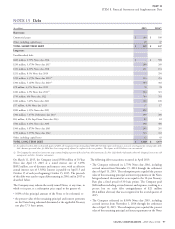

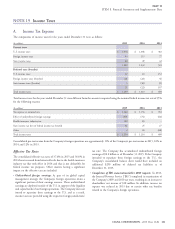

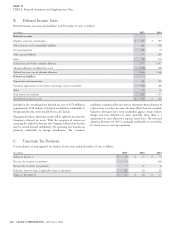

Cigna 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

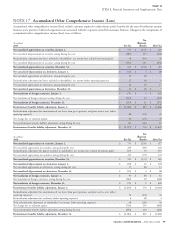

PART II

ITEM 8. Financial Statements and Supplementary Data

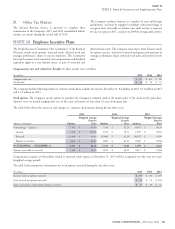

The Company conducts business in a number of state and foreign

D. Other Tax Matters

jurisdictions, and may be engaged in multiple audit proceedings at

The Internal Revenue Service is expected to complete their any given time. Generally, no further state audit activity is expected

examination of the Company’s 2011 and 2012 consolidated federal for tax years prior to 2011, and prior to 2009 for foreign audit activity.

income tax returns during the second half of 2016.

Employee Incentive Plans

The People Resources Committee (‘‘the Committee’’) of the Board of deferred stock units. The Company issues shares from Treasury stock

Directors awards stock options, restricted stock, deferred stock and for option exercises, awards of restricted stock grants and payment of

strategic performance shares to certain employees. The Committee strategic performance shares, deferred stock units and restricted stock

has issued common stock instead of cash compensation and dividend units.

equivalent rights to a very limited extent, as part of restricted and

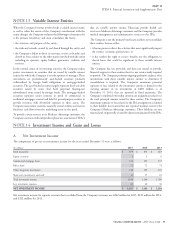

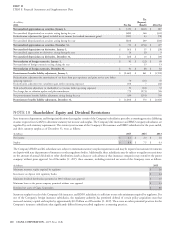

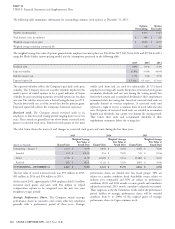

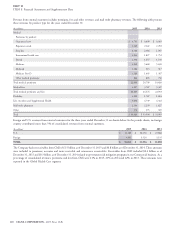

Compensation cost and related tax benefits for these awards were as follows:

(In millions)

2015 2014 2013

Compensation cost $ 111 $ 101 $ 88

Tax benefits $24 $12 $25

The Company had the following number of common stock shares available for award at December 31: 8.6 million in 2015, 10.3 million in 2014

and 13.2 million in 2013.

Stock options. The Company awards options to purchase the Company’s common stock at the market price of the stock on the grant date.

Options vest over periods ranging from one to five years and expire no later than 10 years from grant date.

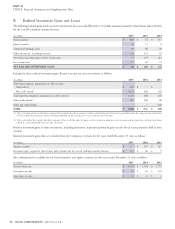

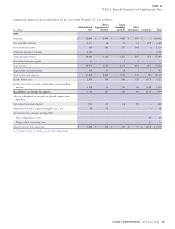

The table below shows the status of, and changes in, common stock options during the last three years:

2015 2014 2013

Weighted Average Weighted Average Weighted Average

Exercise Exercise Exercise

(Options in thousands)

Options Price Options Price Options Price

Outstanding — January 1 7,331 $ 51.84 7,350 $ 42.24 8,951 $ 36.29

Granted 1,410 $ 120.94 2,012 $ 78.11 1,890 $ 58.84

Exercised (2,146) $ 43.63 (1,869) $ 41.29 (3,107) $ 34.99

Expired or canceled (162) $ 86.04 (162) $ 64.27 (384) $ 43.86

OUTSTANDING — DECEMBER 31 6,433 $ 68.86 7,331 $ 51.84 7,350 $ 42.24

Options exercisable at year-end 3,414 $ 46.55 3,919 $ 38.11 4,217 $ 35.84

Compensation expense of $36 million related to unvested stock options at December 31, 2015 will be recognized over the next two years

(weighted average period).

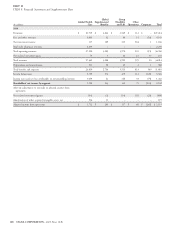

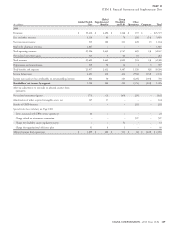

The table below summarizes information for stock options exercised during the last three years:

(In millions)

2015 2014 2013

Intrinsic value of options exercised $ 179 $ 84 $ 105

Cash received for options exercised $ 94 $ 76 $ 109

Excess tax benefits realized from options exercised $ 33 $ 19 $ 23

CIGNA CORPORATION - 2015 Form 10-K 103

NOTE 20