JP Morgan Chase 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332

|

|

1515

common themes across the firm. We have

strengthened the Audit Department and risk

assessment throughout the firm, enhanced

data quality and controls, and also strength-

ened permanent standing committees that

review new clients, new products and all

reputational issues.

The eort is enormous.

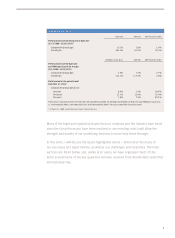

Since 2011, our total headcount directly asso-

ciated with Controls has gone from 24,000

people to 43,000 people, and our total annual

Controls spend has gone from $6 billion to

approximately $9 billion annually over that

same time period. We have more work to

do, but a strong and permanent foundation

is in place. Far more is spent on Controls if

you include the time and eort expended

by front-oce personnel, committees and

reviews, as well as certain technology and

operations functions.

We have also made a very substantial amount

of progress in Anti-Money Laundering/Bank

Secrecy Act.

We deployed a new anti-money laundering

(AML) system, Mantas, which is a moni-

toring platform for all global payment

transactions. It now is functioning across our

company and utilizes sophisticated algo-

rithms that are regularly enhanced based on

transactional experience. We review elec-

tronically $105 trillion of gross payments

each month, and then, on average, 55,000

transactions are reviewed by humans after

algorithms identify any single transaction

as a potential issue. Following this eort,

we stopped doing business with 18,000

customers in 2015. We also are required to

file suspicious activity reports (SAR) with the

government on any suspicious activity. Last

year, we filed 180,000 SARs, and we estimate

that the industry as a whole files millions

each year. We understand how important

this activity is, not just to protect our

company but to help protect our country

from criminals and terrorists.

We exited or restricted approximately 500

foreign correspondent banking relationships

and tens of thousands of client relationships

to simplify our business and to reduce our

AML risk. The cost of doing proper AML/

KYC (Know Your Customer) diligence on a

client increased dramatically, making many

of these relationships immediately unprofit-

able. But we did not exit simply due to profit-

ability – we could have maintained unprofit-

able client relationships to be supportive of

countries around the world that are allies to

the United States. The real reason we exited

was often because of the extraordinary legal

risk if we were to make a mistake. In many of

these places, it simply is impossible to meet

the new requirements, and if you make just

one mistake, the regulatory and legal conse-

quences can be severe and disproportionate.

We also remediated 130,000 accounts for

KYC – across the Private Bank, Commercial

Bank and the Corporate & Investment Bank.

This exercise vastly improved our data, gave

us far more information on our clients and

also led to our exiting a small number of

client relationships. We will be vigilant on

onboarding and maintaining files on all new

clients in order to stay as far away as we can

from any client with unreasonable risk.

In all cases, we carefully tried to get the balance

right while treating customers fairly.

You can see that we are doing everything in

our power to meet and even exceed the spirit

and the letter of the law to avoid making

mistakes and the high cost – both monetarily

and to our reputation – that comes with

that. But we also tried to make sure that in

our quest to eliminate risk, we did not ask

a lot of good clients to exit. We hope that in

the future, the regulatory response to any

mistakes – if and when they happen, and

they will happen – will take into account the

extraordinary eort to get it right.