Mattel 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

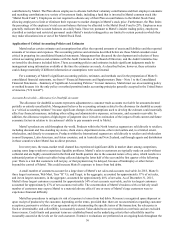

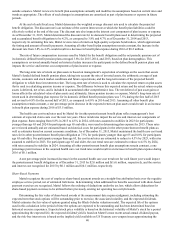

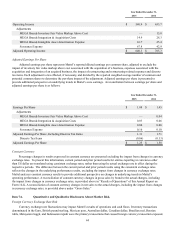

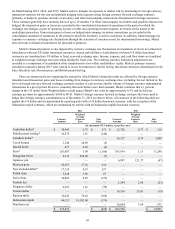

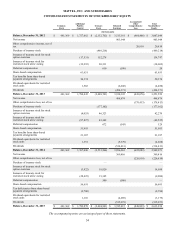

* The weighted average contract rate for these contracts is quoted in US dollar per local currency.

For the purchase of foreign currencies, fair value reflects the amount, based on dealer quotes, that Mattel would pay at

maturity for contracts involving the same notional amounts, currencies, and maturity dates, if they had been entered into as of

December 31, 2015. For the sale of foreign currencies, fair value reflects the amount, based on dealer quotes, that Mattel would

receive at maturity for contracts involving the same notional amounts, currencies, and maturity dates, if they had been entered

into as of December 31, 2015. The differences between the market forward amounts and the contract amounts are expected to

be fully offset by currency transaction gains and losses on the underlying hedged transactions.

In addition to the contracts involving the US dollar detailed in the above table, Mattel also had contracts to sell British

pound sterling for the purchase of Euro. As of December 31, 2015, these contracts had a contract amount of $26.1 million and a

fair value of $0.3 million.

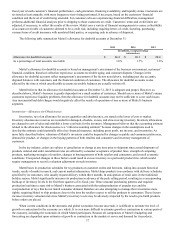

Had Mattel not entered into hedges to limit the effect of currency exchange rate fluctuations on its results of operations

and cash flows, its income before income taxes would have decreased by approximately $6 million in 2015, increased by

approximately $32 million in 2014, and decreased by approximately $9 million in 2013.

Venezuelan Operations

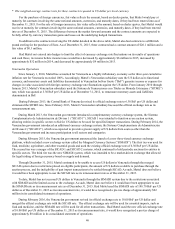

Since January 1, 2010, Mattel has accounted for Venezuela as a highly inflationary economy as the three-year cumulative

inflation rate for Venezuela exceeded 100%. Accordingly, Mattel’s Venezuelan subsidiary uses the US dollar as its functional

currency, and monetary assets and liabilities denominated in Venezuelan bolívar fuerte (“BsF”) generate income or expense for

changes in value associated with foreign currency exchange rate fluctuations against the US dollar. From January 2010 through

January 2013, Mattel’s Venezuelan subsidiary used the Sistema de Transacciones con Títulos en Moneda Extranjera (“SITME”)

rate, which was quoted at 5.30 BsF per US dollar as of December 31, 2012, to remeasure monetary assets and liabilities

denominated in BsF.

During February 2013, the Central Bank of Venezuela revised its official exchange rate to 6.30 BsF per US dollar and

eliminated the SITME rate. Since February 2013, Mattel’s Venezuelan subsidiary has used the official exchange rate as its

remeasurement rate.

During March 2013, the Venezuelan government introduced a complementary currency exchange system, the Sistema

Complementario de Administración de Divisas 1 (“SICAD 1”). SICAD 1 was intended to function as an auction system,

allowing entities in specific sectors to bid for US dollars to be used for specified import transactions. During February 2014, the

Venezuelan government introduced an additional currency exchange system, the Sistema Complementario de Administración

de Divisas 2 (“SICAD 2”), which was expected to provide a greater supply of US dollars from sources other than the

Venezuelan government and increase participation to all sectors and companies.

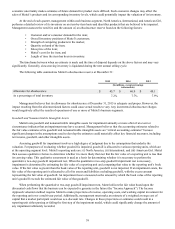

During February 2015, the Venezuelan government announced the launch of a new three-tiered currency exchange

platform, which included a new exchange system called the Marginal Currency System (“SIMADI”). The first tier was used for

food, medicine, agriculture, and other essential goods and used the existing official exchange rate of 6.30 BsF per US dollar.

The second tier was a merger of the SICAD 1 and SICAD 2 systems, which continued to hold periodic auctions for entities in

specific sectors. The third tier was the new SIMADI system, which was intended to be a market-driven exchange that allowed

for legal trading of foreign currency based on supply and demand.

Through December 31, 2015, Mattel continued to be unable to access US dollars in Venezuela through the merged

SICAD system due to restrictions placed on eligible participants, the amount of US dollars available to purchase through the

auction process, and the ineligibility of past import transactions to be settled through SICAD. As such, Mattel does not believe

it would have been appropriate to use the SICAD rate as its remeasurement rate as of December 31, 2015.

To date, Mattel has not accessed US dollars in Venezuela through the SIMADI system due to the restrictions associated

with SIMADI and the limited access to the exchange. As such, Mattel does not believe it would have been appropriate to use

the SIMADI rate as its remeasurement rate as of December 31, 2015. Had Mattel used the SIMADI rate of 198.70 BsF per US

dollar as of December 31, 2015 as its remeasurement rate, it would have recognized a pre-tax charge of approximately $22

million in its consolidated statement of operations.

During February 2016, the Venezuelan government revised its official exchange rate to 10.00 BsF per US dollar and

merged the official exchange rate with the SICAD rate. The official exchange rate will be used for essential imports, such as

food and medicine, and the SIMADI rate will be used for all other transactions. Had Mattel used the new official exchange rate

of 10.00 BsF per US dollar as of December 31, 2015 as its remeasurement rate, it would have recognized a pre-tax charge of

approximately $8 million in its consolidated statement of operations.