Foot Locker 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The primary currencies to which the Company is exposed are the euro, the British Pound and the Canadian Dollar.

When using a forward contract as a hedging instrument, the Company excludes the time value from the assessment of

effectiveness. The change in a forward contract’s time value is reported in earnings. For forward foreign exchange contracts

designated as cash flow hedges of inventory, the effective portion of gains and losses is deferred as a component of

accumulated other comprehensive loss and is recognized as a component of cost of sales when the related inventory is

sold. For 2003 and 2002, gains reclassified to cost of sales related to such contracts were approximately $2 million and

$1 million, respectively. The Company enters into other forward contracts to hedge intercompany foreign currency royalty

cash flows. The effective portion of gains and losses associated with these forward contracts is reclassified from

accumulated other comprehensive loss to selling, general and administrative expenses in the same quarter as the

underlying intercompany royalty transaction occurs. For 2003, amounts related to these royalty contracts were not

significant; for 2002, losses reclassified to selling, general and administrative expenses related to such contracts were

approximately $1 million; and for 2001, such amounts were not material.

For 2003, the fair value of forward contracts designated as cash flow hedges of inventory was offset by the change

in fair value of forward contracts designated as cash flow hedges of intercompany royalties, which was not significant.

For 2002, the fair value of forward contracts designated as cash flow hedges of inventory increased by approximately

$1 million and was substantially offset by the change in fair value of forward contracts designated as cash flow hedges

of intercompany royalties. The ineffective portion of gains and losses related to cash flow hedges recorded to earnings

in 2003 and 2002 was not material. The Company is hedging forecasted transactions for no more than the next twelve

months and expects all derivative-related amounts reported in accumulated other comprehensive loss to be reclassified

to earnings within twelve months.

The changes in fair value of forward contracts and option contracts that do not qualify as hedges are recorded in

earnings. In 2002, the Company entered into certain forward foreign exchange contracts to hedge intercompany foreign-

currency denominated firm commitments and recorded losses of approximately $9 million in selling, general and

administrative expenses to reflect their fair value. These losses were more than offset by foreign exchange gains of

approximately $13 million related to the underlying commitments, which were expected to be settled in 2003 and 2004.

In 2003, the Company recorded a gain of approximately $7 million for the change in fair value of derivative

instruments not designated as hedges, which was offset by a foreign exchange loss related to the underlying transactions.

These amounts were primarily related to the intercompany foreign-currency denominated firm commitments as the gains

on the other forward contracts was not significant.

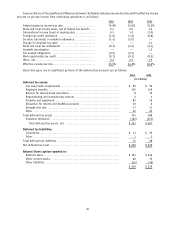

The fair value of derivative contracts outstanding at January 31, 2004 comprised current assets of $1 million, current

liabilities of $3 million and other liabilities of $1 million. The fair value of derivative contracts outstanding at February 1,

2003 comprised current assets of $1 million, other assets of $1 million and current liabilities of $8 million.

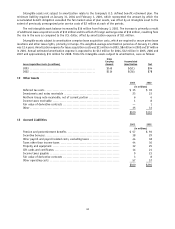

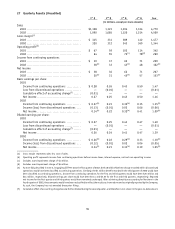

Foreign Currency Exchange Rates

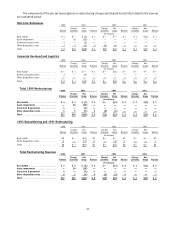

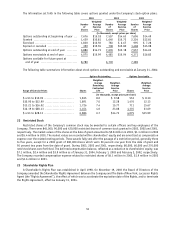

The table below presents the fair value, notional amounts and weighted-average exchange rates of foreign exchange

forward contracts outstanding at January 31, 2004.

Fair Value

(US in millions)

Contract Value

(US in millions)

Weighted-Average

Exchange Rate

Inventory

Buy euro/ Sell British pound ............................... $(1) $ 41 0.7028

Buy $US/Sell euro .......................................... — 2 1.2631

$ (1) $ 43

Intercompany

Buy $US/Sell euro .......................................... $— $ 78 1.2331

Buy $US/Sell CAD$ ......................................... — 6 0.7588

Buy euro/Sell British pound ................................ (1) 27 0.7086

$ (1) $111

47