Mattel 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

used as a tax deduction or credit in Mattel’s tax returns in future years for which Mattel has already recorded a tax benefit in its

consolidated statement of operations. Mattel records a valuation allowance to reduce its deferred income tax assets if, based on

the weight of available evidence, management believes expected future taxable income is not likely to support the use of a

deduction or credit in that jurisdiction. Management evaluates the level of Mattel’s valuation allowances at least annually, and

more frequently if actual operating results differ significantly from forecasted results.

Mattel records unrecognized tax benefits for US federal, state, local, and foreign tax positions related primarily to transfer

pricing, tax credits claimed, tax nexus, and apportionment. For each reporting period, management applies a consistent

methodology to measure unrecognized tax benefits and all unrecognized tax benefits are reviewed periodically and adjusted as

circumstances warrant. Mattel’s measurement of its unrecognized tax benefits is based on management’s assessment of all

relevant information, including prior audit experience, the status of audits, conclusions of tax audits, lapsing of applicable

statutes of limitations, identification of new issues, and any administrative guidance or developments. Mattel recognizes

unrecognized tax benefits in the first financial reporting period in which information becomes available indicating that such

benefits will more-likely-than-not (a greater than 50 percent likelihood) be realized.

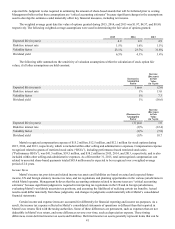

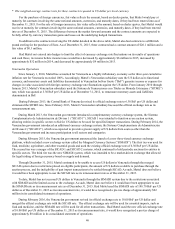

Mattel’s effective tax rate on income before income taxes in 2015 was 20.4%, as compared to 15.0% in 2014. The income

tax provision included net tax benefits of $19.1 million, $42.6 million, and $32.2 million in 2015, 2014, and 2013, respectively.

The 2015 net tax benefits primarily relate to reassessments of prior years’ tax liabilities based on the status of audits and tax

filings in various jurisdictions around the world, settlements, and enacted tax law changes. The 2014 net tax benefits primarily

related to the reassessments of prior years’ tax liabilities based on the status of audits and tax filings in various jurisdictions

around the world, settlements, and enacted tax law changes, partially offset by a tax charge related to a 2014 tax restructuring

for the HIT Entertainment and MEGA Brands operations. The 2013 net tax benefits primarily related to the reassessments of

prior years’ tax liabilities based on the status of audits and tax filings in various jurisdictions around the world, settlements, and

enacted tax law changes.

In the normal course of business, Mattel is regularly audited by federal, state, local, and foreign tax authorities. The

ultimate settlement of any particular issue with the applicable taxing authority could have a material impact on Mattel’s

consolidated financial statements.

New Accounting Pronouncements

See Item 8 “Financial Statements and Supplementary Data—Note 1 to the Consolidated Financial Statements—Summary

of Significant Accounting Policies.”

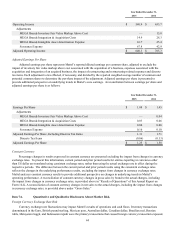

Non-GAAP Financial Measures

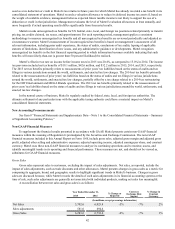

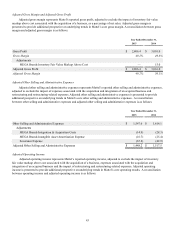

To supplement the financial results presented in accordance with GAAP, Mattel presents certain non-GAAP financial

measures within the meaning of Regulation G promulgated by the Securities and Exchange Commission. The non-GAAP

financial measures included in this Annual Report on Form 10-K include gross sales, adjusted gross margin and adjusted gross

profit, adjusted other selling and administrative expenses, adjusted operating income, adjusted earnings per share, and constant

currency. Mattel uses these non-GAAP financial measures to analyze its continuing operations and to monitor, assess, and

identify meaningful trends in its operating and financial performance. These measures are not, and should not be viewed as,

substitutes for GAAP financial measures.

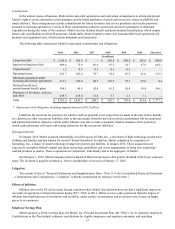

Gross Sales

Gross sales represent sales to customers, excluding the impact of sales adjustments. Net sales, as reported, include the

impact of sales adjustments, such as trade discounts and other allowances. Mattel presents changes in gross sales as a metric for

comparing its aggregate, brand, and geographic results to highlight significant trends in Mattel’s business. Changes in gross

sales are discussed because, while Mattel records the details of such sales adjustments in its financial accounting systems at the

time of sale, such sales adjustments are generally not associated with individual products, making net sales less meaningful.

A reconciliation between net sales and gross sales is as follows:

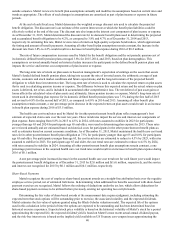

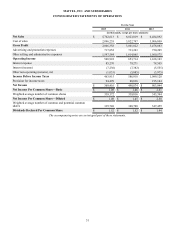

Year Ended December 31, % Change as

Reported

Currency

Exchange Rate

Impact

% Change in

Constant

Currency

2015 2014

(In millions, except percentage information)

Net Sales 5,702.6 6,023.8 -5%-7%2%

Sales adjustments 581.0 694.6

Gross Sales 6,283.6 6,718.4 -6%-7%1%