Cigna 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

time to time and may also remove such suspensions, generally without

Financing activities

public announcement. We may also repurchase shares at times by

Cash used in financing activities decreased in 2015 compared with using a Rule 10b5-1 trading plan when we otherwise might be

2014, primarily reflecting lower share repurchases. Cash used in precluded from doing so under insider trading laws or because of

financing activities increased in 2014 compared with the same period self-imposed trading block-out periods.

in 2013, primarily due to higher share repurchases. In 2015, we repurchased 5.5 million shares for $683 million. From

January 1, 2016 through February 25, 2016 we repurchased

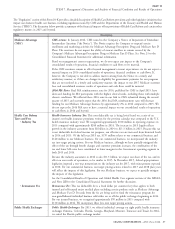

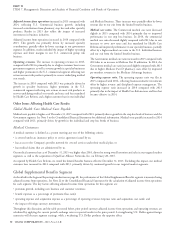

Share repurchase

0.8 million shares for $110 million. The total remaining share

We maintain a share repurchase program, authorized by our Board of repurchase authorization as of February 25, 2016 was $390 million.

Directors. Under this program, we may repurchase shares from time We repurchased 18.5 million shares for $1.6 billion in 2014 and

to time, depending on market conditions and alternate uses of capital. repurchased 13.6 million shares for $1.0 billion in 2013.

We may suspend activity under our share repurchase program from

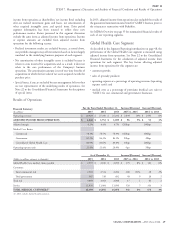

Interest Expense

Interest expense on long-term debt, short-term debt and capital leases was as follows:

(In millions)

2015 2014 2013

Interest expense $ 252 $ 265 $ 270

Interest expense reported above for the year ended 2015 excludes parent company’s combined cash obligations are expected to be

losses on the early extinguishment of debt. approximately $365 million to pay for interest, commercial paper

maturities and dividends.

The weighted average interest rate for outstanding short-term debt

(primarily commercial paper) was 0.69% at December 31, 2015 and We expect, based on the parent company’s current cash position,

0.27% at December 31, 2014. current projections for subsidiary dividends, and the ability to

refinance its commercial paper borrowing, to have sufficient liquidity

to meet the obligations discussed above.

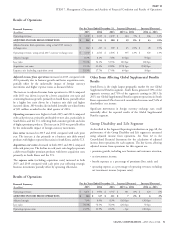

Capital Resources

Our cash projections may not be realized and the demand for funds

Our capital resources (primarily retained earnings and proceeds from could exceed available cash if our ongoing businesses experience

the issuance of debt and equity securities) provide protection for unexpected shortfalls in earnings, or we experience material adverse

policyholders, furnish the financial strength to underwrite insurance effects from one or more risks or uncertainties described more fully in

risks and facilitate continued business growth. the Risk Factors section of this Form 10-K. In those cases, we expect

to have the flexibility to satisfy liquidity needs through a variety of

Management, guided by regulatory requirements and rating agency

measures, including intercompany borrowings and sales of liquid

capital guidelines, determines the amount of capital resources that we

investments. The parent company may borrow up to $1.3 billion

maintain. Management allocates resources to new long-term business

from its insurance subsidiaries without additional state approval. As of

commitments when returns, considering the risks, look promising

December 31, 2015, the parent company had $63 million of net

and when the resources available to support existing business are

intercompany loans receivable from its insurance subsidiaries.

adequate.

Alternatively, to satisfy parent company liquidity requirements we

We prioritize our use of capital resources to: may use short-term borrowings, such as the commercial paper

program, the committed revolving credit and letter of credit

provide the capital necessary to support growth and maintain or

agreement of up to $1.5 billion subject to the maximum debt leverage

improve the financial strength ratings of subsidiaries and to fund

covenant in its line of credit agreement. As of December 31, 2015,

pension obligations;

$1.5 billion of short-term borrowing capacity under the credit

consider acquisitions that are strategically and economically agreement was available to us. Within the maximum debt leverage

advantageous; and covenant in the line of credit agreement as described in Note 15, we

have $7.9 billion of borrowing capacity in addition to the $5.2 billion

return capital to investors through share repurchase.

of debt outstanding. This additional borrowing capacity includes the

The availability of capital resources will be impacted by equity and $1.5 billion available under the credit agreement.

credit market conditions. Extreme volatility in credit or equity market

Though we believe we have adequate sources of liquidity, significant

conditions may reduce our ability to issue debt or equity securities.

disruption or volatility in the capital and credit markets could affect

our ability to access those markets for additional borrowings or

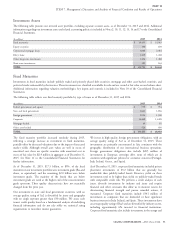

Liquidity and Capital Resources Outlook

increase costs associated with borrowing funds.

At December 31, 2015, there was approximately $1.4 billion in cash We maintain a capital management strategy to retain overseas a

and investments available at the parent company level. In 2016, the significant portion of the earnings from our foreign operations. These

CIGNA CORPORATION - 2015 Form 10-K 43

•

•

•