Cigna 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

changes in the fair values of all insurance-related assets and liabilities

Effect of Market Fluctuations

have been excluded because their primary risks are insurance rather

The examples that follow illustrate the adverse effect of hypothetical than market risk;

changes in market rates or prices on the fair value of certain financial changes in the fair values of investments recorded using the equity

instruments including: method of accounting and liabilities for pension and other

a hypothetical increase in market interest rates, primarily for fixed postretirement and postemployment benefit plans (and related

maturities and commercial mortgage loans, partially offset by assets) have been excluded, consistent with the disclosure guidance;

liabilities for long-term, largely fixed-rate debt; and and

a hypothetical strengthening of the U.S. dollar to foreign currencies, changes in the fair values of other significant assets and liabilities

primarily for the net assets of foreign subsidiaries denominated in a such as goodwill, deferred policy acquisition costs, taxes, and various

foreign currency. accrued liabilities have been excluded; because they are not financial

instruments, their primary risks are other than market risk.

Management believes that actual results could differ materially from

these examples because:

these examples were developed using estimates and assumptions;

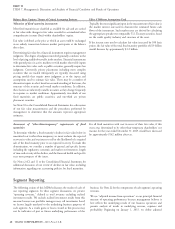

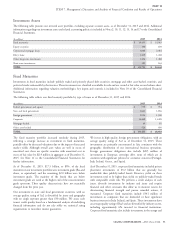

The effects of hypothetical changes in market rates or prices on the fair values of certain of our financial instruments, subject to the exclusions

noted above (particularly insurance liabilities), would have been as follows as of December 31:

Loss in fair value

Market scenario for certain non-insurance financial instruments

(in millions)

2015 2014

100 basis point increase in interest rates $ 865 $ 850

10% strengthening in U.S. dollar to foreign currencies $ 340 $ 320

The effect of a hypothetical increase in interest rates was determined dollar equivalent fair value. Our foreign operations hold investment

by estimating the present value of future cash flows using various assets, such as fixed maturities, cash, and cash equivalents, that are

models, primarily duration modeling. The impact of a hypothetical generally invested in the currency of the related liabilities. The effect

increase to interest rates at December 31, 2015 was greater than that of a hypothetical 10% strengthening in the U.S. dollar to foreign

at December 31, 2014 reflecting increased purchases of longer currencies at December 31, 2015 was greater than that effect at

duration assets, partially offset by valuation decreases resulting from December 31, 2014 due to increased amounts of investments that are

higher market yields of fixed maturities during 2015. primarily denominated in the South Korean won.

The effect of a hypothetical strengthening of the U.S. dollar relative to

the foreign currencies held by us was estimated to be 10% of the U.S.

56 CIGNA CORPORATION - 2015 Form 10-K

•

•

•

••

•