Mattel 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Mattel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72

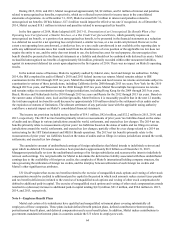

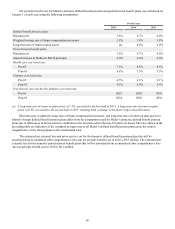

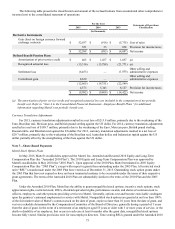

In January 2016, a major credit rating agency changed Mattel's long-term credit rating from A- to BBB+, maintained its

short-term credit rating of F2, and changed its outlook from negative to stable. In January 2015, a major credit rating agency

changed Mattel’s long-term credit rating from BBB+ to BBB and maintained its short-term credit rating of A-2 and outlook at

stable. Another major credit rating agency maintained Mattel’s long-term credit rating of Baa1 and short-term credit rating of

P-2 and changed its outlook from stable to negative. A third major credit rating agency maintained Mattel’s long-term credit

rating of A- and short-term credit rating of F2 and changed its outlook from stable to negative. A reduction in Mattel’s credit

ratings could increase the cost of obtaining financing.

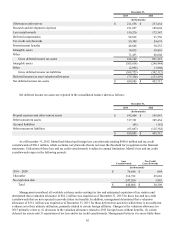

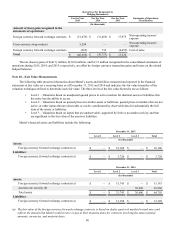

Short-Term Borrowings

As of December 31, 2015, Mattel had foreign short-term bank loans outstanding of $16.9 million. As of December 31,

2014, Mattel had no foreign short-term bank loans outstanding. As of December 31, 2015 and 2014, Mattel had no borrowings

outstanding under the credit facility.

During 2015 and 2014, Mattel had average borrowings of $2.9 million and $17.5 million, respectively, under its foreign

short-term bank loans, and $374.3 million and $680.8 million, respectively, under the credit facility and other short-term

borrowings, to help finance its seasonal working capital requirements. The weighted average interest rate on foreign short-term

bank loans during 2015 and 2014 was 13.7% and 11.2%, respectively. The weighted average interest rate on the credit facility

and other short-term borrowings during 2015 and 2014 was 0.3% and 0.2%, respectively.

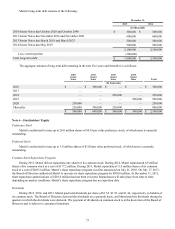

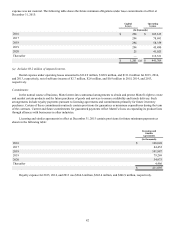

Long-Term Debt

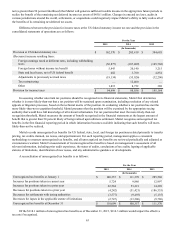

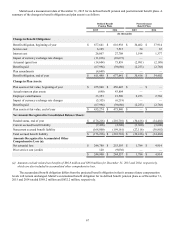

In May 2014, Mattel issued $500.0 million aggregate principal amount of 2.35% senior unsecured notes due May 6, 2019

(“2014 Senior Notes”). Interest on the 2014 Senior Notes is payable semi-annually on May 6 and November 6 of each year,

beginning November 6, 2014. Mattel may redeem all or part of the 2014 Senior Notes at any time or from time to time at its

option, at a redemption price equal to the greater of (i) 100% of the principal amount of the notes being redeemed plus accrued

and unpaid interest to, but excluding, the redemption date, and (ii) a “make-whole” amount based on the yield of a comparable

US Treasury security plus 12.5 basis points.

In March 2013, Mattel issued $250.0 million aggregate principal amount of 1.70% senior unsecured notes (“1.70%

Senior Notes”) due March 15, 2018 and $250.0 million aggregate principal amount of 3.15% senior unsecured notes (“3.15%

Senior Notes”) due March 15, 2023 (collectively, “2013 Senior Notes”). Interest on the 2013 Senior Notes is payable semi-

annually on March 15 and September 15 of each year, beginning September 15, 2013. Mattel may redeem all or part of the

1.70% Senior Notes at any time or from time to time at its option, at a redemption price equal to the greater of (i) 100% of the

principal amount of the notes being redeemed plus accrued and unpaid interest to, but excluding, the redemption date, and (ii) a

“make-whole” amount based on the yield of a comparable US Treasury security plus 15 basis points. Mattel may redeem all or

part of the 3.15% Senior Notes at any time or from time to time prior to December 15, 2022 (three months prior to the maturity

date of the 3.15% Senior Notes) at its option, at a redemption price equal to the greater of (i) 100% of the principal amount of

the notes being redeemed plus accrued and unpaid interest to, but excluding, the redemption date, and (ii) a “make-whole”

amount based on the yield of a comparable US Treasury security plus 20 basis points. Mattel may redeem all or part of the

3.15% Senior Notes at any time or from time to time on or after December 15, 2022 (three months prior to the maturity date for

the 3.15% Senior Notes) at its option, at a redemption price equal to 100% of the principal amount of the notes to be redeemed

plus accrued and unpaid interest to, but excluding, the redemption date.

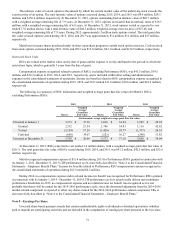

Mattel’s 2010 Senior Notes bear interest at fixed rates ranging from 4.35% to 6.20%, with a weighted average interest

rate of 5.28% as of December 31, 2015 and 2014. Mattel’s 2011 Senior Notes bear interest at fixed rates ranging from 2.50% to

5.45%, with a weighted average interest rate of 3.98% as of December 31, 2015 and 2014. Mattel’s 2013 Senior Notes bear

interest at fixed rates ranging from 1.70% to 3.15%, with a weighted average interest rate of 2.43% as of December 31, 2015

and 2014. Mattel’s 2014 Senior Notes bear interest at a fixed rate of 2.35% as of December 31, 2015.

During 2014, Mattel repaid $44.6 million of long-term borrowings assumed through the acquisition of MEGA Brands.