Honeywell 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our contracts with the U.S. Government are subject to audits, investigations, and termination by the

government. See “Item 1A. Risk Factors.”

Backlog

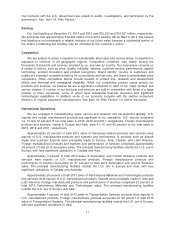

Our total backlog at December 31, 2013 and 2012 was $16,523 and $16,307 million, respectively.

We anticipate that approximately $12,262 million of the 2013 backlog will be filled in 2014. We believe

that backlog is not necessarily a reliable indicator of our future sales because a substantial portion of

the orders constituting this backlog may be canceled at the customer’s option.

Competition

We are subject to active competition in substantially all product and service areas. Competition is

expected to continue in all geographic regions. Competitive conditions vary widely among the

thousands of products and services provided by us, and vary by country. Our businesses compete on

a variety of factors, such as price, quality, reliability, delivery, customer service, performance, applied

technology, product innovation and product recognition. Brand identity, service to customers and

quality are important competitive factors for our products and services, and there is considerable price

competition. Other competitive factors include breadth of product line, research and development

efforts and technical and managerial capability. While our competitive position varies among our

products and services, we believe we are a significant competitor in each of our major product and

service classes. A number of our products and services are sold in competition with those of a large

number of other companies, some of which have substantial financial resources and significant

technological capabilities. In addition, some of our products compete with the captive component

divisions of original equipment manufacturers. See Item 1A “Risk Factors” for further discussion.

International Operations

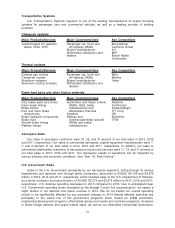

We are engaged in manufacturing, sales, service and research and development globally. U.S.

exports and foreign manufactured products are significant to our operations. U.S. exports comprised

14, 14 and 12 percent of our total sales in 2013, 2012 and 2011, respectively. Foreign manufactured

products and services, mainly in Europe and Asia, were 41, 41 and 43 percent of our total sales in

2013, 2012 and 2011, respectively.

Approximately 23 percent of total 2013 sales of Aerospace-related products and services were

exports of U.S. manufactured products and systems and performance of services such as aircraft

repair and overhaul. Exports were principally made to Europe, Asia, Canada, and Latin America.

Foreign manufactured products and systems and performance of services comprised approximately

16 percent of total 2013 Aerospace sales. The principal manufacturing facilities outside the U.S. are in

Europe, with less significant operations in Canada and Asia.

Approximately 3 percent of total 2013 sales of Automation and Control Solutions products and

services were exports of U.S. manufactured products. Foreign manufactured products and

performance of services accounted for 57 percent of total 2013 Automation and Control Solutions

sales. The principal manufacturing facilities outside the U.S. are in Europe and Asia, with less

significant operations in Canada and Australia.

Approximately 30 percent of total 2013 sales of Performance Materials and Technologies products

and services were exports of U.S. manufactured products. Exports were principally made to Asia and

Latin America. Foreign manufactured products and performance of services comprised 23 percent of

total 2013 Performance Materials and Technologies sales. The principal manufacturing facilities

outside the U.S. are in Europe and Asia.

Approximately 4 percent of total 2013 sales of Transportation Systems products were exports of

U.S. manufactured products. Foreign manufactured products accounted for 84 percent of total 2013

sales of Transportation Systems. The principal manufacturing facilities outside the U.S. are in Europe,

with less significant operations in Asia.

11