JP Morgan Chase 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332

|

|

1313

tive credit losses were for all banks during

the Great Recession (they were 5.6%), and

our credit book today is materially better

than what we had at that time. The 2015

CCAR losses were even with the actual losses

for banks during the worst two years of the

Great Depression in the 1930s (6.4%).

The stress test is extremely severe on trading and

counterparty risk.

Our 2015 CCAR trading and counterparty

losses were $24 billion. We have two compar-

isons that should give comfort that our losses

would never be this large.

First, recall what actually happened to us in

2008. In the worst quarter of 2008, we lost

$1.7 billion; for the entire year, we made $6.3

billion in trading revenue in the Investment

Bank, which included some modest losses

on the Lehman default (one of our largest

counterparties). The trading books are much

more conservative today than they were in

2008, and at that time, we were still paying

a considerable cost for assimilating and

de-risking Bear Stearns.

Second, we run hundreds of stress tests

of our own each week, across our global

trading operations, to ensure our ability

to withstand and survive many bad and

extreme scenarios. These scenarios include

events such as what happened in 2008, other

historically damaging events and also new

situations that might occur. We manage

our company so that even under the worst

market stress test conditions, we would

almost never bear a loss of more than $5

billion (remember, we earn approximately

$10 billion pre-tax, pre-provision each

quarter). We recognize that on rare occa-

sions, we could experience a negative signifi-

cant event that could lead to our having a

poor quarter. But we will be vigilant and will

never take such a high degree of risk that it

jeopardizes the health of our company and

our ability to continue to serve our clients.

This is a bedrock principle. Later in this

letter, I will also describe how we think about

idiosyncratic geopolitical risk.

And the capital we have to bear losses is

enormous.

We have an extraordinary amount of capital

to sustain us in the event of losses. It is

instructive to compare assumed extreme

losses against how much capital we have for

this purpose.

You can see in the table below that JPMorgan

Chase alone has enough loss absorbing

resources to bear all the losses, assumed by

CCAR, of the 31 largest banks in the United

States. Because of regulations and higher

capital, large banks in the United States are

far stronger. And even if any one bank might

fail, in my opinion, there is virtually no

chance of a domino eect. Our shareholders

should understand that while large banks do

significant business with each other, they do

not directly extend much credit to one other.

And when they trade derivatives, they mark-

to-market and post collateral to each other

every day.

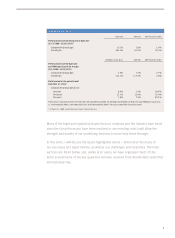

Resilience of JPMorgan Chase through multiple layers of protection

($ in billions)

Total loss absorbing resources

December 31, 2015:

JPMorgan Chase quarterly estimated

pre-tax, pre-provision earnings ~$ 10

Eligible long-term debt $ 125

Preferred equity 26 CCAR industry losses2

CET1 173 JPMorgan Chase losses $ 55

Total reserves1 25 Losses of 30 other participating banks 167

Total resources ˜$ 350 Total CCAR losses $ 222

1 Includes credit, legal, tax and valuation reserves.

2 As estimated for the nine quarters ending December 31, 2016, by the Federal Reserve in the 2015 CCAR severely adverse scenario.

Note: Numbers may not sum due to rounding.