JVC 1998 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1998 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC 1998 25

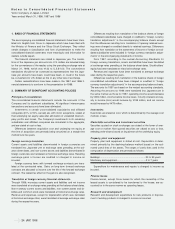

Income taxes

Current income taxes are provided for the amounts currently payable

for each year based on taxable income. Deferred income taxes are pro-

vided on significant temporary differences between income for financial

reporting purposes and income for taxation purposes.

No provision for income taxes is made on undistributed earnings of

foreign subsidiaries and affiliated companies as the Company considers

that such earnings are permanently reinvested.

Employees’ retirement benefits and pension plans

The Company has funded pension plans and unfunded benefit plans to

provide retirement benefits for substantially all employees. Approximate-

ly 87% of total retirement benefits for employees is covered by funded

pension plans.

Upon retirement or termination of employment for reasons other

than dismissal for cause, eligible employees are entitled to lump-sum

and/or annuity payments based on their current rates of pay and length

of service.

Employees’ retirement benefits is principally stated at 40% (100%

for certain employees whose age reached 55) of the amount which

would be required to be paid (less the amount which is expected to be

covered by the pension plans) if all eligible employees voluntarily termi-

nated their employment at the balance sheet date, plus the unamor-

tized balance of certain previously accumulated amounts.

Costs with respect to the pension plans are funded as accrued in an

amount determined actuarially. Prior service costs are being funded

over 10 years and the resultant charges to income are offset by amorti-

zation of the excess amount of employees’ retirement benefits which is

expected to be covered by the pension plans.

Certain of the consolidated subsidiaries also have employees’ retire-

ment benefit plans and funded pension plans similar to those of the

Company.

Amounts per share of common stock

The computation of net income per share is based on the weighted av-

erage number of shares of common stock outstanding during each

year.

Diluted net income per share of the common stock for the year

ended March 31, 1996 was not shown since the outstanding convert-

ible bonds had no dilutive effect on the net income per share data for

1996.

Cash dividends per share represent the actual amount declared as

applicable to the respective years.

3. CHANGE IN ACCOUNTING POLICY

In the year ended March 31, 1996, one of domestic consolidated sub-

sidiaries changed its accounting for production cost of karaoke soft-

ware from direct charging to income when announced to sell to capital-

izing to inventories and amortizing by the declining balance method

over two years. This change was made to get better matching of cost

with revenue under the condition that the software is expected to be

sold continuously and the sales volume is expected to increase. This

change resulted in increases in operating income and income before in-

come taxes, minority interests and equity in loss by ¥863 million, re-

spectively. As to effect on segment information, see Note 14.

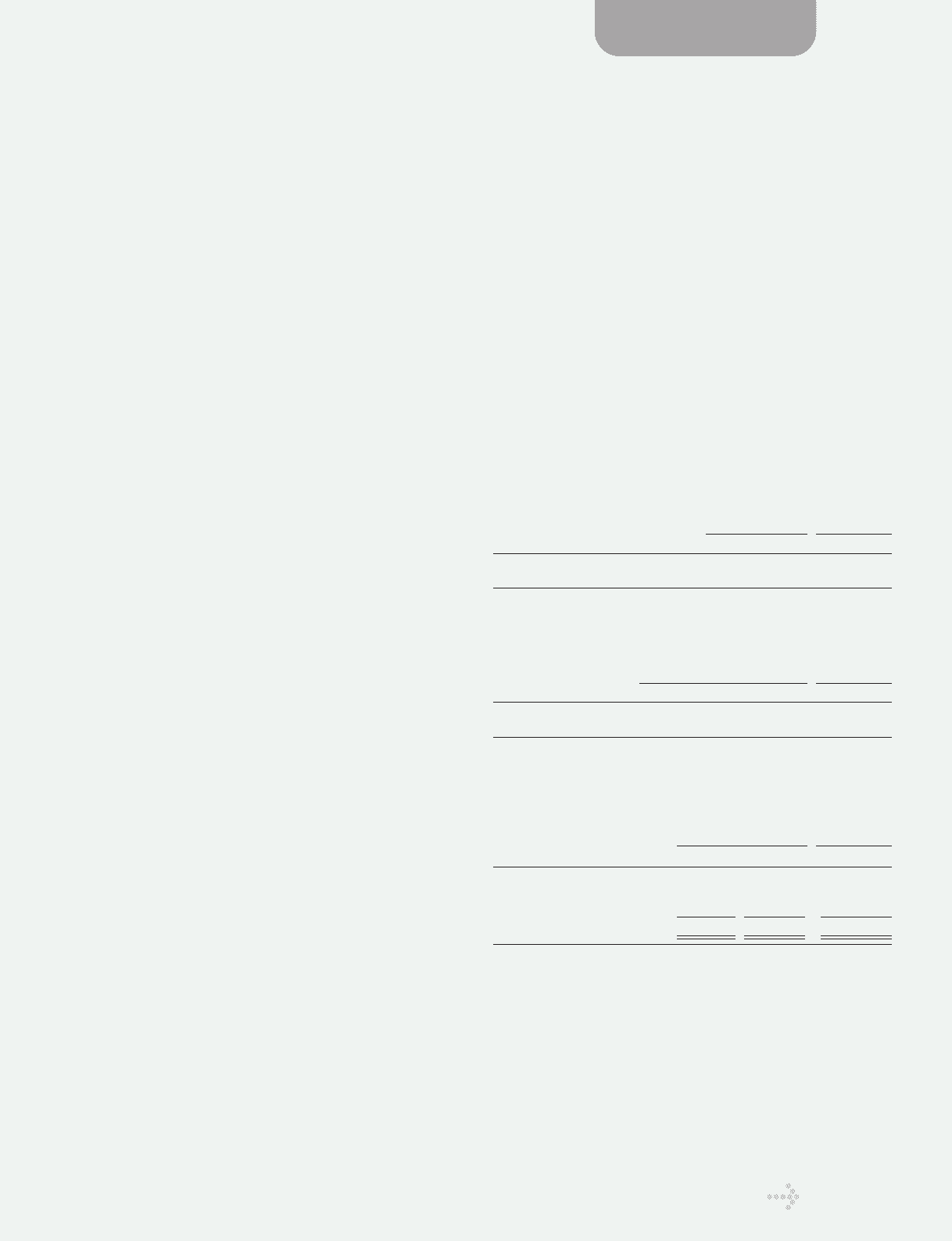

4. TRANSACTIONS WITH MATSUSHITA ELECTRIC

INDUSTRIAL CO., LTD.

The Company is a subsidiary of Matsushita Electric Industrial Co., Ltd.

(“Matsushita”). The Company’s relationship with Matsushita dates back

to 1954 when Matsushita acquired a controlling equity interest in the

Company. Since then the Company has pursued an independent man-

agement policy in all aspects of its operations based on the principle of

“mutual development through competition.” There is no relationship of

financial assistance between the two companies. Each company has a

right of access to the technology developed by the other. At March 31,

1998, Matsushita held 133,227 thousand shares of common stock of

the Company, 52.40% of the total outstanding shares.

Main account balances with Matsushita at March 31, 1998 and

1997, were as follows:

Thousands of

Millions of yen U.S. dollars

1998 1997 1998

Due from Matsushita ....................... ¥ 112 ¥ 136 $ 848

Due to Matsushita ........................... 3,238 2,807 24,530

Sales to and purchases from Matsushita for the years ended March

31, 1998, 1997 and 1996, were as follows:

Thousands of

Millions of yen U.S. dollars

1998 1997 1996 1998

Net sales......................... ¥ 1,125 ¥ 1,558 ¥ 2,231 $ 8,523

Net purchases................. 33,225 34,965 34,273 251,705

5. INVENTORIES

Inventories at March 31, 1998 and 1997, were as follows:

Thousands of

Millions of yen U.S.dollars

1998 1997 1998

Finished goods........................... ¥101,254 ¥ 88,749 $ 767,076

Work in process ......................... 20,681 18,040 156,674

Raw materials and supplies........ 27,690 20,660 209,773

.................................................. ¥149,625 ¥127,449 $1,133,523

Financial Section