Mattel 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

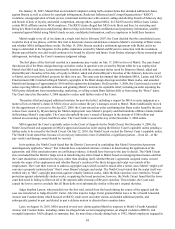

93

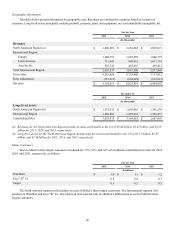

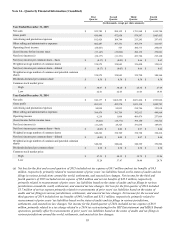

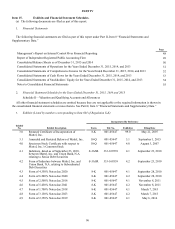

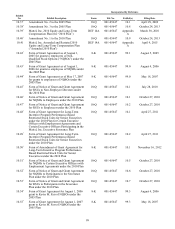

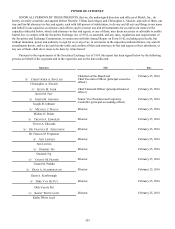

Note 14—Quarterly Financial Information (Unaudited)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

(In thousands, except per share amounts)

Year Ended December 31, 2015

Net sales $ 922,749 $ 988,152 $ 1,791,968 $ 1,999,744

Gross profit 450,448 472,858 879,597 1,003,455

Advertising and promotion expenses 102,428 104,744 213,245 297,435

Other selling and administrative expenses 402,487 367,551 365,579 411,967

Operating (loss) income (54,467) 563 300,773 294,053

(Loss) Income before income taxes (73,147) (19,898) 286,139 270,821

Net (loss) income (a) (58,177) (11,351) 223,784 215,160

Net (loss) income per common share—basic $ (0.17) $ (0.03) $ 0.66 $ 0.63

Weighted average number of common shares 338,579 338,843 339,420 339,815

Net (loss) income per common share—diluted $ (0.17) $ (0.03) $ 0.66 $ 0.63

Weighted average number of common and potential common

shares 338,579 338,843 339,790 340,364

Dividends declared per common share $ 0.38 $ 0.38 $ 0.38 $ 0.38

Common stock market price:

High $ 30.47 $ 30.20 $ 26.34 $ 27.69

Low 22.61 22.65 21.03 19.83

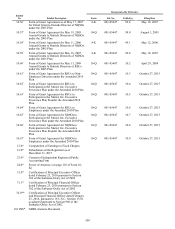

Year Ended December 31, 2014

Net sales $ 946,177 $ 1,062,252 $ 2,021,424 $ 1,993,966

Gross profit 481,531 492,570 1,021,138 1,005,783

Advertising and promotion expenses 90,834 99,853 218,746 323,810

Other selling and administrative expenses 384,479 391,709 392,913 444,964

Operating income 6,218 1,008 409,479 237,009

(Loss) Income before income taxes (9,421) (14,371) 394,180 216,522

Net (loss) income (a) (11,218) 28,325 331,836 149,931

Net (loss) income per common share—basic $ (0.03) $ 0.08 $ 0.97 $ 0.44

Weighted average number of common shares 340,226 338,709 338,728 338,416

Net (loss) income per common share—diluted $ (0.03) $ 0.08 $ 0.97 $ 0.44

Weighted average number of common and potential common

shares 340,226 340,644 340,329 339,506

Dividends declared per common share $ 0.38 $ 0.38 $ 0.38 $ 0.38

Common stock market price:

High $ 47.39 $ 40.32 $ 39.79 $ 31.86

Low 35.24 37.47 30.48 28.78

(a) Net loss for the first and second quarters of 2015 included net tax expense of $0.7 million and net tax benefits of $4.3

million, respectively, primarily related to reassessments of prior years’ tax liabilities based on the status of audits and tax

filings in various jurisdictions around the world, settlements, and enacted law changes. Net income for the third and

fourth quarters of 2015 included net tax expense of $0.8 million and net tax benefits of $16.3 million, respectively,

primarily related to reassessments of prior years’ tax liabilities based on the status of audits and tax filings in various

jurisdictions around the world, settlements, and enacted tax law changes. Net loss for the first quarter of 2014 included

$3.7 million of net tax expense primarily related to reassessments of prior years’ tax liabilities based on the status of

audits and tax filings in various jurisdictions, settlements, and enacted tax law changes. Net income for the second and

third quarters of 2014 included net tax benefits of $40.1 million and $15.1 million, respectively, primarily related to

reassessments of prior years’ tax liabilities based on the status of audits and tax filings in various jurisdictions,

settlements, and enacted tax law changes. Net income for the fourth quarter of 2014 included net tax expense of $8.9

million, primarily related to a tax charge related to a 2014 tax restructuring for the HIT Entertainment and MEGA Brands

operations, partially offset by reassessments of prior years’ tax liabilities based on the status of audits and tax filings in

various jurisdictions around the world, settlements, and enacted tax law changes.