Honeywell 2013 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2013 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHAREOWNER LETTER—2014

March 1, 2014

We had very good performance in another “weakish” year in the global economy. We

were able to grow sales 4% to $39.1 billion and earnings per share* by 11% to $4.97. Our

segment margin rate grew 70 basis points to 16.3% and free cash flow** grew to $3.8 billion, a

96% conversion rate.** As usual, we also took the opportunity to continue our seed

planting…products, technologies, restructuring, geographies, services, processes, new

capacity…to ensure that growth continues far into the future.

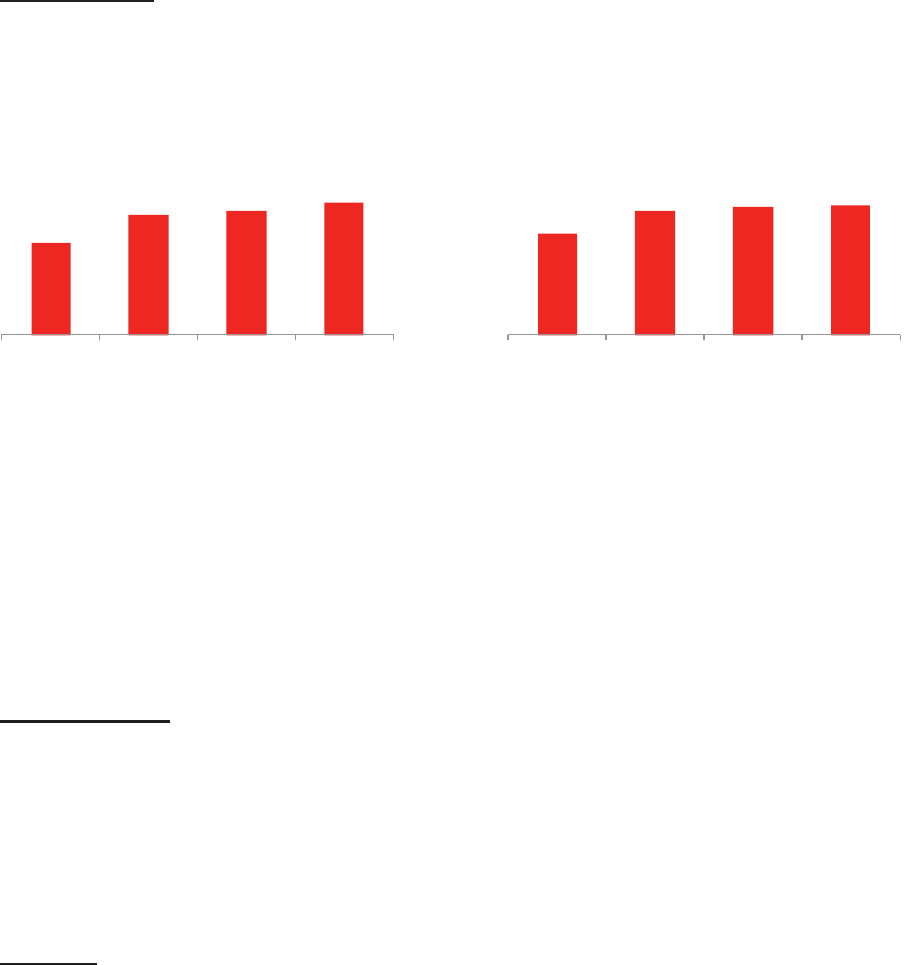

Five-Year Plan

The year 2014 is the last in the five-year plan (2010-2014) Honeywell introduced in

March 2010. Despite economic and foreign exchange headwinds versus what we assumed

then, we’ve performed quite well as you can see from the chart below.

$30.0

$39.1

$41.0 -

45.0

$40.3 -

40.7

2009 2013 2014E 2014 Target

Sales ($B)

13.3%

16.3%

16.0 -

18.0%

16.6 -

16.9%

2009 2013 2014E 2014 Target

Segment Margin Rate

We estimate that those headwinds versus our original macro assumptions cost us about

$3 billion in sales over the 2010-2014 period. Even with those headwinds, we expect to

almost touch the bottom of the targeted sales range growing sales 6% annually and expect to

be around the midpoint of the margin rate range (a margin rate increase of approximately 350

basis points).

While there was a lot of skepticism in 2010 about our five-year plan, our performance

has generated a lot of interest in the next five-year plan covering 2014-2018. We will be

introducing it at Investor Day on March 5. Our intent, of course, is to continue outperforming

our peers, and we look forward to discussing it with you.

Business Model

That outperformance will continue through the application of our Business Model…a

great portfolio of businesses, a focus on internal processes, and a culture that learns,

evolves, and performs. With the recently announced divestiture of Friction Materials, we’re

now at a point where 99% of the Company’s sales come from Great Positions in Good

Industries. That is, markets where we can win with differentiated technology. That’s a nice

position to be in and allows us to use our disciplined acquisition process to fuel further

growth.

* Proforma, V% exclude pension mark-to-market adjustment

** Free cash flow (cash flow from operations less capital expenditures) and free cash flow conversion prior to any cash pension

contributions, NARCO Trust establishment payments and cash taxes relating to the sale of available for sale investments