JVC 1998 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1998 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

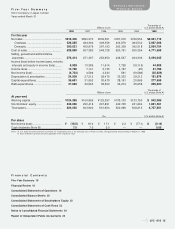

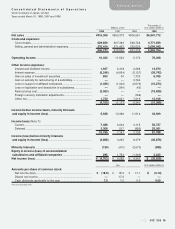

JVC 1998 23

Thousands of

Millions of yen U.S. dollars (Note 1)

1998 1997 1996 1998

Cash flows from operating activities:

Net income (loss)........................................................................ ¥ (4,703) ¥ 4,586 ¥ 4,343 $ (35,629)

Adjustments to reconcile net income to net cash provided

by operating activities:

Depreciation and amortization ................................................ 24,008 27,212 28,475 181,879

Equity in loss (income) of unconsolidated subsidiaries and .....

affiliated companies............................................................... (295) (1,754) 1,366 (2,235)

Loss (gain) on disposal of property, plant and

equipment, net ...................................................................... 199 (180) (1,765) 1,508

Loss on liquidation and dissolution of subsidiaries.................. —255 43 —

Loss on support of affiliated companies ................................. —529 2,674 —

Gain on subsidy for restructuring of a subsidiary .................... —— (3,744) —

Deferred income taxes............................................................ 3,755 (57) (1,385) 28,447

Bonuses to directors and statutory auditors........................... (94) (71) (1) (712)

Changes in assets and liabilities:

Increase in notes and accounts receivable ............................. (2,074) (9,666) (21,736) (15,712)

Decrease (increase) in inventories ........................................... (20,689) 13,695 (21,046) (156,735)

Increase in other current assets.............................................. (532) (1,549) (5,281) (4,030)

Increase (decrease) in notes and accounts payable................ 15,108 (9,607) 19,972 114,455

Increase in accrued income taxes........................................... 1,420 1,079 25 10,758

Increase (decrease) in other current liabilities .......................... 2,448 (290) 1,238 18,545

Effect of changes in number of consolidated subsidiaries,

unconsolidated subsidiaries and affiliated companies............ 1,480 634 (4,764) 11,212

Other ...................................................................................... 2,068 2,924 3,826 15,666

Net cash provided by operating activities ............................... 22,099 27,740 2,240 167,417

Cash flows from investing activities:

Capital expenditures ................................................................... (36,651) (31,552) (30,479) (277,659)

Proceeds from sales of fixed assets............................................ 2,027 1,834 5,560 15,356

Decrease (increase) in marketable securities............................... (1,776) (4,019) 10,438 (13,455)

Decrease (increase) in investment securities ............................... 3,079 (8,866) (1,398) 23,326

Decrease (increase) in investment in and advances to

unconsolidated subsidiaries and affiliated companies................ (4,137) 151 (4,799) (31,341)

Other........................................................................................... 754 3,285 (4,339) 5,712

Net cash used in investing activities ........................................ (36,704) (39,167) (25,017) (278,061)

Cash flows from financing activities:

Proceeds from long-term loans................................................... —1,813 — —

Repayments of long-term loans.................................................. (2,572) (3,697) (1,622) (19,485)

Proceeds from issuance of bonds .............................................. —40,000 — —

Repayments of bonds................................................................. (1,494) (5,827) — (11,318)

Increase (decrease) in short-term bank loans.............................. 13,357 (551) 15,487 101,190

Increase (decrease) in commercial paper.................................... (6,869) 3,662 (833) (52,038)

Cash dividends paid ................................................................... (2,033) (1,907) (23) (15,402)

Net cash provided by financing activities ................................ 389 33,493 13,009 2,947

Effect of exchange rate changes on cash ............................... 567 1,452 (3,621) 4,295

Net increase (decrease) in cash ................................................ (13,649) 23,518 (13,389) (103,402)

Cash at beginning of the year ................................................... 84,797 61,279 74,668 642,402

Cash at end of the year .............................................................. ¥ 71,148 ¥ 84,797 ¥ 61,279 $ 539,000

See accompanying notes.

Consolidated Statements of Cash Flows

Victor Company of Japan, Limited

Years ended March 31, 1998, 1997 and 1996

Financial Section