Foot Locker 2003 Annual Report Download - page 45

Download and view the complete annual report

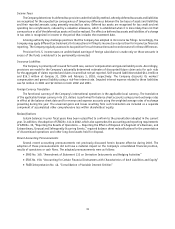

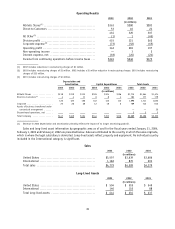

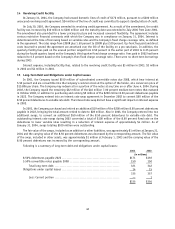

Please find page 45 of the 2003 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the fourth quarter of 2002, as a result of the accounting divestiture, the Note was recorded in the financial

statements at its estimated fair value of CAD$16 million (approximately US$10 million). The Company, with the assistance

of an independent third party, determined the estimated fair value by discounting expected cash flows at an interest rate

of 18 percent. This rate was selected considering such factors as the credit rating of the purchaser, rates for similar

instruments and the lack of marketability of the Note. As the net assets of the former operations were previously written

down to zero, the fair value of the Note was recorded as a gain on disposal within discontinued operations. The Company

will no longer present the assets and liabilities of Northern Canada as “Assets of business transferred under contractual

arrangement (note receivable)” and “Liabilities of business transferred under contractual arrangement,” but rather will

record the Note, initially at its estimated fair value.

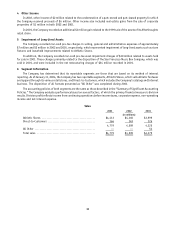

On May 6, 2003, the amendments to the Note were executed and a cash payment of CAD$5.2 million (approximately

US$3.5 million) was received representing principal and interest through the date of the amendment. After taking into

account this payment, the remaining principal due under the Note was reduced to CAD$17.5 million (approximately

US$12 million). Under the terms of the renegotiated Note, a principal payment of CAD$1 million was due and received

on January 15, 2004, further reducing the principal balance on the note. Under the terms of the amended Note, an

accelerated principal payment of CAD$1 million may be due if certain events occur. The remaining amount of the Note

is required to be repaid upon the occurrence of “payment events,” as defined in the purchase agreement, but no later

than September 28, 2008. Interest is payable semiannually and began to accrue on May 1, 2003 at a rate of 7.0 percent

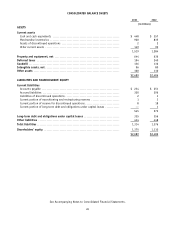

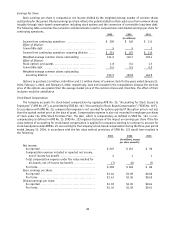

per annum. At January 31, 2004 and February 1, 2003, US$2 million and US$4 million, respectively, are classified as a

current receivable, with the remainder classified as long term within other assets in the accompanying Condensed

Consolidated Balance Sheet.

Future adjustments, if any, to the carrying value of the Note will be recorded pursuant to SEC Staff Accounting Bulletin

Topic 5:Z:5, “Accounting and Disclosure Regarding Discontinued Operations,” which requires changes in the carrying value

of assets received as consideration from the disposal of a discontinued operation to be classified within continuing

operations. Interest income will also be recorded within continuing operations. The Company will recognize an impairment

loss when, and if, circumstances indicate that the carrying value of the Note may not be recoverable. Such circumstances

would include a deterioration in the business, as evidenced by significant operating losses incurred by the purchaser or

nonpayment of an amount due under the terms of the Note.

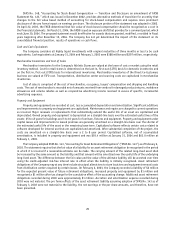

As the stock transfer on September 28, 2001 was accounted for in accordance with SAB Topic 5:E, a disposal was

not achieved pursuant to APB No. 30. If the Company had applied the provisions of Emerging Issues Task Force 90-16,

“Accounting for Discontinued Operations Subsequently Retained” (“EITF 90-16”), prior-reporting periods would not be

restated, accordingly reported net income would not have changed. However, the results of operations of the Northern

business segment in all prior periods would have been reclassified from discontinued operations to continuing operations.

The incurred loss on disposal at September 28, 2001 would continue to be classified as discontinued operations, however,

the remaining accrued loss on disposal at this date, of U.S. $24 million, primarily relating to the lease liability of the

Northern U.S. business, would have been reversed as part of discontinued operations. Since the liquidation of this business

was complete, this lease liability would have been recorded in continuing operations in the same period pursuant to EITF

94-3, “Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including

Certain Costs Incurred in a Restructuring).” With respect to Northern Canada, the business was legally sold as of

September 28, 2001 and thus operations would no longer be recorded, but instead the business would be accounted for

pursuant to SAB Topic 5:E. In the first quarter of 2002, the $18 million charge recorded within discontinued operations

would be classified as continuing operations. Similarly, the $1 million benefit recorded in the third quarter of 2002 would

also have been classified as continuing operations. Having achieved divestiture accounting in the fourth quarter of 2002

and applying the provisions of SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets,” the

Company would have then reclassified all prior periods’ of the Northern Group to discontinued operations. Reported net

income in each of the periods would not have changed and therefore the Company did not amend any of its prior filings.

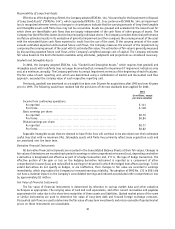

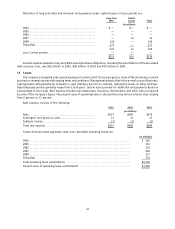

During the third quarter of 2003, a charge in the amount of $1 million before-tax was recorded to cover additional

liabilities related to the exiting of the former leased corporate office in excess of the previous estimate. In the fourth

quarter of 2003, the Company made a CAD$10 million payment (approximately US$7 million) to the landlord, which

released the Company from all future liability related to the lease.

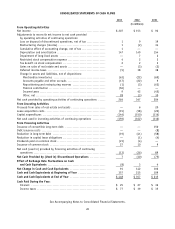

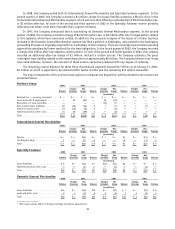

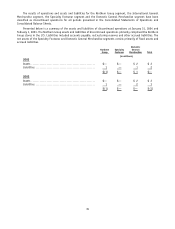

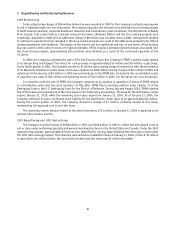

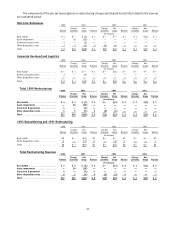

Net disposition activity of $6 million in 2003 primarily related to the $7 million payment for the buyout of the former

leased corporate office. Net disposition activity of $13 million in 2002 included the $18 million reduction in the carrying

value of the net assets and liabilities, recognition of the note receivable of $10 million, real estate disposition activity

of $1 million and severance and other costs of $4 million. The remaining reserve balance of $2 million at January 31, 2004

is expected to be utilized within twelve months.

33