Medco 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Medco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37 Express Scripts 2015 Annual Report

2014, our European operations were substantially shut down. During 2013, we sold our acute infusion therapies line of business

and various portions of our UBC line of business. Our acute infusion therapies line of business was previously included in our

PBM segment and the remaining businesses were previously included in our Other Business Operations segment. The results of

operations for these businesses were reported as discontinued operations and excluded from all periods presented in the

information provided below.

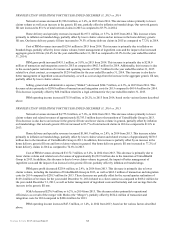

Throughout the description below, reference is made to the impact of generic fill rates. Generally, higher generic fill

rates reduce PBM revenues, as generic drugs are generally priced lower than branded drugs. However, as ingredient cost on

generic drugs is incrementally lower than the price charged, higher generic fill rates generally have a favorable impact on gross

profit.

The home delivery generic fill rate is currently lower than the network generic fill rate as fewer generic substitutions

are available among maintenance medications (e.g., therapies for chronic conditions) commonly dispensed from home delivery

pharmacies as compared to acute medications which are primarily dispensed by pharmacies in our retail networks.

In 2011, Medco Health Solutions, Inc. (“Medco”) announced its pharmacy benefit services agreement with

UnitedHealth Group would not be renewed; although we continued to provide service under an agreement which expired on

December 31, 2012. A transition agreement was in place throughout 2013, during which time patients moved in tranches off of

the Medco platform. Due to this transition of UnitedHealth Group, claims volume and related revenues and cost of revenues

decreased throughout 2013.

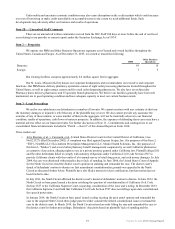

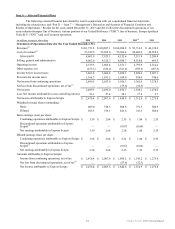

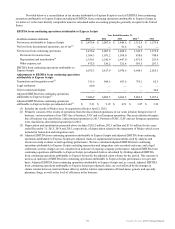

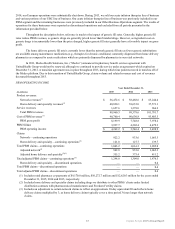

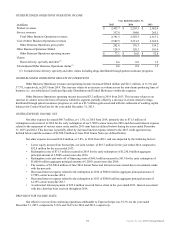

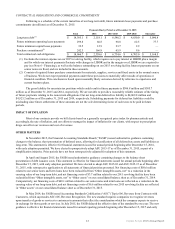

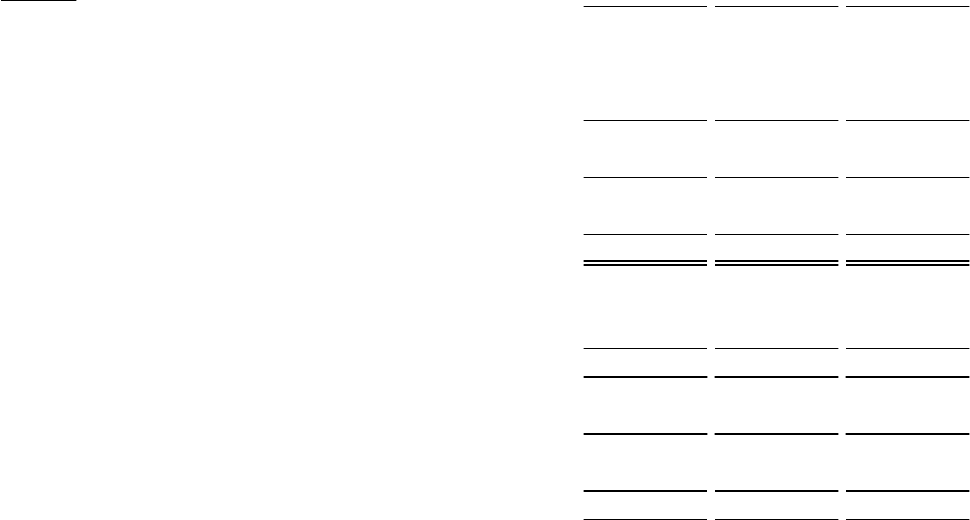

PBM OPERATING INCOME

Year Ended December 31,

(in millions) 2015 2014 2013

Product revenues:

Network revenues(1) $ 56,472.6 $ 58,468.6 $ 63,244.4

Home delivery and specialty revenues(2) 40,830.1 38,633.0 37,571.1

Service revenues 1,657.6 1,278.0 966.2

Total PBM revenues 98,960.3 98,379.6 101,781.7

Cost of PBM revenues(1) 90,760.4 90,630.8 93,803.5

PBM gross profit 8,199.9 7,748.8 7,978.2

PBM SG&A 3,937.7 4,202.4 4,479.3

PBM operating income $ 4,262.2 $ 3,546.4 $ 3,498.9

Claims

Network—continuing operations 922.2 933.6 1,065.3

Home delivery and specialty—continuing operations(2) 121.0 127.7 139.7

Total PBM claims—continuing operations 1,043.2 1,061.3 1,205.0

Adjusted network(3) 942.8 933.6 1,065.3

Adjusted home delivery and specialty(2)(3) 355.2 375.4 411.2

Total adjusted PBM claims—continuing operations(3) 1,298.0 1,309.0 1,476.5

Home delivery and specialty—discontinued operations — — 0.4

Total PBM claims—discontinued operations — — 0.4

Total adjusted PBM claims—discontinued operations — — 0.4

(1) Includes retail pharmacy co-payments of $9,170.0 million, $10,272.7 million and $12,620.3 million for the years ended

December 31, 2015, 2014 and 2013, respectively.

(2) Includes home delivery and specialty claims including drugs we distribute to other PBMs’ clients under limited

distribution contracts with pharmaceutical manufacturers and Freedom Fertility claims.

(3) Includes an adjustment to certain network claims to reflect an approximate 30-day equivalent fill and reflects home

delivery claims multiplied by 3, as home delivery claims typically cover a time period 3 times longer than network

claims.