Foot Locker 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

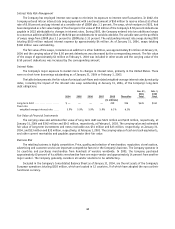

Interest Rate Risk Management

The Company has employed interest rate swaps to minimize its exposure to interest rate fluctuations. In 2002, the

Company entered into an interest rate swap agreement with a notional amount of $50 million to receive interest at a fixed

rate of 8.50 percent and pay interest at a variable rate of LIBOR plus 3.1 percent. The swap, which matures in 2022, had

been designated as a fair value hedge of the changes in fair value of $50 million of the Company’s 8.50 percent debentures

payable in 2022 attributable to changes in interest rates. During 2003, the Company entered into two additional swaps

to convert an additional $50 million of the 8.50 percent debentures to variable rate debt. The variable rates on the portfolio

of swaps range from LIBOR plus 3.1 percent to LIBOR plus 3.33 percent. The outstanding interest rate swaps during 2003

totaling $100 million reduced interest expense by approximately $4 million. As of January 31, 2004, swaps totaling

$100 million were outstanding.

The fair value of the swaps, included as an addition to other liabilities, was approximately $1 million at January 31,

2004 and the carrying value of the 8.50 percent debentures was decreased by the corresponding amount. The fair value

of the swaps of approximately $1 million at February 1, 2003 was included in other assets and the carrying value of the

8.50 percent debentures was increased by the corresponding amount.

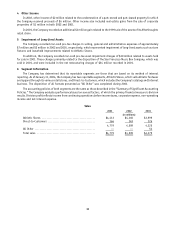

Interest Rates

The Company’s major exposure to market risk is to changes in interest rates, primarily in the United States. There

were no short-term borrowings outstanding as of January 31, 2004 or February 1, 2003.

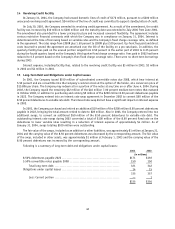

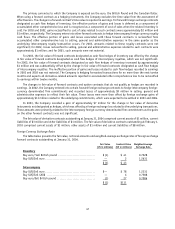

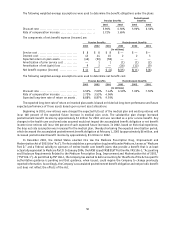

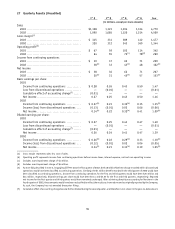

The table below presents the fair value of principal cash flows and related weighted-average interest rates by maturity

dates, including the impact of the interest rate swap outstanding at January 31, 2004, of the Company’s long-term

debt obligations.

2004 2005 2006 2007 2008 Thereafter

Jan. 31,

2004

Total

Feb. 1,

2003

Total

(in millions)

Long-term debt ..................... $ — — — — 239 196 $435 $341

Fixed rate

weighted-average interest rate ..... 5.9% 5.9% 5.9% 5.9% 6.1% 6.3%

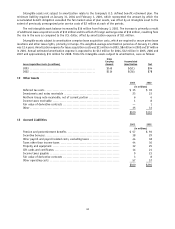

Fair Value of Financial Instruments

The carrying value and estimated fair value of long-term debt was $321 million and $435 million, respectively, at

January 31, 2004 and $342 million and $341 million, respectively, at February 1, 2003. The carrying value and estimated

fair value of long-term investments and notes receivable was $31 million and $33 million, respectively, at January 31,

2004, and $33 million and $32 million, respectively, at February 1, 2003. The carrying values of cash and cash equivalents,

and other current receivables and payables approximate their fair value.

Business Risk

The retailing business is highly competitive. Price, quality and selection of merchandise, reputation, store location,

advertising and customer service are important competitive factors in the Company’s business. The Company operates in

16 countries and purchases merchandise from hundreds of vendors worldwide. In 2003, the Company purchased

approximately 40 percent of its athletic merchandise from one major vendor and approximately 14 percent from another

major vendor. The Company generally considers all vendor relations to be satisfactory.

Included in the Company’s Consolidated Balance Sheet as of January 31, 2004, are the net assets of the Company’s

European operations totaling $303 million, which are located in 12 countries, 9 of which have adopted the euro as their

functional currency.

48