Foot Locker 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Direct-to-Customers

Footlocker.com — Footlocker.com, Inc., sells, through its affiliates, directly to customers through catalogs and its

Internet websites. Eastbay, Inc., one of its affiliates, is one of the largest direct marketers of athletic footwear, apparel,

equipment and licensed private-label merchandise in the United States and provides the Company’s seven full-service

e-commerce sites access to an integrated fulfillment and distribution system. The Company has an agreement with the

National Football League as its official catalog and e-commerce retailer, which includes managing the NFL catalog and

e-commerce businesses. Footlocker.com designs, merchandises and fulfills the NFL’s official catalog (NFL Shop) and the

e-commerce site linked to www.NFLshop.com. The Company has a strategic alliance to offer footwear and apparel on the

Amazon.com website and the Foot Locker brands are featured in the Amazon.com specialty stores for apparel and accessories

and sporting goods. During 2003, the Company entered into an arrangement with the NBA and Amazon.com whereby Foot

Locker began to provide the fulfillment services for NBA licensed products sold over the Internet at NBAstore.com and the

NBA store on Amazon.com. In addition, the Company also entered into a marketing agreement with the U.S. Olympic

Committee (USOC) providing the Company with the exclusive rights to sell USOC licensed products through catalogs and via

a new e-commerce site.

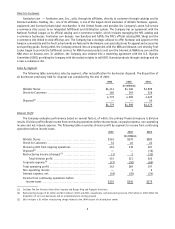

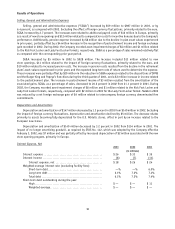

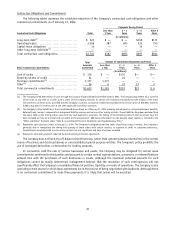

Sales by Segment

The following table summarizes sales by segment, after reclassification for businesses disposed. The disposition of

all businesses previously held for disposal was completed by the end of 2001:

2003 2002 2001

(in millions)

Athletic Stores ............................................. $4,413 $4,160 $3,999

Direct-to-Customers ........................................ 366 349 326

4,779 4,509 4,325

Disposed

(1)

................................................. — — 54

$4,779 $4,509 $4,379

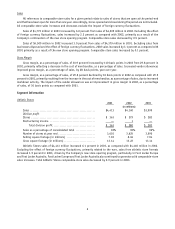

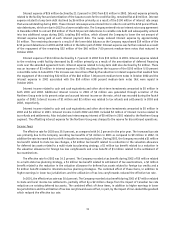

Division Profit

The Company evaluates performance based on several factors, of which, the primary financial measure is division

results. Division profit reflects income from continuing operations before income taxes, corporate expense, non-operating

income and net interest expense. The following table reconciles division profit by segment to income from continuing

operations before income taxes.

2003 2002 2001

(in millions)

Athletic Stores ............................................. $363 $279 $283

Direct-to-Customers ........................................ 53 40 24

Division profit from ongoing operations .................... 416 319 307

Disposed

(1)

................................................. — — (12)

Restructuring income (charges)

(2)

.......................... (1) 2 (33)

Total division profit ................................... 415 321 262

Corporate expense

(3)

....................................... (73) (52) (65)

Total operating profit ...................................... 342 269 197

Non-operating income ..................................... — 3 2

Interest expense, net ...................................... (18) (26) (24)

Income from continuing operations before

income taxes ............................................ $324 $246 $175

(1) Includes The San Francisco Music Box Company and Burger King and Popeye’s franchises.

(2) Restructuring charges of $1 million and $33 million in 2003 and 2001, respectively, and restructuring income of $2 million in 2002 reflect the

disposition of non-core businesses and an accelerated store-closing program.

(3) 2001 includes a $1 million restructuring charge related to the 1999 closure of a distribution center.

5