small commercial vehicles built on a mini commercial vehi-

cle platform for the domestic and overseas markets, with an

emphasis on producing results in ASEAN and other Asian

nations. MMC started supplying PSA Peugeot Citroën (PSA)

with an SUV model in May 2007, and with this venture pro-

gressing steadily, we concluded a contract with PSA for local

production in Russia. Moreover, PSA and MMC have agreed to

consider collaborating in the area of electric vehicles. We will

continue to broadly search for win-win collaborations and alli-

ances on individual business ventures.

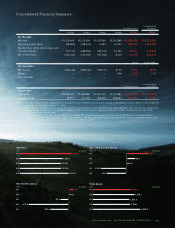

Sales Volume Target

MMC targets sales volume of 1,422,000 units in fiscal year

2010, an increase of approximately 5%, or 62,000 units, from

fiscal year 2007. Specifically, we are targeting steady increases

in sales volume in high-growth markets, such as Russia and the

Ukraine, and approximately 35% growth for the European

market as a whole, including the aforementioned nations. We

also see strong prospects for volume growth in resource-rich

nations in the Middle East, Latin America and elsewhere.

Boosting Global Production Efficiency

At the start of the Mitsubishi Motors Revitalization Plan, one of

the most important issues was overcapacity in production. By

fiscal year 2007, almost all of this overcapacity was eliminated.

Currently, our three plants in Japan and our production facility in

Thailand, which serves as an export base for one-ton pickup

trucks, continue to operate at high capacity utilization rates. To

make better use of overcapacity at our Netherlands Plant, we

transferred production of the

Outlander

for the European market

from the Okazaki Plant to that facility in August 2008, followed

by the shift of production of PSA-bound SUVs from the

Mizushima Plant, thereby opening up production capacity at our

domestic plants. With these moves, we aim to construct a pro-

duction system that is more efficient and better able to respond

to changes in demand for individual models, thereby avoiding

missed sales opportunities and maximizing profits.

Measures for Improving Profits

Measures to improve profits naturally include closer coopera-

tion among the development, production and sales divisions, as

well as stronger ties with members of the MMC Group, includ-

ing dealers and suppliers, and the pursuit of more improve-

ments on a global scale.

First, we are enhancing our logistics processes so as to elimi-

nate waste and to improve efficiency. We will do this by reducing

costs through more rigorous inventory management and by

upgrading functions for adjusting the supply-demand balance.

Second, we are working to expand profits in peripheral busi-

nesses, mainly in mature markets. Specifically, in Japan, because

the turnover period for new vehicles is becoming longer, we have

positioned policies aimed at strengthening ties with customers.

We will strengthen the sales companies’ marketing base by offer-

ing an increased number of products and service menus that

reflect customer needs. Finally, we have implemented programs

to reduce materials costs. Because of persistently high crude oil

prices, we must prepare for the risk of sharp increases in raw

materials costs and ensure stable procurement. We are therefore

working to establish a more robust procurement framework by

u

Better able to meet customer needs thanks

to procured technology and products

u Improved productivity including better

capacity utilization

u Cut costs (R&D expenses, fixed expenses,

equipment investment)

Alliance benefits

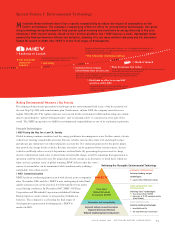

Reinforcing and Expanding Alliances

Current collaboration

Models supplied

Models procured

Components procured

Environmental technologies

Mitsubishi Heavy Industries

Yuasa and Mitsubishi Corporation

Models to supply

(Pajero Mini)

Models procured

(fall 2008 onwards)

(Nissan model name: AD/AD Expert)

Production

local production (start production in 2011)

Under consideration

vehicles based on minicar-class commercial

vehicles in Japan and overseas

Future

powertrains for electric vehicles

FY2008 and beyond