JVC 1998 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 1998 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC 1998 27

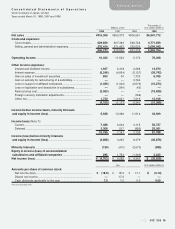

The aggregate annual maturities of long-term debt at March 31,

1998, were as follows:

Thousands of

Year ending March 31, Millions of yen U.S. dollars

1999 ................................................... ¥20,431 $154,780

2000 ................................................... 18,233 138,129

2001 ................................................... 30 227

2002 ................................................... 591 4,477

2003 ................................................... 20,029 151,735

Thereafter............................................ 32,012 242,515

........................................................... ¥91,326 $691,863

9. PLEDGED ASSETS

The following assets were pledged as collateral for long-term debt and

accrued expenses at March 31, 1998:

Thousands of

Millions of yen U.S. dollars

Investments......................................... ¥ 8 $ 61

Machinery and equipment ................... 561 4,250

Finished goods.................................... 166 1,257

........................................................... ¥735 $5,568

10. LEGAL RESERVE AND RETAINED EARNINGS

The Commercial Code of Japan provides that an amount equal to at

least 10% of cash dividends and bonuses to directors and statutory au-

ditors for each fiscal year shall be appropriated and set aside as a legal

reserve until such reserve equals 25% of common stock. This legal re-

serve is not available for dividends, but may be used to reduce a deficit

by resolution of a stockholders’ meeting or may be capitalized by reso-

lution of the Board of Directors.

Consolidated retained earnings included legal reserves and re-

tained earnings of consolidated subsidiaries, which were earned after

acquisition.

11. CONTINGENT LIABILITIES

The contingent liabilities of the Company and its consolidated sub-

sidiaries at March 31, 1998, were as follows:

Thousands of

Millions of yen U.S. dollars

As endorser of export bills

discounted with banks........................ ¥ 4,988 $ 37,788

As guarantor for loans of

employees.......................................... 17,579 133,174

........................................................... ¥22,567 $170,962

12. FORWARD FOREIGN EXCHANGE CONTRACTS —

12. THE COMPANY ONLY

At March 31, 1998, the Company had contracts to sell various foreign

currencies, mainly U.S. dollars. The aggregate contract amount and

fair value of forward foreign exchange contracts equivalent in Japanese

yen at March 31, 1998, were ¥54,613 million and ¥56,047 million,

respectively.

The Company also had contracts to purchase various foreign

currencies, mainly U.S. dollars. The aggregate contract amount and

fair value of forward foreign exchange contracts equivalent in Japanese

yen at March 31, 1998, were ¥32,119 million and ¥33,550 million,

respectively.

The forward contracts on the foreign currency receivables and

payables translated into Japanese yen at the forward exchange rates

on the financial statements were not included in the above amounts.

13. SUBSEQUENT EVENTS

On June 26, 1998, the Company’s stockholders authorized (1) payment

of a cash dividend to stockholders of record on March 31, 1998 of ¥3.5

($0.03) per share, totaling ¥890 million ($6,742 thousand), (2) payment

of bonuses to directors and statutory auditors of ¥72 million ($545

thousand) and (3) transfer to legal reserve of ¥96 million ($727 thou-

sand) from retained earnings.

14. SEGMENT INFORMATION

The Company and its consolidated subsidiaries operate primarily in the

audiovisual and information-related business and entertainment busi-

ness. As explained in Note 2, the amounts for 1997 are based on

revised accounting standards. Assuming the amounts for 1996 are

translated into Japanese yen based on the same manner as those for

1997, operating income (loss) of the Audiovisual and information-

related business segment and the Entertainment business segment

would increase by ¥829 million and ¥435 million, respectively. Also, as-

sets of the Audiovisual and information-related business segment and

the Entertainment business segment would decrease by ¥172 million

and ¥787 million, respectively.

As explained in Note 3, a consolidated subsidiary changed its ac-

counting for the production cost of karaoke software in 1996. As a re-

sult, operating expenses of Entertainment business segment decreased

by ¥863 million and operating income increased by the same amount

for the year ended March 31, 1996.

Financial Section