JP Morgan Chase 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332

|

|

1111

In support of our main mission – to serve

our clients and our communities – there

is nothing more important than to protect

our company so that we are strong and can

continue to be here for all of those who

count on us. We have taken many actions

that should give our shareholders, clients and

regulators comfort and demonstrate that our

company is rock solid.

The actions we have taken to strengthen

our company.

In this section, we describe the many

actions that we have taken to make our

company stronger and safer: our fortress

balance sheet with enhanced capital and

liquidity, our ability to survive extreme

stress of multiple types, our extensive

de-risking and simplification of the busi-

ness, and the building of fortress controls in

meeting far more stringent regulatory stan-

dards. Taken together, these actions have

enabled us to make extraordinary progress

toward reducing and ultimately eliminating

the risk of JPMorgan Chase failing and

the cost of any failure being borne by the

American taxpayer or the U.S. economy.

II. WEMUSTANDWILLPROTECTOURCOMPANYAND

THOSEWESERVE

You say you have a “fortress balance sheet.” What does that mean? Can you handle the

extreme stress that seems to happen around the world from time to time?

Nearly every year since the Great Recession,

we have improved virtually every measure of

financial strength, including many new ones.

It’s important to note as a starting point that

in the worst years of 2008 and 2009, JPMorgan

Chase did absolutely fine – we never lost

money, we continued to serve our clients,

and we had the wherewithal and capability

to buy and integrate Bear Stearns and

Washington Mutual. That said, we none-

theless recognize that many Americans did

not do fine, and the financial crisis exposed

weaknesses in the mortgage market and

other areas. Later in this letter, I will also

describe what we are doing to strengthen

JPMorgan Chase and to help support the

entire economy.

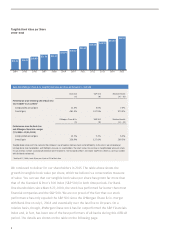

The chart on page 12 shows many of the

measures of our financial strength – both

from the year preceding the crisis and our

improvement in the last year alone.

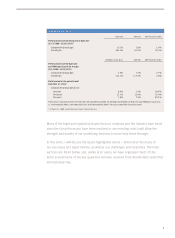

In addition, every year, the Federal Reserve puts

all large banks through a very severe and very

detailed stress test.

Among other things, last year’s stress test

assumed that unemployment would go to

10.1%, housing prices would fall 25%, equity

markets would decline by nearly 60%, real

gross domestic product (GDP) would decline

4.6%, credit spreads would widen dramati-

cally and oil prices would rise to $110 per

barrel. The stress test also assumed an instan-

taneous global market shock, eectively far

worse than the one that happened in 2009,

causing large trading losses. It also assumed

the failure of the largest counterparty (this

is meant to capture the failure of the global

bank that you have the most extensive deriva-

tive relationship with; e.g., a Lehman-type

event), which would cause additional losses.

The stress test assumed that banks would not

stop buying back stock – therefore depleting

their capital – and would continue to grow

dramatically. (Of course, growing dramati-

cally and buying back stock if your bank were

under stress would be irresponsible – and is

something we would never do.) Under this

assumed stress, the Federal Reserve esti-

mates that JPMorgan Chase would lose

* Footnote: Our Chief Operating

Ocer Matt Zames talks in his

letter on pages 52–55 about

many important initiatives to

protect our company, including

our physical security and

cybersecurity, so I will not

duplicate any of that information.