Cigna 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

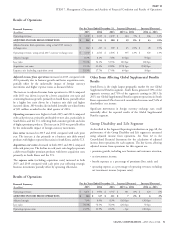

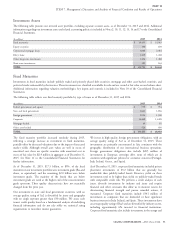

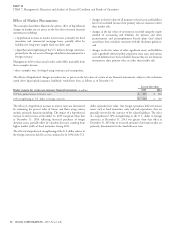

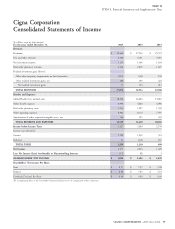

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

natural gas sector of $1.5 billion with gross unrealized losses of have $205 million of loans maturing in the next twelve months. Given

$59 million. These investments have an average quality rating of Baa1 the quality and diversity of the underlying real estate, positive debt

and are diversified by issuer with no single exposure greater than service coverage and significant borrower cash investment or equity

$35 million. value averaging 30%, we remain confident that borrowers will

continue to perform as expected under their contract terms.

We have approximately $25 million of aggregate corporate fixed

maturity investments in China-based companies. In addition to

amounts classified in fixed maturities on our Consolidated Balance

Other Long-term Investments

Sheet, we operate a joint venture in China in which we have a 50% Other long-term investments of $1.4 billion primarily include

ownership interest. We account for this joint venture on the equity investments in security partnership and real estate funds as well as

basis of accounting and report it in other assets, including other direct investments in real estate joint ventures. The funds typically

intangibles. This entity has an investment portfolio of approximately invest in mezzanine debt or equity of privately held companies

$2 billion that is primarily invested in diversified corporate fixed (securities partnerships) and equity real estate. Given our subordinate

maturities and has no investments with a material unrealized loss as of position in the capital structure of these underlying entities, we

December 31, 2015. assume a higher level of risk for higher expected returns. To mitigate

risk, investments are diversified across approximately 105 separate

Commercial Mortgage Loans

partnerships, and approximately 65 general partners who manage one

or more of these partnerships. Also, the funds’ underlying investments

Our commercial mortgage loans are fixed rate loans, diversified by are diversified by industry sector or property type, and geographic

property type, location and borrower. Loans are secured by high region. No single partnership investment exceeds 6% of our securities

quality commercial properties and are generally made at less than 70% and real estate partnership portfolio.

of the property’s value at origination of the loan. Property value, debt

service coverage, quality, building tenancy and stability of cash flows

are all important financial underwriting considerations. We hold no

Problem and Potential Problem Investments

direct residential mortgage loans and do not securitize or service ‘‘Problem’’ bonds and commercial mortgage loans are either

mortgage loans. delinquent by 60 days or more or have been restructured as to terms,

We completed an annual in-depth review of our commercial mortgage including concessions by us for modification of interest rate, principal

loan portfolio during the second quarter of 2015. This review payment or maturity date. ‘‘Potential problem’’ bonds and commercial

included an analysis of each property’s year-end 2014 financial mortgage loans are considered current (no payment is more than

statements, rent rolls, operating plans and budgets for 2015, a physical 59 days past due), but management believes they have certain

inspection of the property and other pertinent factors. Based on characteristics that increase the likelihood that they may become

property values and cash flows estimated as part of this review and problems. The characteristics management considers include, but are

subsequent fundings and repayments, the portfolio’s average not limited to, the following:

loan-to-value ratio improved to 58% at December 31, 2015, from request from the borrower for restructuring;

63% as of December 31, 2014, and the portfolio’s average debt service

coverage ratio also improved to 1.78 at December 31, 2015 from 1.66 principal or interest payments past due by more than 30 but fewer

as of December 31, 2014. These improvements reflect payoffs of loans than 60 days;

with below average debt service coverage ratios and high loan to value downgrade in credit rating;

ratios, as well as increased operating income and value across most

underlying properties. See Note 11 to the Consolidated Financial collateral losses on asset-backed securities; and

Statements for further information. for commercial mortgages, deterioration of debt service coverage

Commercial real estate capital markets remain very active for below 1.0 or value declines resulting in estimated loan-to-value

well-leased, quality commercial real estate located in strong ratios increasing to 100% or more.

institutional investment markets. The vast majority of properties We recognize interest income on problem bonds and commercial

securing the mortgages in our mortgage portfolio possess these mortgage loans only when payment is actually received because of the

characteristics. risk profile of the underlying investment. The amount that would

The $1.9 billion commercial mortgage loan portfolio consists of have been reflected in net income if interest on non-accrual

approximately 65 loans. The portfolio includes three impaired loans investments had been recognized in accordance with the original

with a carrying value totaling $98 million, net of $15 million in terms was not significant for 2015 or 2014.

reserves, that are classified as problem or potential problem loans. We

54 CIGNA CORPORATION - 2015 Form 10-K

•

•

•

•

•