Mattel 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

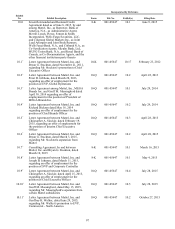

91

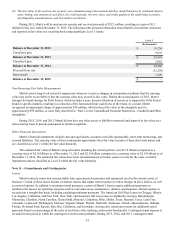

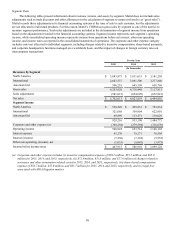

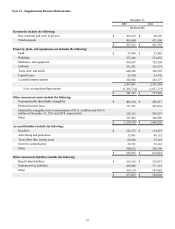

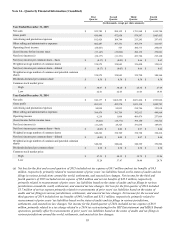

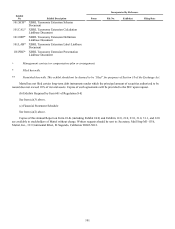

Note 13—Supplemental Financial Information

December 31,

2015 2014

(In thousands)

Inventories include the following:

Raw materials and work in process $ 105,917 $ 88,395

Finished goods 481,604 473,360

$ 587,521 $ 561,755

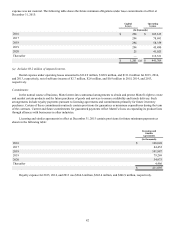

Property, plant, and equipment, net includes the following:

Land $ 27,049 $ 27,465

Buildings 275,266 274,452

Machinery and equipment 764,657 728,299

Software 331,251 316,374

Tools, dies, and molds 840,586 782,507

Capital leases 23,970 23,970

Leasehold improvements 245,082 242,177

2,507,861 2,395,244

Less: accumulated depreciation (1,766,714)(1,657,375)

$ 741,147 $ 737,869

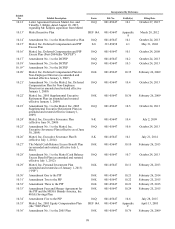

Other noncurrent assets include the following:

Nonamortizable identifiable intangibles $ 488,144 $ 498,517

Deferred income taxes 317,391 385,434

Identifiable intangibles (net of amortization of $131.5 million and $103.6

million at December 31, 2015 and 2014, respectively) 212,161 240,227

Other 212,463 280,080

$ 1,230,159 $ 1,404,258

Accrued liabilities include the following:

Royalties $ 122,153 $ 112,823

Advertising and promotion 75,991 88,132

Taxes other than income taxes 66,848 53,182

Incentive compensation 52,721 25,601

Other 340,512 360,106

$ 658,225 $ 639,844

Other noncurrent liabilities include the following:

Benefit plan liabilities $ 195,916 $ 229,963

Noncurrent tax liabilities 108,808 171,181

Other 169,139 182,882

$ 473,863 $ 584,026