Mattel 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

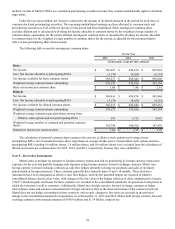

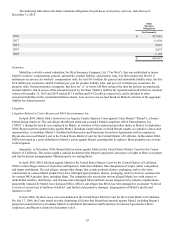

(b) The fair value of the auction rate security was estimated using a discounted cash flow model based on (i) estimated interest

rates, timing, and amount of cash flows, (ii) credit spreads, recovery rates, and credit quality of the underlying securities,

(iii) illiquidity considerations, and (iv) market correlation.

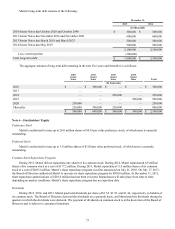

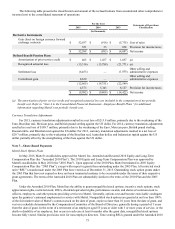

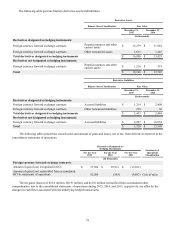

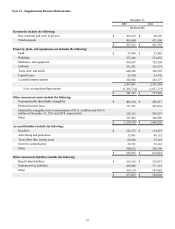

During 2015, Mattel sold its auction rate security and received proceeds of $32.3 million, resulting in a gain of $1.3

million for the year ended December 31, 2015. The following table presents information about Mattel's investments measured

and reported at fair value on a recurring basis using significant Level 3 inputs:

Level 3

(In thousands)

Balance at December 31, 2012 $ 19,256

Unrealized gain 9,639

Balance at December 31, 2013 $ 28,895

Unrealized gain 2,065

Balance at December 31, 2014 $ 30,960

Proceeds from sale (32,250)

Gain on sale 1,290

Balance at December 31, 2015 $—

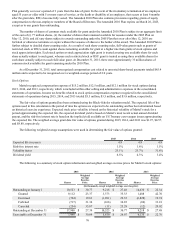

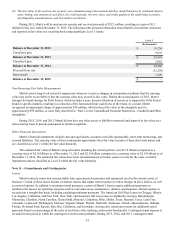

Non-Recurring Fair Value Measurements

Mattel tests its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying

value may not be recoverable or that the carrying value may exceed its fair value. During the second quarter of 2013, Mattel

changed its brand strategy for Polly Pocket, which includes a more focused allocation of resources to support the Polly Pocket

brand in specific markets, resulting in a reduction of the forecasted future cash flows of the brand. As a result, Mattel

recognized an impairment charge of approximately $14 million, which reduced the value of the intangible asset to

approximately $99 million, as more fully described in “Note 2 to the Consolidated Financial Statements—Goodwill and Other

Intangibles.”

During 2015, 2014, and 2013, Mattel did not have any other assets or liabilities measured and reported at fair value on a

non-recurring basis in periods subsequent to initial recognition.

Other Financial Instruments

Mattel’s financial instruments include cash and equivalents, accounts receivable and payable, short-term borrowings, and

accrued liabilities. The carrying value of these instruments approximate their fair value because of their short-term nature and

are classified as Level 2 within the fair value hierarchy.

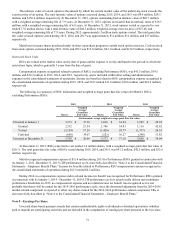

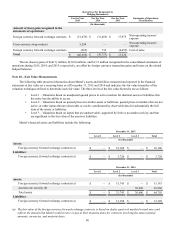

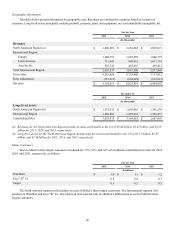

The estimated fair value of Mattel’s long-term debt, including the current portion, was $2.15 billion (compared to a

carrying value of $2.10 billion) as of December 31, 2015 and $2.18 billion (compared to a carrying value of $2.10 billion) as of

December 31, 2014. The estimated fair values have been calculated based on broker quotes or rates for the same or similar

instruments and are classified as Level 2 within the fair value hierarchy.

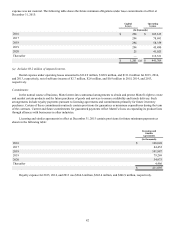

Note 11—Commitments and Contingencies

Leases

Mattel routinely enters into noncancelable lease agreements for premises and equipment used in the normal course of

business. Certain of these leases include escalation clauses that adjust rental expense to reflect changes in price indices, as well

as renewal options. In addition to minimum rental payments, certain of Mattel’s leases require additional payments to

reimburse the lessors for operating expenses such as real estate taxes, maintenance, utilities, and insurance. Rental expense is

recorded on a straight-line basis, including escalating minimum payments. The American Girl Place leases in Chicago, Illinois,

Los Angeles, California, and New York, New York, and American Girl store leases in Alpharetta, Georgia, Bloomington,

Minnesota, Charlotte, North Carolina, Chesterfield, Missouri, Columbus, Ohio, Dallas, Texas, Houston, Texas, Lone Tree,

Colorado, Lynnwood, Washington, McLean, Virginia, Miami, Florida, Nashville, Tennessee, Natick, Massachusetts, Orlando,

Florida, Overland Park, Kansas, Palo Alto, California, and Scottsdale, Arizona also contain provisions for additional rental

payments based on a percentage of the sales of each store after reaching certain sales benchmarks. Contingent rental expense is

recorded in the period in which the contingent event becomes probable. During 2015, 2014, and 2013, contingent rental