JP Morgan Chase 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2015

Table of contents

-

Page 1

A NNU A L REPORT 2015 -

Page 2

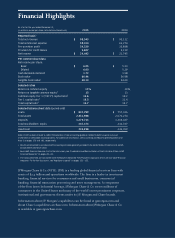

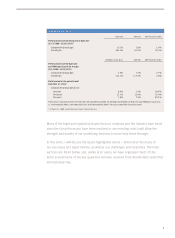

...Net income per share: Basic Diluted Cash dividends declared Book value Tangible book value2 Selected ratios Return on common equity Return on tangible common equity2 Common equity Tier 1 ("CET1") capital ratio3 Tier 1 capital ratio3 Total capital ratio3 Selected balance sheet data (period-end) Loans... -

Page 3

communities clients customers employees veterans nonprofits business owners schools hospitals local governments -

Page 4

...opportunities to invest for the future and to do more for our clients and our communities - as well as continue to support the growth of economies around the world. I feel enormously blessed to work for this great company and with such talented employees. Our management team and employees have built... -

Page 5

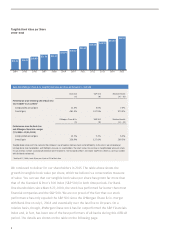

... 2013 2014 2015 Net income Diluted earnings per share Return on tangible common equity While we did produce record profits last year, our returns on tangible common equity have been coming down, mostly due to higher capital requirements, higher control costs and low interest rates. Our return... -

Page 6

... (B) Performance since the Bank One and JPMorgan Chase & Co. merger (7/1/2004-12/31/2015) Compounded annual gain Overall gain 13.7% 336.9% 7.4% 127.6% 6.3% 209.3% Tangible book value over time captures the company's use of capital, balance sheet and profitability. In this chart, we are looking... -

Page 7

Stock total return analysis Bank One S&P 500 S&P Financials Index Performance since becoming CEO of Bank One (3/27/2000-12/31/2015)1 Compounded annual gain Overall gain 10.2% 364.1% 3.8% 81.3% 1.9% 35.3% JPMorgan Chase & Co. S&P 500 S&P Financials Index Performance since the Bank One and ... -

Page 8

...to earn a fair profit? Many banks say that the cost of all the new rules makes this hard to do. • What is all this talk of regulatory optimization, and don't some of these things hurt clients? When will you know the final rules? • How do you manage geopolitical and country risks? • How do... -

Page 9

... in payments, particularly with so many strong competitors - many from Silicon Valley? • You always seem to be segmenting your businesses - how and why are you doing this? • How and why do you use big data? • Why are you investing in sales and trading, as well as in your Investment Bank... -

Page 10

... ROTCE represents implied net income minus preferred stock dividends (NIAC) for each comparable LOB peer weighted by JPM average tangible common equity: WFC, Citi Institutional Clients Group (Citi), Fifth Third Bank (FITB), Bank of America Global Wealth and Investment Management (BAC), T. Rowe Price... -

Page 11

... 10 years. Irreplicable Client Franchises Built Over the Long Term 2006 Deposits market share1 # of top 50 Chase markets where we are #1 (top 3) deposits Average deposits growth rate Active mobile customers growth rate Card sales market share2 Merchant processing volume3,4 Global Investment Banking... -

Page 12

... in terms of customer loyalty. In Asset Management, where customers vote with their wallet, JPMorgan Funds finished second in long-term net flows among all fund complexes. Later on in this letter, I will describe our fortress balance sheet and controls, as well as the discipline we have around risk... -

Page 13

... the risk of JPMorgan Chase failing and the cost of any failure being borne by the American taxpayer or the U.S. economy. You say you have a "fortress balance sheet." What does that mean? Can you handle the extreme stress that seems to happen around the world from time to time? Nearly every year... -

Page 14

... and short-term wholesale funding N/A = Not applicable $55 billion pre-tax over a nine-quarter period, an amount that we would easily manage because of the strength of our capital base. Remember, the Federal Reserve stress test is not a forecast - it appropriately assumes multiple levels of... -

Page 15

... long-term debt Preferred equity CET1 Total reserves1 Total resources 1 2 JPMorgan Chase losses Losses of 30 other participating banks Total CCAR losses $ 55 167 $ 222 Includes credit, legal, tax and valuation reserves. As estimated for the nine quarters ending December 31, 2016, by the Federal... -

Page 16

...International Commercial Card ü S old Retirement Plan Services unit ü E xited government prepaid card ü 1 S impliï¬ed Mortgage Banking products from 37 ü Ceased originating student loans ü D e-risking by discontinuing certain businesses ü with high-risk clients in high-risk... -

Page 17

... any client with unreasonable risk. In all cases, we carefully tried to get the balance right while treating customers fairly. We deployed a new anti-money laundering (AML) system, Mantas, which is a monitoring platform for all global payment transactions. It now is functioning across our company... -

Page 18

... the client experience and decrease our costs. What is all this talk of regulatory optimization, and don't some of these things hurt clients? When will you know the final rules? In the new world, our company has approximately 20 new or significantly enhanced balance sheet and liquidity-related... -

Page 19

... need financing and advice (M&A, equity, debt and loans), risk management (foreign exchange and interest rates) and asset management services (financial planning and investment management), as well as operating services (custody and cash management) in their own countries and globally. It... -

Page 20

... States. For years, this country has had fairly consistent job growth and increasingly strong consumers (home prices are up, and the consumer balance sheet is in the best shape it's ever been in). Housing is in short supply, and household formation is going up, car sales are at record levels, and we... -

Page 21

... and agency securities), which often is used for normal money market operations - movement of collateral, short-term money market investing and legitimate hedging activities. This is clearly due to the higher cost of capital and liquidity under the new capital rules. 19 In the last year or two... -

Page 22

.... The real risk is that high volatility, rapidly dropping prices, and the inability of certain investors and issuers to raise money may not be isolated to the financial markets. These may feed back into the real economy as they did in 2008. The trading markets are adjusting to the new world. There... -

Page 23

...data and our company. We necessarily have a huge amount of data about our customers because of underwriting, credit card transactions and other activities, and we use some of this data to help serve our customers better (I'll speak more about big data later in this letter). And we do extensive work... -

Page 24

...and improve our culture. That said, we acknowledge that we, at times, have fallen short of the standards we have set for ourselves. This year, the company pleaded guilty to a single antitrust violation as part of a settlement with the U.S. Department of Justice related to foreign exchange activities... -

Page 25

... have more rewarding lives both inside and outside the office. Our commitment starts with offering comprehensive benefits programs and policies that support our employees and their families. To do this, JPMorgan Chase spent $1.1 billion in 2015 on medical benefits for employees based in the United... -

Page 26

... Asset Management, Finance and Legal - some of our other businesses and functions headed by women include Auto Finance, Business Banking, U.S. Private Bank, U.S. Mergers & Acquisitions, Global Equity Capital Markets, Global Research, Regulatory Affairs, Global Philanthropy, our U.S. branch network... -

Page 27

..., having an effective balance is important for everyone's well-being, including our junior investment bankers. In the Investment Bank, we have reduced weekend work to only essential execution work for all employees. And the protected weekend program for analysts and associates will remain in place... -

Page 28

..., we have new business initiative approval committees, credit committees, reputational risk committees, capital governance committees, global technology architecture committees and hundreds of others). We have asked that each chair of every committee take charge - start meetings on time, make sure... -

Page 29

... key people? Quite well, thank you. The Board of Directors and I feel we have one of the best management teams we have ever had. Many of our investors who have spent a considerable amount of time with our leaders - not just with my direct reports but with the layer of management below them - will... -

Page 30

...innovation, technology and FinTech? And have banks been good innovators? Do you have economies of scale, and how are they benefiting your clients? We have to be innovating all the time to succeed. Investing in the future is critical to our business and crucial for our growth. Every year we ask, "Are... -

Page 31

... play" stands for a deposit account, a business credit card and Chase merchant processing - all at once. Now that's customer service! - Chase Business Quick Capital. Working with a FinTech company called OnDeck, we will be piloting a new working capital product. The process will be entirely... -

Page 32

...-art service centers, allowing customers to receive different denominations of bills, accept deposited checks, pay certain bills and access all their accounts. • The cost and ability to raise capital and buy and sell securities. Thirty years ago, it cost, on average, 15 cents to trade a share... -

Page 33

...your debit or credit card. It will allow you to pay online with a "Chase Pay" button or in-store with your mobile phone. We also hope to get the Chase Pay button inside merchant apps. Chase Pay will offer lower cost of payment, loyalty programs and fraud liability protection to merchants, as well as... -

Page 34

...more customers wanting to open checking accounts with us and use our credit cards. I also want to mention one more payment capability, this one for our corporate clients: Corporate QuickPay. Leveraging tremendous six partner banks, Chase is launching a P2P solution with real-time funds availability... -

Page 35

... in 11 key markets, all highly aligned with our Investment Banking team. With this model, we can provide investment banking services, comprehensive payment capabilities and international products to address the needs of technology clients through every stage of growth. In Asset Management, we have... -

Page 36

... straightthrough processing rate - going from 70% two years ago to 97% today. Prime Brokerage. Our Prime Brokerage platform, which was once a predominantly U.S. operation, is now a top-tier global business that continues to grow clients and balances. Our international and DMA (direct market access... -

Page 37

... the mortgage business? That is a valid question. The mortgage business can be volatile and has experienced increasingly lower returns as new regulations add both sizable costs and higher capital requirements. In addition, it is not just the cost of the new rules in origination and servicing, it is... -

Page 38

...of mortgages. Part of the risk comes from the penalties that the government charges if you make a mistake - and part of the risk is because these types of mortgages default frequently. And in the new world, the cost of default servicing is extraordinarily high. • Servicing. If we had our druthers... -

Page 39

.... The Service Corps program recruits top-performing employees from around the world to put their skills and expertise to work on behalf of nonprofit partners that are helping to build stronger communities. This program, combining leadership development with philanthropic purpose, started small in... -

Page 40

...million investment in Detroit, they started off by asking about our priorities for the city's recovery - not just mine but those of our community and philanthropic leaders as well. Today, we can see the impact of JPMorgan Chase's commitment to Detroit in many places - in the opening of a new grocery... -

Page 41

... on preparing young people, from all income levels, with the skills and experiences to be college and career ready. The public and private sectors need to forge deeper relationships and make greater investments in developing and expanding effective models of career-focused education that are aligned... -

Page 42

...approximately $700 million a year on research so that we can educate investors, institutions and governments about economies, markets and companies. For countries, we raised $60 billion of capital in 2015. We help these nations develop their capital markets, get ratings from ratings agencies and, in... -

Page 43

... services, given their unique connection to their communities. Not long ago, I read some commentary excoriating big banks written by the CEO of a regional bank. The grievances weren't new or surprising - in the current climate, one doesn't have to look far to find someone attacking large financial... -

Page 44

... valuable risk management tools (such as interest rate swaps and foreign exchange), creating syndicated credit facilities that smaller banks' clients can participate in and offering direct financing. JPMorgan Chase has raised $16.2 billion in growth equity capital for smaller banks since 2014... -

Page 45

... cost of doing business to manage through the cycles. JPMorgan Chase consistently supports consumers, businesses and communities in both good times and the toughest of times. In 2015, the firm provided $22 billion of credit to U.S. small businesses, which allowed them to develop new products, expand... -

Page 46

...Including non-operating deposits reduction of ~ $200 billion 2011 2012 2013 2014 2015 1 Represents assets under management, as well as custody, brokerage, administration and deposit accounts. Represents activities associated with the safekeeping and servicing of assets. Assets under custody2... -

Page 47

...maintain their own strong capital positions. Quarterly Capital Markets Issuances and U.S. Bank Loans Outstanding 2007-2010 ($ in trillions) $7.0 $3.0 $6.0 6000 U.S. bank loans outstanding (left scale) $5.0 4500 4000 $4.0 $2.0 3600 $3.0 Commercial paper outstanding (right scale) 2700 2000 1800... -

Page 48

... years since the financial crisis and six years since Dodd-Frank. Regulators should take more credit for the extraordinary amount that has been accomplished and should state this clearly to the American public. This should help improve consumer confidence in the banking system - and in the economy... -

Page 49

... would help create a more active mortgage market at a lower cost to customers and, again, at no risk to safety and soundness if done right. This, too, would be a plus to consumers and the economy. • Capital rules. Without reducing total capital levels, capital rules could be modified to be... -

Page 50

...bad public policy? Yes, bad public policy, and I'm not looking at this in a partisan way, creates risk for the economies of the world and the living standards of the people on this planet - and, therefore, for the future of JPMorgan Chase - more so than credit or market risks. We have many real-life... -

Page 51

Our current inability to work together in addressing important, long-term issues. We have spoken many times about the extraordinarily positive and resilient American economy. Today, it is growing stronger, and it is far better than you hear in the current political discourse. But we have serious ... -

Page 52

... new way we are doing this is through the development of our JPMorgan Chase Institute, which aims to support sounder economic and public policy through better facts, timely data and thoughtful analysis. Our work at the Institute, whether analyzing income and consumption volatility, small businesses... -

Page 53

... to work at this company and with its outstanding people. What they have accomplished during these often difficult circumstances has been extraordinary. I know that if you could see our people up close in action, you would join me in expressing deep gratitude to them. I am proud to be their partner... -

Page 54

...products, platforms and services our customers and clients value and trust. We serve nearly 40 million digital customers and process $1 trillion in merchant transactions annually. Each day, we process $5 trillion of payments, as well as trade and settle $1.5 trillion of securities. We see technology... -

Page 55

... benefit from big data technologies and improved data management practices across our businesses. Enabling customers and clients Last year, in our Custody and Fund Services business, we introduced NAVExplain, an industry-first solution that puts key insights about underlying fund activity and asset... -

Page 56

...000 employees now use their personal mobile devices to securely access business applications, offering them the freedom and flexibility to be productive on the go. In addition, investments in real-time collaboration tools allow teams to communicate seamlessly across the globe. For example, this year... -

Page 57

... competitiveness. Our sophisticated interest rate and liquidity risk management frameworks prepare us for a range of market scenarios and ongoing regulatory changes. Our focus on technology, be it developing innovative solutions, capitalizing on big data or investing in cyber defenses, underscores... -

Page 58

... results Consumer & Community Banking (CCB) had another strong year in 2015. For the full year, we achieved a return on equity of 18% on net income of $9.8 billion and revenue of $43.8 billion. All of our CCB businesses performed well. We continued our strategy of delivering an outstanding customer... -

Page 59

...% of new checking accounts Business Banking Consumer Banking 1 2 3 Excludes Commercial Card Excludes held-for-sale loans Excludes write-offs of purchased credit-impaired loans bps = basis points Scale does not mean acting like a "big bank." Today's customers expect a great customer experience... -

Page 60

...use for customers and employees. And we know continued investment in marketing provides proven returns. For example, a $100 million investment in Credit Card marketing typically generates on average ~400,000 new accounts, ~$3 billion in annual customer spend and ~$600 million in outstanding balances... -

Page 61

... small business solution for quick access to working capital. This new, entirely digital offering, Chase Business Quick CapitalSM, will provide real-time approvals for small dollar loans. Once approved, our business customers will get next-day - or, in many cases, same-day - funding to run and grow... -

Page 62

... testament to our employees based in 60 countries and their focus on client service. 2015 accomplishments We delivered solid results in 2015 and made progress on multiple priorities. The CIB reported net income of $8.1 billion on net revenue of $33.5 billion with a reported return on equity (ROE) of... -

Page 63

... client focus. Once again, J.P. Morgan ranked #1 in Global Investment Banking fees, according to Dealogic, with a 7.9% market share. In addition, the CIB ranked in top-tier positions in 16 out of 17 product areas, according to Coalition, another industry analytics firm. For example, Equity Capital... -

Page 64

... replicate and offers holistic client coverage. Our unique capabilities in advisory and account structuring position J.P. Morgan well to serve the growing number of global multinationals that have complex needs across regions, countries and currencies. Investing in Custody and Fund Services to build... -

Page 65

...capital optimization but in ways that carefully consider the impact on clients. Long term, the approach is to identify ways to maximize returns while adhering to the risk, liquidity and leverage standards governing the CIB. The CIB has maintained its strength while adjusting to the inevitable market... -

Page 66

... to share our 2015 results and our plans for 2016. 2015 performance For the year, Commercial Banking (CB) produced strong results, with $6.9 billion of revenue, $2.2 billion of net income and a return on equity of 15%. Loan growth across the business was robust, ending 2015 with record loan balances... -

Page 67

... consists of three wellcoordinated businesses: Commercial Term Lending, Real Estate Banking and Community Development Banking. Together, our real estate teams originated $32 billion in loans in 2015, up 28% from the prior year. As the industry moves through the real estate cycle, we believe we... -

Page 68

... • #1 Customer Satisfaction, CFO Magazine Commercial Banking Survey, 2015 • Top 3 in overall Middle Market, large Middle Market and Asset Based Lending bookrunner2 • Real Estate Banking - Completed its best year ever with record originations over $11 billion • Community Development Banking... -

Page 69

... and 30 market strategists in Global Investment Management (GIM) to form the foundation of our investments platform. Each of them wakes up every day thinking % of 2015 AUM Over Peer Median1 (net of fees) 3-Year 5-Year 10-Year Equity 82% 81% 87% Fixed Income 78% 68% 77% Multi-Asset Solutions 72... -

Page 70

... banks. At the end of 2015, 84% of our 10-year, long-term mutual fund assets under management (AUM) ranked in the top two quartiles. That collective performance is complemented by equally strong asset class performance in Equity (87%), Fixed Income (77%) and Multi-Asset Solutions (84%), resulting... -

Page 71

..., Asset Management 2015 HiGHliGHtS and aCCoMpliSHMEntS Business highlights • #1 cumulative long-term active mutual fund flows (2010-2015) Leadership positions • #1 Institutional Money Market Fund Manager Worldwide (iMoneyNet, September 2015) • #1 Private Bank in the World (Global Finance... -

Page 72

...-wage jobs - with the skills and training needed to get on the road to a well-paying, long-term career. Through Small Business Forward, we are opening the doors that have too often been shut to minority and community-based small business owners by creating programs and investments that provide the... -

Page 73

... loans to finance housing and mixed-use real estate projects and to help small businesses in the city expand and create new jobs through the $50 million in two new funds we seeded with our community development lending partners. • Provided critical financial support to the Detroit Land Bank... -

Page 74

...local economies and communities • Provided $3.1 billion to low- and moderate-income communities through community development lending and equity investments. • Awarded $48 million since 2014 to networks of community development financial institutions (CDFI), providing capital to small businesses... -

Page 75

... Risk Management Capital Management Liquidity Risk Management Critical Accounting Estimates Used by the Firm Accounting and Reporting Developments Nonexchange-Traded Commodity Derivative Contracts at Fair Value Forward-Looking Statements Note: The following pages from JPMorgan Chase & Co.'s 2015... -

Page 76

... ratio High quality liquid assets ("HQLA") (in billions)(c) Common equity tier 1 ("CET1") capital ratio(d) Tier 1 capital ratio(d) Total capital ratio(d) Tier 1 leverage ratio(d) Selected balance sheet data (period-end) Trading assets Securities Loans Core Loans Total assets Deposits Long-term debt... -

Page 77

... equity benchmark consisting of leading companies from different economic sectors. The KBW Bank Index seeks to reflect the performance of banks and thrifts that are publicly traded in the U.S. and is composed of 24 leading national money center and regional banks and thrifts. The S&P Financial... -

Page 78

...CIB"), Commercial Banking ("CB"), and Asset Management ("AM"). For a description of the Firm's business segments, and the products and services they provide to their respective client bases, refer to Business Segment Results on pages 83-106, and Note 33. 68 JPMorgan Chase & Co./2015 Annual Report -

Page 79

...business, this Annual Report should be read in its entirety. Financial performance of JPMorgan Chase Year ended December 31, (in millions, except per share data and ratios) Selected income statement data Total net revenue Total noninterest expense Pre-provision profit Provision for credit losses Net... -

Page 80

... changing banking landscape, while serving its clients and customers, investing in its businesses, and delivering strong returns to its shareholders. Importantly, the Firm exceeded all of its 2015 financial targets including those related to balance sheet optimization and managing its capital, its... -

Page 81

... relating to the availability of adequate Total Loss Absorbing Capacity ("TLAC"). In Mortgage Banking within CCB, management expects noninterest revenue to decline by approximately $700 million in 2016 as servicing balances continue to decline from year-end 2015 levels. The Card net charge-off rate... -

Page 82

...increase JPMorgan Chase & Co./2015 Annual Report Revenue Year ended December 31, (in millions) Investment banking fees Principal transactions Lending- and deposit-related fees Asset management, administration and commissions Securities gains Mortgage fees and related income Card income Other income... -

Page 83

... structured notes. Private equity gains increased as a result of higher net gains on sales. These increases were partially offset by lower fixed income markets revenue in CIB, primarily driven by credit-related and rates products, as well as the impact of business simplification initiatives. Lending... -

Page 84

... 2014 The effective tax rate decreased compared with the prior year, predominantly due to the recognition in 2015 of tax benefits of $2.9 billion and other changes in the mix of income and expense subject to U.S. federal, state and local income taxes, partially offset by prior-year tax adjustments... -

Page 85

...ANALYSIS Selected Consolidated balance sheets data December 31, (in millions) Assets Cash and due from banks Deposits with banks Federal funds sold and securities purchased under resale agreements Securities borrowed Trading assets: Debt and equity instruments Derivative receivables Securities Loans... -

Page 86

... of a cash management product that offered customers the option of sweeping their deposits into commercial paper ("customer sweeps"), and lower issuances in the wholesale markets, consistent with Treasury's short-term funding plans. For additional information, see Liquidity Risk Management on pages... -

Page 87

... of a credit rating downgrade to JPMorgan Chase Bank, N.A. For certain liquidity commitments to SPEs, JPMorgan Chase Bank, N.A. could be required to provide funding if its shortterm credit rating were downgraded below specific levels, Off-balance sheet lending-related financial instruments... -

Page 88

... cash obligations By remaining maturity at December 31, (in millions) On-balance sheet obligations Deposits(a) Federal funds purchased and securities loaned or sold under repurchase agreements Commercial paper Other borrowed funds(a) Beneficial interests issued by consolidated VIEs Long-term debt... -

Page 89

... in trading assets from client-driven market-making activities in CIB, resulting in lower levels of debt securities, partially offset by net cash used in connection with loans originated or purchased for sale. Cash provided by operating activities for all periods also reflected net income after... -

Page 90

...-GAAP financial measures used by other companies. The following summary table provides a reconciliation from the Firm's reported U.S. GAAP results to managed basis. 2015 Year ended December 31, (in millions, except ratios) Other income Total noninterest revenue Net interest income Total net revenue... -

Page 91

...financial measures are calculated as follows: Book value per share ("BVPS") Common stockholders' equity at period-end / Common shares at period-end Overhead ratio Total noninterest expense / Total net revenue Return on assets ("ROA") Reported net income / Total average assets Return on common equity... -

Page 92

...CIB's markets-based activities to assess the performance of the Firm's lending, investing (including asset-liability management) and deposit-raising activities. The data presented below are non-GAAP financial measures due to the exclusion of CIB's markets-based net interest income and related assets... -

Page 93

... • Fixed Income Markets • Equity Markets • Securities Services • Credit Adjustments & Other Commercial Banking • Middle Market Banking • Corporate Client Banking • Commercial Term Lending • Real Estate Banking Asset Management • Global Investment Management • Global Wealth... -

Page 94

..., except ratios) Consumer & Community Banking Corporate & Investment Bank Commercial Banking Asset Management Corporate Total $ $ Provision for credit losses 2015 3,059 $ 332 442 4 (10) 3,827 $ 2014 3,520 $ (161) (189) 4 (35) 3,139 $ 2013 335 (232) 85 65 (28) 225 $ Net income/(loss) 2015 9,789... -

Page 95

... credit cards to consumers and small businesses, offers payment processing services to merchants, and provides auto loans and leases and student loan services. Selected income statement data Year ended December 31, (in millions, except ratios) Revenue Lending- and deposit-related fees $ 3,137 Asset... -

Page 96

Management's discussion and analysis Selected metrics As of or for the year ended December 31, (in millions, except headcount) Selected balance sheet data (period-end) Total assets Trading assets - loans(a) Loans: Loans retained Loans held-for-sale(b) Total loans Core loans Deposits Equity(c) ... -

Page 97

... Time and other Total average deposits Deposit margin Average assets Net charge-offs Net charge-off rate Allowance for loan losses Nonperforming assets Retail branch business metrics Net new investment assets Client investment assets % managed accounts Number of: Chase Private Client locations... -

Page 98

... expense. 2014 2013 Mortgage Banking Selected Financial statement data As of or for the year ended December 31, (in millions, except ratios) Revenue Mortgage fees and related income(a) All other income Noninterest revenue Net interest income Total net revenue Provision for credit losses Noninterest... -

Page 99

Selected balance sheet data As of or for the year ended December 31, (in millions) Trading assets - loans (period-end)(a) Trading assets - loans (average)(a) Loans, excluding PCI loans Period-end loans owned Home equity Prime mortgage, including option adjustable rate mortgages ("ARMs") Subprime ... -

Page 100

Management's discussion and analysis Mortgage servicing-related matters The financial crisis resulted in unprecedented levels of delinquencies and defaults of 1-4 family residential real estate loans. Such loans required varying degrees of loss mitigation activities. Foreclosure is usually a last ... -

Page 101

Card, Commerce Solutions & Auto Selected income statement data As of or for the year ended December 31, (in millions, except ratios) Revenue Card income All other income Noninterest revenue Net interest income Total net revenue Provision for credit losses Noninterest expense Income before income tax... -

Page 102

... Selected balance sheet data (average) Total assets Loans: Credit Card Auto Student Total loans Auto operating lease assets Business metrics Credit Card, excluding Commercial Card Sales volume (in billions) New accounts opened Open accounts Accounts with sales activity % of accounts acquired online... -

Page 103

Selected metrics As of or for the year ended December 31, (in millions, except ratios) Credit data and quality statistics Net charge-offs: Credit Card Auto Student Total net charge-offs Net charge-off rate: Credit Card Auto Student Total net charge-off rate Delinquency rates 30+ day delinquency rate... -

Page 104

... data Year ended December 31, (in millions, except ratios) Financial ratios Return on common equity Overhead ratio Compensation expense as percentage of total net revenue Revenue by business Investment banking(a) Treasury Services(b) Lending(b) Total Banking(a) Fixed Income Markets(a) Equity Markets... -

Page 105

... in credit-related products on an industry-wide slowdown, partially offset by increased revenue in Rates and Currencies & Emerging Markets on higher client activity. The lower Fixed Income revenue also reflected higher interest costs on higher long-term debt. Equity Markets revenue was $5.7 billion... -

Page 106

...78) 2015 2014 2013 Loans held-for-sale and loans at fair value Total loans Core Loans Equity Selected balance sheet data (average) Assets Trading assets-debt and equity instruments Trading assets-derivative receivables Loans: Loans retained(a) Loans held-for-sale and loans at fair value Total loans... -

Page 107

... book manager/equal if joint. Business metrics As of or for the year ended December 31, (in millions, except where otherwise noted) Market risk-related revenue - trading loss days(a) Assets under custody ("AUC") by asset class (period-end) in billions: Fixed Income Equity Other(b) Total AUC Client... -

Page 108

... of the client or location of the trading desk, as applicable. Loans outstanding (excluding loans held-for-sale and loans at fair value), client deposits and other thirdparty liabilities, and AUC are based predominantly on the domicile of the client. 98 JPMorgan Chase & Co./2015 Annual Report -

Page 109

... real estate investors and owners. Partnering with the Firm's other businesses, CB provides comprehensive financial solutions, including lending, treasury services, investment banking and asset management to meet its clients' domestic and international financial needs. Selected income statement data... -

Page 110

... lending and investment-related activities within the Community Development Banking business. Selected metrics Year ended December 31, (in millions, except ratios) Revenue by product Lending(a) Treasury services(a) Investment banking Other(a) Total Commercial Banking net revenue Investment banking... -

Page 111

...Total assets Loans: Loans retained Loans held-for-sale and loans at fair value Total loans Core loans Equity Period-end loans by client segment Middle Market Banking(a) Corporate Client Banking(a) Commercial Term Lending Real Estate Banking Other Total Commercial Banking loans Selected balance sheet... -

Page 112

...investment needs. For Global Wealth Management clients, AM also provides retirement products and services, brokerage and banking services including trusts and estates, loans, mortgages and deposits. The majority of AM's client assets are in actively managed portfolios. Selected income statement data... -

Page 113

..., including investment management, capital markets and risk management, tax and estate planning, banking, lending and specialty-wealth advisory services. Selected metrics As of or for the year ended December 31, (in millions, except ranking data and ratios) % of JPM mutual fund assets rated as... -

Page 114

...year due to net inflows to long-term products and the effect of higher market levels. Client assets December 31, (in billions) Assets by asset class Liquidity Fixed income Equity Multi-asset and alternatives Total assets under management Custody/brokerage/ administration/deposits Total client assets... -

Page 115

.... The Corporate segment's balance sheets and results of operations were not impacted by this reporting change. (d) Average core loans were $2.5 billion, $3.3 billion and $5.2 billion for the years ended December 31, 2015, 2014 and 2013, respectively. JPMorgan Chase & Co./2015 Annual Report 105 -

Page 116

...interest rate, foreign exchange and other risks, Treasury and CIO VaR and the Firm's earnings-at-risk, see Market Risk Management on pages 133-139. Selected income statement and balance sheet data As of or for the year ended December 31, (in millions) Securities gains Investment securities portfolio... -

Page 117

...-WIDE RISK MANAGEMENT Risk is an inherent part of JPMorgan Chase's business activities. When the Firm extends a consumer or wholesale loan, advises customers on their investment decisions, makes markets in securities, or offers other products or services, the Firm takes on some degree of risk. The... -

Page 118

... model tier 159-164 Market risk 133-139 Model risk 142 Non-U.S. dollar foreign exchange ("FX") risk The risk that changes in foreign exchange rates affect the value of the Firm's assets or FX net open position ("NOP") liabilities or future results. 139 Operational The risk of loss resulting... -

Page 119

...applicable to the offering of the Firm's products and services to clients and customers. Internal Audit, a function independent of the businesses, Compliance and the Risk Management Organization, tests and evaluates the Firm's risk governance and management, as well as its internal control processes... -

Page 120

... Firm's global risk management framework and approves the primary risk-management policies of the Firm. The Committee's responsibilities include oversight of management's exercise of its responsibility to assess and manage risks of the Firm, as well as its capital and liquidity planning and analysis... -

Page 121

... the Firm's Funds Transfer Pricing Policy (through which lines of business "transfer" interest rate risk to Treasury) and the Firm's Intercompany Funding and Liquidity Policy. ALCO is also responsible for reviewing the Firm's Contingency Funding Plan. The Capital Governance Committee, chaired... -

Page 122

... retained on the balance sheet. In its wholesale businesses, the Firm is exposed to credit risk through its underwriting, lending, market-making, and hedging activities with and for clients and counterparties, as well as through its operating services activities (such as cash management and clearing... -

Page 123

...Detailed portfolio reporting of industry, customer, product and geographic concentrations occurs monthly, and the appropriateness of the allowance for credit losses is reviewed by senior management at least on a quarterly basis. Through the risk reporting and governance structure, credit risk trends... -

Page 124

... in loan satisfactions Real estate owned Other Total assets acquired in loan satisfactions Total assets Lending-related commitments Total credit portfolio Credit derivatives used in credit portfolio management activities(a) Liquid securities and other cash collateral held against derivatives Year... -

Page 125

...2014, excluded operating lease assets of $9.2 billion and $6.7 billion, respectively. (b) At December 31, 2015 and 2014, approximately 64% and 57% of the PCI option ARMs portfolio has been modified into fixed-rate, fully amortizing loans, respectively. (c) Credit card and home equity lending-related... -

Page 126

...by Washington Mutual were generally revolving loans for a 10-year period, after which time the HELOC converts to an interest-only loan with a balloon payment at the end of the loan's term. The unpaid principal balance of HELOCs outstanding was $41 billion at December 31, 2015. Since January 1, 2014... -

Page 127

... Firm will continue to monitor exposure on future claim payments for government insured loans, but any financial impact related to exposure on future claims is not expected to be significant and was considered in estimating the allowance for loan losses. JPMorgan Chase & Co./2015 Annual Report 117 -

Page 128

...Current estimated loan-to-values ("LTVs") of residential real estate loans The current estimated average LTV ratio for residential real estate loans retained, excluding mortgage loans insured by U.S. government agencies and PCI loans, was 59% at both December 31, 2015 and 2014. Although home prices... -

Page 129

... on homes with negative equity, as well as on the cost of alternative housing. For further information on current estimated LTVs of residential real estate loans, see Note 14. Loan modification activities - residential real estate loans The performance of modified loans generally differs by product... -

Page 130

...Year ended December 31, (in millions) Beginning balance Additions Reductions: Principal payments and other(a) Charge-offs Returned to performing status Foreclosures and other liquidations Total reductions Net additions/(reductions) Ending balance (a) Other reductions includes loan sales. $ 2015 2014... -

Page 131

...and 2014, the net charge-off rates were 2.51% and 2.75%, respectively. The Credit Card 30+ day delinquency rate and net charge-off rate remain near historic lows. Charge-offs have improved compared to a year ago due to continued discipline in credit underwriting as well as improvement in the economy... -

Page 132

..., market-making, and hedging activities with and for clients and counterparties, as well as through various operating services such as cash management and clearing activities. A portion of the loans originated or acquired by the Firm's wholesale businesses is generally retained on the balance sheet... -

Page 133

.... The total criticized component of the portfolio, excluding loans held-for-sale and loans at fair value, was $14.6 billion at December 31, 2015, compared with $10.1 billion at December 31, 2014, driven by downgrades within the Oil & Gas portfolio. JPMorgan Chase & Co./2015 Annual Report 123 -

Page 134

... Cos Oil & Gas Utilities State & Municipal Govt(b) Asset Managers Transportation Central Govt Chemicals & Plastics Metals & Mining Automotive Insurance Financial Markets Infrastructure Securities Firms All other(c) Subtotal Loans held-for-sale and loans at fair value Receivables from customers and... -

Page 135

... and $501.5 billion, at December 31, 2015 and 2014, respectively, placed with various central banks, predominantly Federal Reserve Banks. (e) Credit exposure is net of risk participations and excludes the benefit of "Credit derivatives used in credit portfolio management activities" held against... -

Page 136

...portfolio for the years ended December 31, 2015 and 2014. Wholesale nonaccrual loan activity Year ended December 31, (in millions) Beginning balance Additions Reductions: Paydowns and other Gross charge-offs Returned to performing status Sales Total reductions Net changes Ending balance $ 534 87 286... -

Page 137

... was predominantly driven by declines in interest rate derivatives, commodity derivatives, foreign exchange derivatives and equity derivatives due to market movements, maturities and settlements related to clientdriven market-making activities in CIB. JPMorgan Chase & Co./2015 Annual Report 127 -

Page 138

... correlations over time. To the extent that these correlations are identified, the Firm may adjust the CVA associated with that counterparty's AVG. The Firm risk manages exposure to changes in CVA by entering into credit derivative transactions, as well as interest rate, foreign exchange, equity and... -

Page 139

... derivatives used in credit portfolio management activities do not qualify for hedge accounting under U.S. GAAP; these derivatives are reported at fair value, with gains and losses recognized in principal transactions revenue. In contrast, the loans and lending-related commitments being risk-managed... -

Page 140

... for credit losses increased from December 31, 2014, reflecting the impact of downgrades in the Oil & Gas portfolio. Excluding Oil and Gas, the wholesale portfolio continued to experience generally stable credit quality trends and low charge-off rates. 130 JPMorgan Chase & Co./2015 Annual Report -

Page 141

... rates. (c) The allowance for lending-related commitments is reported in other liabilities on the Consolidated balance sheets. (d) The Firm's policy is generally to exempt credit card loans from being placed on nonaccrual status as permitted by regulatory guidance. JPMorgan Chase & Co./2015 Annual... -

Page 142

... with $3.1 billion for the year ended December 31, 2014. The total consumer provision for credit losses for the year ended December 31, 2015 reflected lower net charge-offs due to continued discipline in credit underwriting as well as improvement in the economy driven by increasing home prices and... -

Page 143

... measure can reflect all aspects of market risk, the Firm uses various metrics, both statistical and nonstatistical, including VaR Economic-value stress testing Nonstatistical risk measures Loss advisories Profit and loss drawdowns Earnings-at-risk JPMorgan Chase & Co./2015 Annual Report 133 -

Page 144

... services clients across fixed income, foreign exchange, equities and commodities • Market risk arising from changes in market prices (e.g. rates and credit spreads) resulting in a potential decline in net income Positions included in Risk Management VaR • Market risk(a) related to: • Trading... -

Page 145

...an actual price-based time series for these products, if available, would affect the VaR results presented. JPMorgan Chase & Co./2015 Annual Report In addition, data sources used in VaR models may not be the same as those used for financial statement valuations. In cases where market prices are not... -

Page 146

... (http:// investor.shareholder.com/jpmorganchase/basel.cfm). The table below shows the results of the Firm's Risk Management VaR measure using a 95% confidence level. Total VaR As of or for the year ended December 31, (in millions) CIB trading VaR by risk type Fixed income Foreign exchange Equities... -

Page 147

... by the Firm due to a broad sell off in bond markets or an extreme widening in corporate credit spreads. The flexibility of the JPMorgan Chase & Co./2015 Annual Report stress testing framework allows risk managers to construct new, specific scenarios that can be used to form decisions about future... -

Page 148

... short-term and long-term market interest rates change (for example, changes in the slope of the yield curve) The impact of changes in the maturity of various assets, liabilities or off-balance sheet instruments as interest rates change • • • The Firm manages interest rate exposure related... -

Page 149

... risk is the risk that changes in foreign exchange rates affect the value of the Firm's assets or liabilities or future results. The Firm has structural non-U.S. dollar FX exposures arising from capital investments, forecasted expense and revenue, the investment securities portfolio and issuing debt... -

Page 150

... for credit losses and cash and marketable securities collateral received • Securities financing exposures are measured at their receivable balance, net of collateral received • Debt and equity securities are measured at the fair value of all positions, including both long and short positions... -

Page 151

... financing receivables or related to client clearing activities). These indirect exposures are managed in the normal course of business through the Firm's credit, market, and operational risk governance, rather than through Country Risk Management. The Firm's internal country risk reporting... -

Page 152

... and in product and market developments, as well as to capture improvements in available modeling techniques and systems capabilities. The Model Risk review and governance functions review and approve a wide range of models, including risk management, valuation, and regulatory capital models used by... -

Page 153

...), private equity and various debt investments. The Firm's principal investments are managed under various lines of business and are captured within the respective LOB's financial results. The Firm's approach to managing principal risk is consistent with the Firm's general risk governance structure... -

Page 154

... RISK MANAGEMENT Operational risk is the risk of loss resulting from inadequate or failed processes or systems, human factors or due to external events that are neither market- nor credit-related. Operational risk is inherent in the Firm's activities and can manifest itself in various ways... -

Page 155

...result of a statistical model, the Loss Distribution Approach ("LDA"), which simulates the frequency and severity of future operational risk losses based on historical data. The LDA model is used to estimate an aggregate operational risk loss over a one-year time horizon, at a 99.9% confidence level... -

Page 156

... the Firm's business operations during and quickly after various events in 2015 that have resulted in business interruptions, such as severe winter weather and flooding in the U.S. and various global protest-related activities. LEGAL RISK MANAGEMENT Legal risk is the risk of loss or imposition of... -

Page 157

... clients fairly, as required under applicable law or regulation. Other specific compliance risks include those associated with anti-money laundering compliance, trading activities, market conduct, and complying with the rules and regulations related to the offering of products and services across... -

Page 158

... is overseen by a Firmwide Reputation Risk Governance function, which provides oversight of the governance infrastructure and process to support the consistent identification, escalation, management and reporting of reputation risk issues firmwide. 148 JPMorgan Chase & Co./2015 Annual Report -

Page 159

... strategy and competitive position. The Firm's capital strategy focuses on long-term stability, which enables the Firm to build and invest in market-leading businesses, even in a highly stressed environment. Prior to making any decisions on future business activities, senior management considers the... -

Page 160

...by the Federal Reserve on July 20, 2015. At December 31, 2014, the ratios included the Firm's GSIB surcharge of 2.5% which was published in November 2014 by the Financial Stability Board and calculated under the Basel Committee on Banking Supervisions Final GSIB rule. The minimum capital ratios will... -

Page 161

... economic risk capital. Regulatory capital The Federal Reserve establishes capital requirements, including well capitalized standards, for the consolidated financial holding company. The OCC establishes similar minimum capital requirements for the Firm's national banks, including JPMorgan Chase Bank... -

Page 162

... 2% of CET1 capital under Method 1 and 3.5% under Method 2. On July 20, 2015, the date of the last published estimate, the Federal Reserve had estimated the Firm's GSIB surcharge to be 2.5% under Method 1 and 4.5% under Method 2 as of December 31, 2014. 152 JPMorgan Chase & Co./2015 Annual Report -

Page 163

...assets Add: Deferred tax liabilities(a) Less: Other CET1 capital adjustments Standardized/Advanced CET1 capital Preferred stock Less: Other Tier 1 adjustments Standardized/Advanced Tier 1 capital Long-term debt and other instruments qualifying as Tier 2 capital Qualifying allowance for credit losses... -

Page 164

... in FVA/DVA, as well as CET1 deductions for defined benefit pension plan assets and deferred tax assets related to net operating loss and tax credit carryforwards. (c) Relates to intangible assets, other than goodwill and MSRs, that are required to be deducted from CET1 capital upon full phase-in... -

Page 165

... and financial stress, and have robust, forward-looking capital assessment and planning processes in place that address each bank holding company's ("BHC") unique risks to enable them to have the ability to absorb losses under certain stress scenarios. Through the CCAR, the Federal Reserve evaluates... -

Page 166

... of a business segment's performance. Line of business equity Year ended December 31, (in billions) Consumer & Community Banking Corporate & Investment Bank Commercial Banking Asset Management Corporate Total common stockholders' equity $ 2015 51.0 62.0 14.0 9.0 79.7 $ 215.7 $ Yearly average 2014 51... -

Page 167

... at the customary times those dividends are declared. For information regarding dividend restrictions, see Note 22 and Note 27. The following table shows the common dividend payout ratio based on reported net income. Year ended December 31, Common dividend payout ratio 2015 28% 2014 29% 2013 33... -

Page 168

... with the market and credit risk standards of Appendix E of the Net Capital Rule. As of December 31, 2015, JPMorgan Securities had tentative net capital in excess of the minimum and notification requirements. J.P. Morgan Securities plc is a wholly owned subsidiary of JPMorgan Chase Bank, N.A. and is... -

Page 169

...and reporting liquidity positions, balance sheet variances and funding activities; • Conducting ad hoc analysis to identify potential emerging liquidity risks. Risk governance and measurement Specific committees responsible for liquidity governance include firmwide ALCO as well as line of business... -

Page 170

... real estate-related loans, with secured borrowings from the FHLBs. Deposits in excess of the amount utilized to fund loans are primarily invested in the Firm's investment securities portfolio or deployed in cash or other short-term liquid investments based on their interest rate and liquidity risk... -

Page 171

... line of business, the period-end and average deposit balances as of and for the years ended December 31, 2015 and 2014. Deposits As of or for the period ended December 31, (in millions) Consumer & Community Banking Corporate & Investment Bank Commercial Banking Asset Management Corporate Total Firm... -

Page 172

... 31, 2015 and 2014. For additional information, see the Consolidated Balance Sheet Analysis on pages 75-76 and Note 21. Sources of funds (excluding deposits) As of or for the year ended December 31, (in millions) Commercial paper: Wholesale funding Client cash management Total commercial paper... -

Page 173

... year 2015, compared with the prior year) was due to a decline in secured financing of trading assets-debt and equity instruments in CIB. The balances associated with securities loaned or sold under agreements to repurchase fluctuate over time due to customers' investment and financing activities... -

Page 174

...risk and credit-related contingent features in Note 6. The credit ratings of the Parent Company and the Firm's principal bank and nonbank subsidiaries as of December 31, 2015, were as follows. JPMorgan Chase & Co. December 31, 2015 Moody's Investors Service Standard & Poor's Fitch Ratings Long-term... -

Page 175

... these estimates and assumptions require significant management judgment and certain assumptions are highly subjective. JPMorgan Chase & Co./2015 Annual Report Formula-based component - Consumer loans and lendingrelated commitments, excluding PCI loans The formula-based allowance for credit losses... -

Page 176

...for credit losses and these estimates are subject to periodic refinement based on any changes to underlying external and Firm-specific historical data. In many cases, the use of alternate estimates (for example, the effect of home prices and unemployment rates JPMorgan Chase & Co./2015 Annual Report -

Page 177

..., see Note 3. December 31, 2015 (in billions, except ratio data) Trading debt and equity instruments Derivative receivables(a) Trading assets AFS securities Loans MSRs Private equity investments(b) Other Total assets measured at fair value on a recurring basis Total assets measured at fair value on... -

Page 178

... used by the Firm could result in a different estimate of fair value at the reporting date. For a detailed discussion of the Firm's valuation process and hierarchy, and its determination of fair value for individual financial instruments, see Note 3. 168 JPMorgan Chase & Co./2015 Annual Report -

Page 179

.... As of December 31, 2015, management has determined it is more likely than not that the Firm will realize its deferred tax assets, net of the existing valuation allowance. JPMorgan Chase & Co./2015 Annual Report JPMorgan Chase does not record U.S. federal income taxes on the undistributed earnings... -

Page 180

... income tax expense. • Adopted April 1, 2015. • The application of this guidance only affected the disclosures related to these investments and had no impact on the Firm's Consolidated balance sheets or results of operations. • For further information, see Note 3.(a) • Accounting amendments... -

Page 181

... the Consolidated Financial Statements. (a) Early adoption is permitted. (b) Early adoption is permitted for the requirement to report changes in fair value due to the Firm's own credit risk in OCI, and the Firm is planning to early adopt this guidance during 2016. JPMorgan Chase & Co./2015 Annual... -

Page 182

... AT FAIR VALUE In the normal course of business, JPMorgan Chase trades nonexchange-traded commodity derivative contracts. To determine the fair value of these contracts, the Firm uses various fair value estimation techniques, primarily based on internal models with significant observable market... -

Page 183

...estimate," "intend," "plan," "goal," "believe," or other words of similar meaning. Forward-looking statements provide JPMorgan Chase's current expectations or forecasts of future events, circumstances, results or aspirations. JPMorgan Chase's disclosures in this Annual Report contain forward-looking... -

Page 184

... persons performing similar functions, and effected by JPMorgan Chase's Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting... -

Page 185

...consolidated balance sheets and the related consolidated statements of income, comprehensive income, changes in stockholders' equity and cash flows present fairly, in all material respects, the financial position of JPMorgan Chase & Co. and its subsidiaries (the "Firm") at December 31, 2015 and 2014... -

Page 186

Consolidated statements of income Year ended December 31, (in millions, except per share data) Revenue Investment banking fees Principal transactions Lending- and deposit-related fees Asset management, administration and commissions Securities gains(a) Mortgage fees and related income Card income ... -

Page 187

Consolidated statements of comprehensive income Year ended December 31, (in millions) Net income Other comprehensive income/(loss), after-tax Unrealized gains/(losses) on investment securities Translation adjustments, net of hedges Cash flow hedges Defined benefit pension and OPEB plans Total other ... -

Page 188

... Chase. At both December 31, 2015 and 2014, the Firm provided limited program-wide credit enhancement of $2.0 billion, related to its Firm-administered multi-seller conduits, which are eliminated in consolidation. For further discussion, see Note 16. The Notes to Consolidated Financial Statements... -

Page 189

... to issue common stock for employee stock-based compensation awards, and related tax effects Other Balance at December 31 Retained earnings Balance at January 1 Cumulative effect of change in accounting principle Balance at beginning of year, adjusted Net income Dividends declared: Preferred stock... -

Page 190

...income to net cash provided by/(used in) operating activities: Provision for credit losses Depreciation and amortization Deferred tax expense Other Originations and purchases of loans held-for-sale Proceeds from sales, securitizations and paydowns of loans held-for-sale Net change in: Trading assets... -

Page 191

... is a leader in investment banking, financial services for consumers and small business, commercial banking, financial transaction processing and asset management. For a discussion of the Firm's business segments, see Note 33. The accounting and financial reporting policies of JPMorgan Chase and its... -

Page 192

... these estimates. Foreign currency translation JPMorgan Chase revalues assets, liabilities, revenue and expense denominated in non-U.S. currencies into U.S. dollars using applicable exchange rates. Gains and losses relating to translating functional currency financial statements for U.S. reporting... -

Page 193

... employee benefit plans Employee stock-based incentives Securities Securities financing activities Loans Allowance for credit losses Variable interest entities Goodwill and other intangible assets Premises and equipment Long-term debt Income taxes Off-balance sheet lending-related financial... -

Page 194

..., fair value is based on models that consider relevant transaction characteristics (such as maturity) and use as inputs observable or unobservable market parameters, including but not limited to yield curves, interest rates, volatilities, equity or debt prices, foreign exchange rates and credit... -

Page 195

... been reviewed need to be, on a full or partial basis, reviewed and approved again. • • A financial instrument's categorization within the valuation hierarchy is based on the lowest level of input that is significant to the fair value measurement. JPMorgan Chase & Co./2015 Annual Report 185 -

Page 196

... Credit costs - allowance for loan losses is considered a reasonable proxy for the credit cost • Projected interest income, late-fee revenue and loan repayment rates • Discount rates • Servicing costs Trading loans - conforming residential mortgage loans expected to be sold Fair value is based... -

Page 197

...speed, conditional default rates, loss severity • Credit spreads • Credit rating data Valued using observable market prices or data Exchange-traded derivatives that are actively traded and valued using the exchange price. Classifications in the valuation hierarchy Level 1 Level 2 or 3 Physical... -

Page 198

...200 of this Note. Level 1 or 2 Level 1 Level 2 or 3(a) Level 2 or 3 Predominantly level 2 Level 2 or 3 (a) Excludes certain investments that are measured at fair value using the net asset value per share (or its equivalent) as a practical expedient. 188 JPMorgan Chase & Co./2015 Annual Report -

Page 199

...(d) Derivative payables: Interest rate Credit Foreign exchange Equity Commodity Total derivative payables(e) Total trading liabilities Accounts payable and other liabilities Beneficial interests issued by consolidated VIEs Long-term debt Total liabilities measured at fair value on a recurring basis... -

Page 200

... rate Credit Foreign exchange Equity Commodity Total derivative payables(e) Total trading liabilities Accounts payable and other liabilities (g) Beneficial interests issued by consolidated VIEs Long-term debt Total liabilities measured at fair value on a recurring basis $ $ $ Level 1 - $ - Level... -

Page 201

... billion at December 31, 2015 and 2014, respectively; this is exclusive of the netting benefit associated with cash collateral, which would further reduce the level 3 balances. (f) Private equity instruments represent investments within the Corporate line of business. The cost basis of the private... -

Page 202

...-to-parameter based on the characteristics of the instruments held by the Firm at each balance sheet date. For the Firm's derivatives and structured notes positions classified within level 3 at December 31, 2015, interest rate correlation inputs used in estimating fair value were concentrated... -

Page 203

... Mortgage servicing rights Private equity investments Long-term debt, other borrowed funds, and deposits(d) 6,608 1,657 14,707 Market comparables Discounted cash flows Market comparables Option pricing $ - (a) The categories presented in the table have been aggregated based upon the product type... -

Page 204

... The loss severity applied in valuing a mortgage-backed security investment depends on factors relating to the underlying mortgages, including the loan-to-value ratio, the nature of the lender's lien on the property and other instrument-specific factors. 194 JPMorgan Chase & Co./2015 Annual Report -

Page 205

...the fair value hierarchy; as these level 1 and level 2 risk management instruments are not included below, the gains or losses in the following tables do not reflect the effect of the Firm's risk management activities related to such level 3 instruments. JPMorgan Chase & Co./2015 Annual Report 195 -

Page 206

... rate Credit Foreign exchange Equity Commodity Total net derivative receivables Available-for-sale securities: Asset-backed securities Other Total available-for-sale securities Loans Mortgage servicing rights Other assets: Private equity investments All other (a) Fair value at January 1, 2015... -

Page 207

...:(b) Deposits Other borrowed funds Trading liabilities - debt and equity instruments Accounts payable and other liabilities Beneficial interests issued by consolidated VIEs Long-term debt Fair value at January 1, 2014 $ Total realized/ unrealized (gains)/ losses (c) (c) Purchases $ (g) Sales... -

Page 208

...: Interest rate Credit Foreign exchange Equity Commodity Total net derivative receivables Available-for-sale securities: Asset-backed securities Other Total available-for-sale securities Loans Mortgage servicing rights Other assets: Private equity investments All other (a) Fair value at January... -

Page 209

... credit spread tightening in nonagency mortgage-backed securities and trading loans, and the impact of market movements on client-driven financing transactions • $1.6 billion of net gains on MSRs. For further discussion of the change, refer to Note 17 • JPMorgan Chase & Co./2015 Annual Report... -

Page 210

... and incorporates JPMorgan Chase's credit spreads as observed through the CDS market to estimate the probability of default and loss given default as a result of a systemic event affecting the Firm. Structured notes DVA is estimated using the current fair value of the structured note as the exposure... -

Page 211

...of the fair value of JPMorgan Chase's assets and liabilities. For example, the Firm has developed long-term relationships with its customers through its deposit base and credit card accounts, commonly referred to as core deposit intangibles and credit card relationships. In the opinion of management... -

Page 212

...Total estimated fair value - $ - 0.1 27.8 484.5 70.1 (in billions) Financial assets Cash and due from banks Deposits with banks Accrued interest and accounts receivable Federal funds sold and securities purchased under resale agreements Securities borrowed Securities, held-to-maturity(a) Loans, net... -

Page 213

... Consolidated balance sheets, nor are they actively traded. The carrying value of the allowance and the estimated fair value of the Firm's wholesale lending-related commitments were as follows for the periods indicated. December 31, 2015 Estimated fair value hierarchy Carrying value(a) 0.8 $ Total... -

Page 214

... notes is actively managed, the gains/(losses) reported in this table do not include the income statement impact of the risk management instruments used to manage such risk. (c) Reported in mortgage fees and related income. (d) Reported in other income. 204 JPMorgan Chase & Co./2015 Annual Report -

Page 215

...option was elected was $4.6 billion and $4.5 billion, respectively, with a corresponding fair value of $(94) million and $(147) million, respectively. For further information regarding off-balance sheet lending-related financial instruments, see Note 29. JPMorgan Chase & Co./2015 Annual Report 205 -

Page 216

..., 2015 Other Long-term borrowed debt funds $ 12,531 $ 3,195 1,765 14,293 640 $ 32,424 $ December 31, 2014 Other Long-term borrowed debt funds $ 10,858 $ 4,023 2,150 12,348 710 (in millions) Risk exposure Interest rate Credit Foreign exchange Equity Commodity Total structured notes Deposits Total... -

Page 217

..., (in millions) Total consumer, excluding credit card Total credit card Total consumer Wholesale-related(a) Real Estate Consumer & Retail Technology, Media & Telecommunications Industrials Healthcare Banks & Finance Cos Oil & Gas Utilities State & Municipal Govt Asset Managers Transportation Central... -

Page 218

...the impact of interest rate fluctuations on earnings. Foreign currency forward contracts are used to manage the foreign exchange risk associated with certain foreign currency-denominated (i.e., non-U.S. dollar) assets and liabilities and forecasted transactions, as well as the Firm's net investments... -

Page 219

... is discontinued. JPMorgan Chase & Co./2015 Annual Report There are three types of hedge accounting designations: fair value hedges, cash flow hedges and net investment hedges. JPMorgan Chase uses fair value hedges primarily to hedge fixed-rate long-term debt, AFS securities and certain commodities... -

Page 220

... Interest rate and foreign exchange • Various • Various Manage the risk of the mortgage pipeline, warehouse loans and MSRs Specified risk management Manage the credit risk of wholesale lending exposures Manage the risk of certain commodities-related contracts and investments Manage the risk of... -

Page 221

... derivative contracts outstanding as of December 31, 2015 and 2014. Notional amounts(b) December 31, (in billions) Interest rate contracts Swaps Futures and forwards Written options Purchased options Total interest rate contracts Credit derivatives(a) Foreign exchange contracts Cross-currency swaps... -

Page 222

... Designated as hedges Total derivative payables Net derivative payables(b) 3,742 $ 942,912 Gross derivative receivables December 31, 2014 (in millions) Trading assets and liabilities Interest rate Credit Foreign exchange Equity Commodity Total fair value of trading assets and liabilities $ 944... -

Page 223

... $74.0 billion at December 31, 2015, and 2014, respectively. (c) The prior period amounts have been revised to conform with the current period presentation. These revisions had no impact on Firm's Consolidated balance sheets or its results of operations. JPMorgan Chase & Co./2015 Annual Report 213 -

Page 224

Notes to consolidated financial statements The following table presents, as of December 31, 2015 and 2014, the gross and net derivative payables by contract and settlement type. Derivative payables have been netted on the Consolidated balance sheets against derivative receivables and cash collateral... -

Page 225

...the policy of JPMorgan Chase to actively pursue, where possible, the use of legally enforceable master netting arrangements and collateral agreements to mitigate derivative counterparty credit risk. The amount of derivative receivables reported on the Consolidated balance sheets is the fair value of... -

Page 226

... risk of long-term debt and AFS securities for changes in spot foreign currency rates. Gains and losses related to the derivatives and the hedged items, due to changes in foreign currency rates, were recorded primarily in principal transactions revenue and net interest income. 216 JPMorgan Chase... -

Page 227

... and floating-rate liabilities. Gains and losses were recorded in net interest income, and for the forecasted transactions that the Firm determined during the year ended December 31, 2015, were probable of not occurring, in other income. Primarily consists of hedges of the foreign currency risk of... -

Page 228

..., MSRs, wholesale lending exposures, AFS securities, foreign currency-denominated assets and liabilities, and commodities-related contracts and investments. Derivatives gains/(losses) recorded in income Year ended December 31, (in millions) Contract type Interest rate(a) Credit(b) Foreign exchange... -

Page 229

...a market-maker, the Firm actively manages a portfolio of credit derivatives by purchasing and selling credit protection, predominantly on corporate debt obligations, to meet the needs of customers. Second, as an end-user, the Firm uses credit derivatives to manage credit risk associated with lending... -

Page 230

... is primarily based on external credit ratings defined by S&P and Moody's Investors Service ("Moody's"). (b) Amounts are shown on a gross basis, before the benefit of legally enforceable master netting agreements and cash collateral received by the Firm. 220 JPMorgan Chase & Co./2015 Annual Report -

Page 231

... natural gas, coal, crude oil and refined products. JPMorgan Chase & Co./2015 Annual Report $ 10,408 $ 10,531 $ 10,141 (a) Commodity derivatives are frequently used to manage the Firm's risk exposure to its physical commodities inventories. For gains/(losses) related to commodity fair value... -

Page 232

...CCB's Mortgage Banking production and servicing revenue, including fees and income derived from mortgages originated with the intent to sell; mortgage sales and servicing including losses related to the repurchase of previously sold loans; the impact of risk-management activities associated with the... -

Page 233

... Securities borrowed(b) Deposits with banks Other assets(c) Total interest income Interest expense Interest bearing deposits Federal funds purchased and securities loaned or sold under repurchase agreements Commercial paper Trading liabilities - debt, shortterm and other liabilities Long-term debt... -

Page 234

... exchange impact and other Benefit obligation, end of year Change in plan assets Fair value of plan assets, beginning of year Actual return on plan assets Firm contributions Employee contributions Benefits paid Foreign exchange impact and other Fair value of plan assets, end of year Net funded... -

Page 235

... Changes in plan assets and benefit obligations recognized in other comprehensive income Net (gain)/loss arising during the year Prior service credit arising during the year Amortization of net loss Amortization of prior service (cost)/credit Foreign exchange impact and other Total recognized in... -

Page 236

... benefit pension and OPEB plan assets is a blended average of the investment advisor's projected long-term (10 years or more) returns for the various asset classes, weighted by the asset allocation. Returns on asset classes are developed using a forward-looking approach and are not strictly based... -

Page 237

... 2015 2014 Weighted-average assumptions used to determine net periodic benefit costs U.S. Year ended December 31, Discount rate: Defined benefit pension plans OPEB plans Expected long-term rate of return on plan assets: Defined benefit pension plans OPEB plans Rate of compensation increase Health... -

Page 238

... are used to partially fund the U.S. OPEB plan, are held in separate accounts of an insurance company and are allocated to investments intended to replicate equity and fixed income indices. The investment policy for the Firm's U.S. defined benefit pension plan assets is to optimize the risk-return... -

Page 239

... of short-term investment funds, domestic and international equity investments (including index) and real estate funds. (b) Unfunded commitments to purchase limited partnership investments for the plans were $895 million and $1.2 billion for 2015 and 2014, respectively. (c) Corporate debt securities... -

Page 240

.../(losses) Purchases, sales and settlements, net Transfers in and/or out of level 3 Fair value, December 31, 2015 Year ended December 31, 2014 (in millions) U.S. defined benefit pension plans Equities Corporate debt securities Mortgage-backed securities Other Total U.S. defined benefit pension plans... -

Page 241

... incentives Employee stock-based awards In 2015, 2014 and 2013, JPMorgan Chase granted longterm stock-based awards to certain employees under its Long-Term Incentive Plan, as amended and restated effective May 19, 2015 ("LTIP"). Under the terms of the LTIP, as of December 31, 2015, 93 million shares... -

Page 242

... not capitalize any compensation expense related to share-based compensation awards to employees. Cash flows and tax benefits Income tax benefits related to stock-based incentive arrangements recognized in the Firm's Consolidated statements of income for the years ended December 31, 2015, 2014 and... -

Page 243

... to ratings as defined by S&P and Moody's). AFS securities are carried at fair value on the Consolidated balance sheets. Unrealized gains and losses, after any applicable hedge accounting adjustments, are reported as net increases or decreases to accumulated other comprehensive income/ (loss). The... -

Page 244

Notes to consolidated financial statements The amortized costs and estimated fair values of the investment securities portfolio were as follows for the dates indicated. 2015 Amortized cost Gross unrealized gains Gross unrealized losses Fair value Amortized cost 2014 Gross unrealized gains Gross ... -

Page 245

... losses Total fair value Total gross unrealized losses Securities with gross unrealized losses Less than 12 months December 31, 2014 (in millions) Available-for-sale debt securities Mortgage-backed securities: U.S. government agencies Residential: Prime and Alt-A Subprime Non-U.S. Commercial Total... -

Page 246