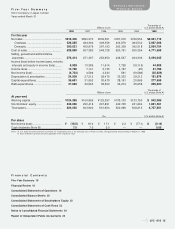

JVC 1998 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1998 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 JVC 1998

1. BASIS OF FINANCIAL STATEMENTS

The accompanying consolidated financial statements have been trans-

lated into English from those in Japanese which have been filed with

the Ministry of Finance and the Tokyo Stock Exchange. They reflect

certain changes in classification and form of presentation to make the

consolidated financial statements more meaningful and informative for

readers outside Japan.

The financial statements are stated in Japanese yen. The transla-

tions of the Japanese yen amounts into U.S. dollars are included solely

for the convenience of the reader, using the prevailing exchange rate at

March 31, 1998, which was ¥132 to U.S.$1.00. The convenience

translations should not be construed as representations that the Japa-

nese yen amounts have been, could have been, or could in the future

be, converted into U.S. dollars at this or any other rate of exchange.

Certain reclassifications have been made in the 1997 and 1996 fi-

nancial statements to comform to the presentation for 1998.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of consolidation

The consolidated financial statements include the accounts of the

Company and its significant subsidiaries. All significant intercompany

transactions and accounts have been eliminated.

Investments in certain unconsolidated subsidiaries and affiliated

companies (20% to 50% owned) are, with minor exceptions, stated at

their underlying net equity value after elimination of unrealized intercom-

pany profits and losses. The Company’s investments in its remaining

subsidiaries and affiliated companies are immaterial in the aggregate,

and are stated at cost or less.

Differences between acquisition cost and underlying net equity at

the time of acquisition are generally being amortized on a straight-line

method over five years.

Foreign currency translation

Current assets and liabilities denominated in foreign currencies are

translated into Japanese yen at exchange rates prevailing at the bal-

ance sheet dates, and non-current assets and liabilities denominated in

foreign currencies are translated at historical exchange rates. Resulting

exchange gains or losses are credited or charged to income as

incurred.

Foreign currency items with forward exchange contracts are trans-

lated at the contracted rates. Gains on long-term forward exchange

contracts are allocated to income over the life of the forward exchange

contract. The related tax effect on the gains is also recognized.

Translation of foreign currency financial statements

Through 1996, monetary current assets and liabilities and net income

were translated at exchange rates prevailing at the balance sheet dates.

Non-monetary current assets and liabilities, non-current assets and lia-

bilities and common stock were translated at historical exchange rates.

Revenue and expenses, except for depreciation which was translated

at historical exchange rates, were translated at average exchange rates

during the respective years.

Differences resulting from translation of the balance sheets of foreign

consolidated subsidiaries were charged or credited to “foreign currency

translation adjustments” in the accompanying balance sheets except

that the differences resulting from translation of opening retained earn-

ings were charged or credited directly to retained earnings. Differences

resulting from translation of the statements of income of foreign consoli-

dated subsidiaries were included in “foreign currency translation adjust-

ments” in the accompanying statements of income.

From 1997, according to the revised Accounting Standards for

Foreign currency translations, assets and liabilities have been translated

at exchange rates prevailing at the balance sheet dates. Stockholders’

equity has been translated at historical exchange rates.

Revenue and expenses have been translated at average exchange

rates during the respective years.

Differences resulting from translation of the balance sheets of foreign

consolidated subsidiaries have been charged or credited to “foreign

currency translation adjustments” in the accompanying balance sheets.

The amounts for 1997 are based on the revised accounting standards.

Assuming the amounts for 1996 were translated into Japanese yen in

the same manner as those for 1997, operating income would decrease

by ¥394 million, income before income taxes, minority interests and eq-

uity in income (loss) would increase by ¥189 million, and net income

would increase by ¥479 million.

Inventories

Inventories are stated at cost, which is determined by the average cost

method, or less.

Marketable securities and investment securities

Securities quoted on stock exchanges are stated at the lower of aver-

age cost or market. Non-quoted securities are valued at cost or less,

reflecting write-downs based on impairment of the underlying equity.

Property, plant and equipment

Property, plant and equipment is stated at cost. Depreciation is deter-

mined primarily by the declining-balance method based on the esti-

mated useful lives of the assets. The ranges of useful lives used in the

computation of depreciation are generally as follows:

Buildings ......................................................................20 to 50 years

Machinery and equipment............................................3 to 7 years

Expenditure for maintenance and repairs is charged to income as

incurred.

Finance leases

Finance leases, except those leases for which the ownership of the

leased assets is considered to be transferred to the lessee, are ac-

counted for in the same manner as operating leases.

Research and development

Research and development expenditure for new products or improve-

ment of existing products is charged to income as incurred.

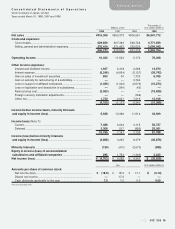

Notes to Consolidated Financial Statements

Victor Company of Japan, Limited

Years ended March 31, 1998, 1997 and 1996