Medco 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Medco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

Express Scripts 2015 Annual Report

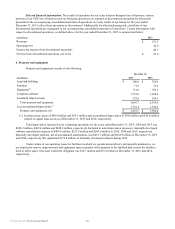

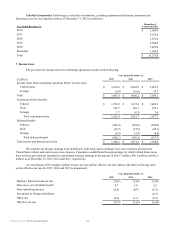

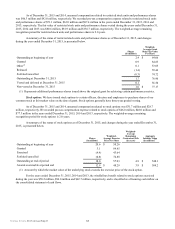

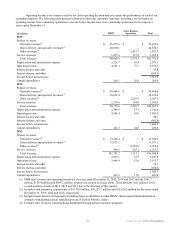

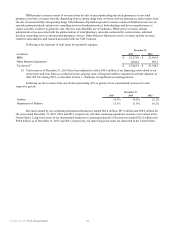

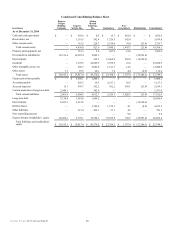

Changes in plan assets, benefit obligation and funded status. Summarized information about the pension plan’s

funded status and the changes in pension plan assets and the projected benefit obligation for the years ended December 31,

2015 and 2014 are as follows:

(in millions) 2015 2014

Fair value of plan assets at beginning of year $ 150.7 $ 179.4

Actual (loss) gain on plan assets (1.5) 6.3

Benefits paid (25.0)(35.0)

Fair value of plan assets at end of year 124.2 150.7

Projected benefit obligation at beginning of year 191.3 225.8

Interest cost 0.3 0.4

Net actuarial loss — 0.1

Benefits paid (25.0)(35.0)

Projected benefit obligation at end of year 166.6 191.3

Underfunded status at end of year $ 42.4 $ 40.6

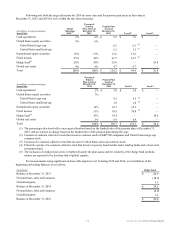

As a result of the pension plan freeze, the accumulated benefit obligation and the projected benefit obligation for the

pension plan are equal at December 31, 2015 and 2014, and are recognized in “Other liabilities” on our consolidated balance

sheet.

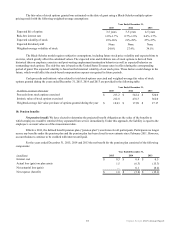

Actuarial assumptions. We have elected an accounting policy that measures the pension plan’s benefit obligation as if

participants were to separate immediately. As a result, a discount rate is not used to value the pension benefit obligation. Also,

since the pension plan is frozen, a rate of compensation increase is not applicable.

Our return on plan assets is calculated based on the actual fair value of plan assets. We recognize actual gains and

losses on pension plan assets immediately in our consolidated operating results. Amounts are recorded each period based on

estimates, and adjusted annually when actual results of the pension plan are measured at December 31.

Pension plan assets. We believe the oversight of the investments held under our pension plan is rigorous and the

investment strategies are prudent. We have adopted a dynamic asset allocation policy. The intent of this policy is to allocate

funds to investments with lower expected risk profiles as the funded ratio of the pension plan improves. The investment

objectives of the pension plan are designed to provide liquidity to meet benefit payments and expenses payable from the

pension plan to offer a reasonable probability of achieving asset growth to reduce the underfunded status of the pension plan

and to manage the pension plan’s assets in a liability framework. The precise amount for which the benefit obligation will be

settled depends on future events, including interest rates and the life expectancy of the pension plan’s members. The obligation

is estimated using actuarial assumptions based on the current economic environment.

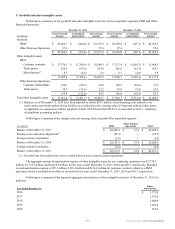

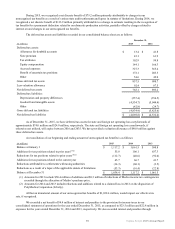

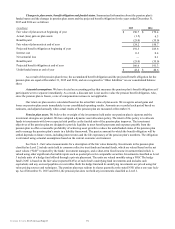

See Note 2 - Fair value measurements for a description of the fair value hierarchy. Investments in the pension plan

classified as Level 2 include units held in common collective trust funds and mutual funds, which are valued based on the net

asset values (“NAV”) reported by the funds’ investment managers, and a short-term fixed income investment fund which is

valued using other significant observable inputs such as quoted prices for comparable securities. Investments classified as Level

3 include units of a hedge fund offered through a private placement. The units are valued monthly using a NAV. The hedge

fund’s NAV is based on the fair value (reported NAVs) of each fund’s underlying fund investments and includes cash

equivalents and any accrued payables or receivables. Both the hedge fund and its underlying investments are priced using fair

value pricing sources and techniques. The pension plan may redeem its shares quarterly at the stated NAV after a one year lock-

up. As of December 31, 2015 and 2014, the pension plan does not hold any investments classified as Level 1.