Foot Locker 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

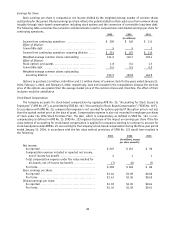

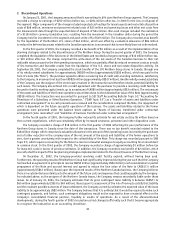

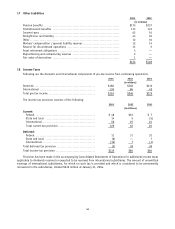

In 1998, the Company exited both its International General Merchandise and Specialty Footwear segments. In the

second quarter of 2002, the Company recorded a $1 million charge for a lease liability related to a Woolco store in the

former International General Merchandise segment, which was more than offset by a net reduction of $2 million before-tax,

or $1 million after-tax, for each of the second and third quarters of 2002 in the Specialty Footwear reserve primarily

reflecting real estate costs more favorable than original estimates.

In 1997, the Company announced that it was exiting its Domestic General Merchandise segment. In the second

quarter of 2002, the Company recorded a charge of $4 million before-tax, or $2 million after-tax, for legal actions related

to this segment, which have since been settled. In addition, the successor-assignee of the leases of a former business

included in the Domestic General Merchandise segment has filed a petition in bankruptcy, and rejected in the bankruptcy

proceeding 15 leases it originally acquired from a subsidiary of the Company. There are currently several actions pending

against this subsidiary by former landlords for the lease obligations. In the fourth quarter of 2002, the Company recorded

a charge of $1 million after-tax related to certain actions. In each of the second and fourth quarters of 2003, the Company

recorded an additional after-tax charge of $1 million, related to certain actions. The Company estimates the gross

contingent lease liability related to the remaining actions as approximately $6 million. The Company believes that it may

have valid defenses; however, the outcome of these actions cannot be predicted with any degree of certainty.

The remaining reserve balances for these three discontinued segments totaled $17 million as of January 31, 2004,

$6 million of which is expected to be utilized within twelve months and the remaining $11 million thereafter.

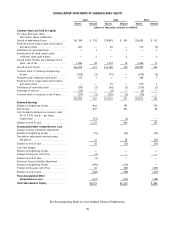

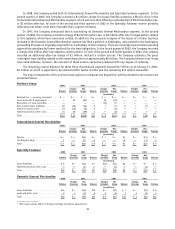

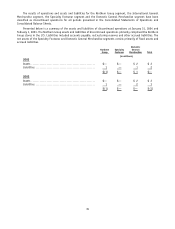

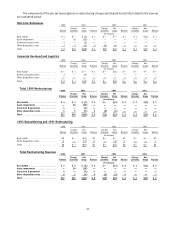

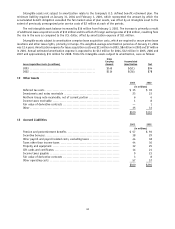

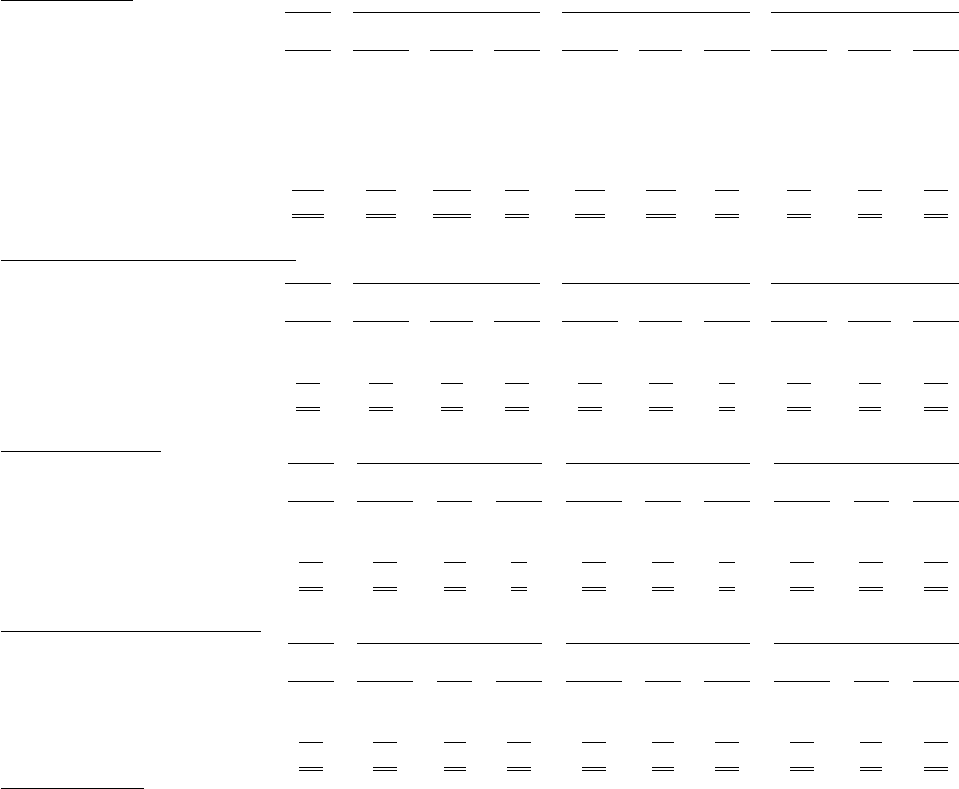

The major components of the pre-tax losses (gains) on disposal and disposition activity related to the reserves are

presented below:

Northern Group 2000 2001 2002 2003

Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

(in millions)

Realized loss — currency movement . . . $ — $ — $ — $— $ — $ — $— $— $— $—

Asset write-offs & impairments ....... — 23 (23) — 18 (18) — — — —

Recognition of note receivable ....... — — — — (10) 10 — — — —

Real estate & lease liabilities ......... 68 (16) (46) 6 1 (1) 6 1 (7) —

Severance & personnel .............. 23 (13) (8) 2 — (2) — — — —

Operating losses & other costs ........ 24 18 (39) 3 — (2) 1 — 1 2

Total ............................ $115 $ 12 $(116) $11 $ 9 $(13) $ 7 $ 1 $ (6) $ 2

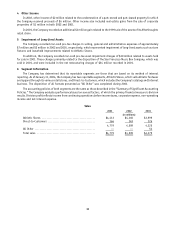

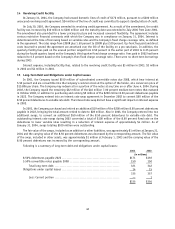

International General Merchandise

2000 2001 2002 2003

Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

(in millions)

Woolco ........................... $— $ 4 $(4) $— $ 1 $— $1 $— $(1) $—

The Bargain! Shop ................. 7 — (1) 6 — — 6 — (1) 5

Total ............................ $ 7 $ 4 $(5) $ 6 $ 1 $— $7 $— $(2) $ 5

Specialty Footwear 2000 2001 2002 2003

Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

(in millions)

Lease liabilities .................... $ 9 $— $(2) $7 $ (4) $(1) $2 $— $— $ 2

Operating losses & other costs ........ 3 — (1) 2 — (1) 1 — (1) —

Total ............................ $12 $— $(3) $9 $ (4) $(2) $3 $— $ (1) $ 2

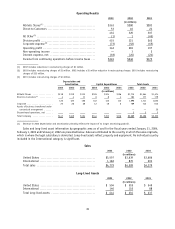

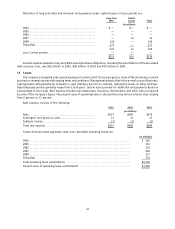

Domestic General Merchandise 2000 2001 2002 2003

Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

(in millions)

Lease liabilities .................... $16 $— $(6) $10 $— $(3) $ 7 $— $(1) $ 6

Legal and other costs ............... 2 3 (3) 2 5 (4) 3 4 (3) 4

Total ............................ $18 $ 3 $(9) $12 $ 5 $(7) $10 $ 4 $(4) $10

* Net usage includes effect of foreign exchange translation adjustments

34