Foot Locker 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

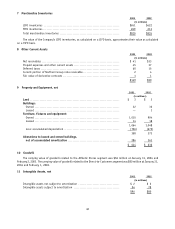

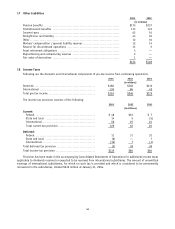

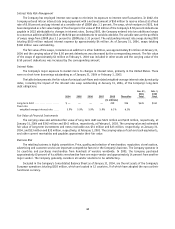

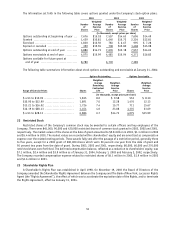

The following weighted-average assumptions were used to determine the benefit obligations under the plans:

Pension Benefits

Postretirement

Benefits

2003 2002 2003 2002

Discount rate ............................................... 5.90% 6.50% 5.90% 6.50%

Rate of compensation increase ............................. 3.72% 3.65%

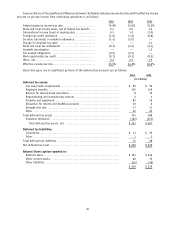

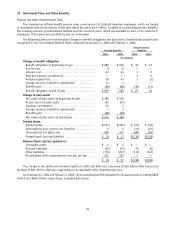

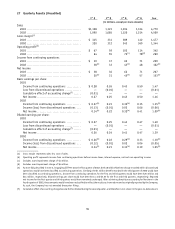

The components of net benefit expense (income) are:

Pension Benefits Postretirement Benefits

2003 2002 2001 2003 2002 2001

(in millions)

Service cost ................................. $ 8 $ 8 $ 8 $ — $ — $—

Interest cost ................................ 43 44 45 2 2 3

Expected return on plan assets .............. (46) (50) (58) — — —

Amortization of prior service cost ........... — 1 1 (1) (1) (2)

Amortization of net (gain) loss .............. 9 3 — (16) (12) (9)

Net benefit expense (income) ............... $ 14 $ 6 $ (4) $(15) $(11) $ (8)

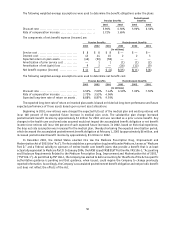

The following weighted-average assumptions were used to determine net benefit cost:

Pension Benefits Postretirement Benefits

2003 2002 2001 2003 2002 2001

(in millions)

Discount rate ................................ 6.50% 7.00% 7.44% 6.50% 7.00% 7.50%

Rate of compensation increase .............. 3.72% 3.53% 4.96%

Expected long-term rate of return on assets . 8.88% 8.87% 9.93%

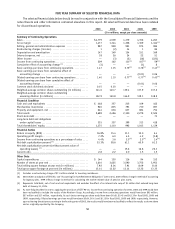

The expected long-term rate of return on invested plan assets is based on historical long-term performance and future

expected performance of those assets based upon current asset allocations.

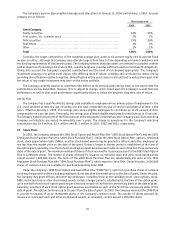

Beginning in 2001, new retirees were charged the expected full cost of the medical plan and existing retirees will

incur 100 percent of the expected future increase in medical plan costs. The substantive plan change increased

postretirement benefit income by approximately $3 million for 2001 and was recorded as a prior service benefit. Any

changes in the health care cost trend rates assumed would not impact the accumulated benefit obligation or net benefit

income since retirees will incur 100 percent of such expected future increases. In 2002, based on historical experience,

the drop out rate assumption was increased for the medical plan, thereby shortening the expected amortization period,

which decreased the accumulated postretirement benefit obligation at February 1, 2003 by approximately $6 million, and

increased postretirement benefit income by approximately $3 million in 2002.

In December 2003, the United States enacted into law the Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (the “Act”). The Act establishes a prescription drug benefit under Medicare, known as “Medicare

Part D,” and a Federal subsidy to sponsors of retiree health care benefit plans that provide a benefit that is at least

actuarially equivalent to Medicare Part D. In January 2004, the FASB issued FASB Staff Position No. FAS 106-1, “Accounting

and Disclosure Requirements Related to the Medicare Prescription Drug, Improvement and Modernization Act of 2003,”

(“FSP 106-1”). As permitted by FSP 106-1, the Company has elected to defer accounting for the effects of the Act as specific

authoritative guidance is pending and that guidance, when issued, could require the Company to change previously

reported information. Accordingly, the Company’s accumulated postretirement benefit obligation and net periodic benefit

cost does not reflect the effects of the Act.

50