JP Morgan Chase 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332

|

|

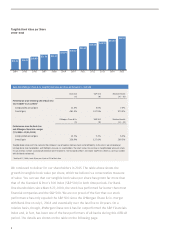

99

Virtually all of our businesses are close to

best in class, in overhead ratios and, more

important, in return on equity (ROE), as

shown on the chart on page 8. Of even more

relevance, we have these strong ratios while

making sizable investments for the future

(which we have reported on extensively in

the past and you can read more about in the

CEO letters). It is easy to meet short-term

targets by skimping on investments for

the future, but that is not our approach for

building the business for the long term.

How do you compare your franchises with your peers? What makes you believe your businesses

are strong?

We are deeply aware that our clients

choose who they want to do business with

each and every day, and we are gratified

that we continue to earn our clients’ busi-

ness and their trust. If you are gaining

customers and market share, you have to

be doing something right. The chart below

shows that we have been meeting this goal

fairly consistently for 10 years.

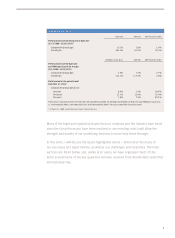

Irreplicable Client Franchises Built Over the Long Term

2006 2014 2015

Consumer &

Community

Banking

Deposits market share1

# of top 50 Chase markets

where we are #1 (top 3) deposits

Average deposits growth rate

Active mobile customers growth rate

Card sales market share2

Merchant processing volume3,4

3.6%

11 (25)

7.7%

NM

16%

#3

7.6%

13 (40)

7.4%

22.1%

21%

#1

7.9%

12 (40)

9.0%

19.5%

21%

#1

Relationships with ~50% of U.S. households

#1 primary banking relationship share in Chase footprint11

#1 retail bank in the U.S. for acquiring, developing and

retaining customers12

#1 U.S. credit card issuer based on loans outstanding13

#1 U.S. co-brand credit card issuer14

#1 wholly-owned merchant acquirer15

Corporate &

Investment

Bank

Global Investment Banking fees5

Market share5

Total Markets revenue6

Market share6

FICC6

Market share6

Equities6

Market share6

#2

8.6%

#8

7.9%

#7

9.1%

#8

6.0%

#1

8.0%

#1

15.5%

#1

17.5%

#3

11.6%

#1

7.9%

#1

15.9%

#1

18.3%

#3

12.0%

>80% of Fortune 500 companies do business with us

Top 3 in 16 product areas out of 1716

#1 in both N.A. and EMEA Investment Banking fees17

#1 in Global Debt, Equity and Equity-related17

#1 in Global Long-Term Debt and Loan Syndications17

#1 in FICC productivity18

Top 3 Custodian globally with AUC of $19.9 trillion

#1 USD clearing house with 18.9% share in 201519

Commercial

Banking

# of states with Middle Market

banking presence

Multifamily lending7

Gross Investment Banking

revenue ($ in billions)

% of North America

Investment Banking fees

22

#28

$0.7

16%

30

#1

$2.0

35%

32

#1

$2.2

36%

#1 in customer satisfaction20

Leveraging the firm’s platform — average ~9 products/client21

Top 3 in overall Middle Market, large Middle Market

and ABL bookrunner

Industry-leading credit performance — 4th straight year of net

recoveries or single digit NCO rate

Asset

Management

Mutual funds with a 4/5 star rating8

Global active long-term open-end

mutual fund AUM flows9

AUM market share9

North America Private Bank (Euromoney)

Client assets market share10

119

#2

1.8%

#1

~3%

226

#1

2.5%

#1

~4%

231

#2

2.6%

#1

~4%

84% of 10-year long-term mutual fund AUM in top 2 quartiles22

Positive client asset flows every year since 2004

#3 Global Private Bank and #1 LatAm Private Bank23

Revenue and long-term AUM growth ~80% since 2006

Doubled GWM client assets (2x industry rate) since 200610

For footnoted information, refer to slide 42 in the 2016 Firm Overview Investor Day presentation, which is available on JPMorgan Chase & Co.’s website at

(http://investor.shareholder.com/jpmorganchase/presentations.cfm), under the heading Investor Relations, Investor Presentations, JPMorgan Chase 2016 Investor Day,

Firm Overview, and on Form 8-K as furnished to the SEC on February 24, 2016, which is available on the SEC’s website (www.sec.gov).

NM = Not meaningful