JVC 1998 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1998 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC 1998 17

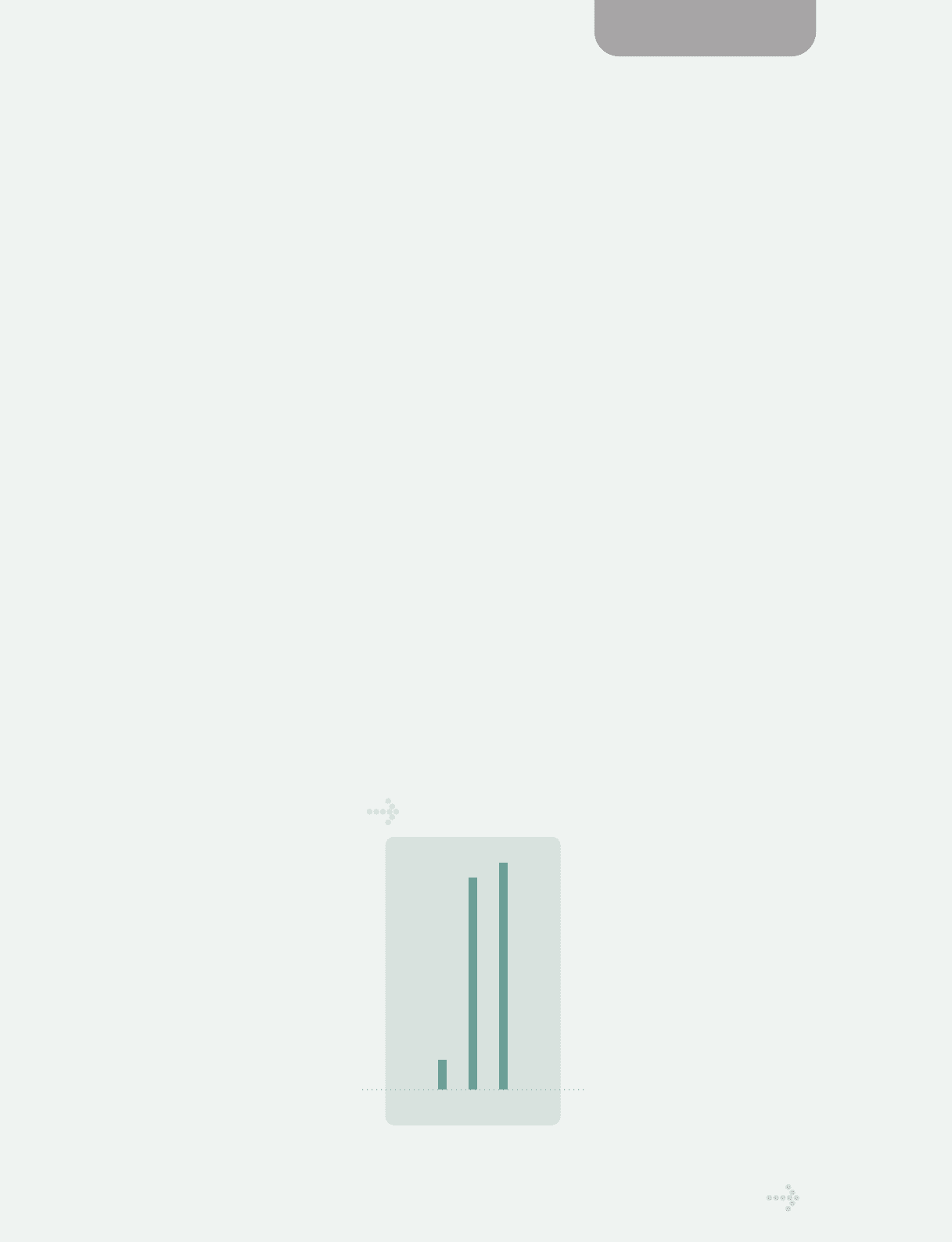

(19.6)

0.6

4.3 4.6

(4.7)

Net Income (Loss) (Billions of yen)

94 95 96 97 98

Financial Section

yokes for use in computer displays, video heads, motors, CD-ROM

drive mechanisms, optical pick-ups and build-up multilayer

boards.

Sales of Components & Devices fell 9.6% to ¥70,843 million

(US$536.7 million), or 7.7% of net sales, down 1.1 percentage

points from the previous fiscal year. Weak demand for personal

computers caused a decline in orders for products, including de-

flection yokes used in computer displays. However, demand is ex-

panding for such strategic products as build-up multilayer boards

for the multimedia market, leading to predictions of a recovery in

sales in the next fiscal year.

Entertainment

The Entertainment business offers such audio and visual software

as CDs and videotapes, and engages in film distribution and game

software operations in the domestic market.

Sales in the Entertainment business rose 1.4% to ¥136,702 mil-

lion (US$1,035.6 million), accounting for 14.9% of net sales, com-

pared with 15.1% in the previous fiscal year. Overall sales in this

business’s mainstay AV software operations were firm. The

Company is planning business expansion in multimedia-related

software operations to establish it as a third business pillar in the

21st century.

Earnings

The cost of sales ratio was 68.7%, a rise of 0.5 percentage point.

JVC lowered costs by optimizing its worldwide production net-

work, and made progress in shifting to high-value-added digital

products. However, these efforts failed to offset the adverse effects

of declining prices for mainstream AV products.

Selling, general and administrative (SG&A) expenses as a per-

centage of net sales improved 0.3 percentage point to 30.2%, an

indication of economies of scale and focused restructuring imple-

mented by management in recent years.

As a result, operating income decreased 12.9% to ¥10,033

million (US$76.0 million).

JVC recorded other expenses of ¥4,105 million (US$31.1 mil-

lion) compared with other expenses of ¥1,137 million in the previ-

ous fiscal year. The primary factors behind the increase were the

liquidation of unprofitable factories and the consolidation of mar-

keting companies, resulting in a restructuring cost of ¥2,063 million

(US$15.6 million) for overseas subsidiaries. Management believes

these adverse factors were temporary and does not expect them

to recur in following terms. In addition, net interest expense (inter-

est expense plus interest and dividend income) increased 35.3% to

¥3,309 million (US$25.1 million) owing to an increase in interest-

bearing debt.

Income before income taxes and other adjustments decreased

42.9% to ¥5,928 million (US$44.9 million). Income taxes, however,

increased to ¥10,796 million (US$81.8 million) from ¥7,141 million

in the previous fiscal year. A principal reason behind this was

higher consolidated tax liability, which does not precisely reflect

changes in income before income taxes because Japanese ac-

counting standards do not recognize tax payments on a consoli-

dated basis. Another reason was the completion of tax payments,

which were accounted for as deferred income taxes during the fis-

cal year, of approximately ¥3,000 million (US$22.7 million) incurred

on the liquidation of a German factory in 1993.

As a result, a net loss of ¥4,703 million (US$35.6 million) was

recorded compared with net income of ¥4,586 million in the