Cash America 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 percent of the loan portfolio in our

E-Commerce Segment is unsecured. An

intelligent “outsider” would instinctively

argue that collateral makes all the

difference in the world during tough

economic times. Surely, the secured

lending business would perform better

and be more profitable in times of

trouble. An intelligent “insider,” on the

other hand, will tell you that while the

collateral may help you sleep better at

night, it really doesn’t dramatically alter

customer behavior. What I have learned in

over 25 years in this business is that our

customers – by and large – fully intend to

honor their commitment for repayment

just as most prime customers do.

So intuitively, you would expect

the two segments to experience

similar trends in demand and portfolio

performance during various economic

cycles. Interestingly, that is not what

happened over the past three years.

Our Retail Services Segment

experienced growth in demand, but at

a moderating level. We had become

accustomed to seeing same store asset

growth in the high single digits prior to

2008. Over this last three-year period,

we have experienced loan growth in

the low to mid single digits. At the

same time – again counterintuitive to

what the outsider may expect – our

customers have been more determined

to repay their loans and redeem their

merchandise. This dynamic reflects a

behavioral shift that I have mentioned

in previous writings and talks. Our

customers became more anxious about

their jobs and providing for their families,

so they became more conservative in

their borrowing and spending habits. As

a result, the Retail Services Segment

enjoyed stable and steady revenue

growth in the mid single digits that

was then leveraged with operating

efficiencies to produce low double-digit

earnings increases. These results are not

bad for the most difficult recessionary

period in our history.

The E-Commerce Segment

experienced a different and more

volatile fate…experiencing significant

downdrafts and updrafts over the three-

year period.

The headwinds encountered by the

E-Commerce Segment were mostly

orchestrated by political fiat. One of

the most frightening and potentially

damaging outcomes of any economic

crisis is the unfettered license it

provides to ideological zealots for

advancing social engineering agendas

that prosperity would never allow. Such

was the development in places like

Ohio, Pennsylvania, Maryland, Florida,

Washington, Arizona, Colorado, Illinois,

etc. All these states capitalized on

the scapegoat of lax financial services

regulation (a significant misperception

with respect to the already highly

regulated financial services we offer)

to introduce new rules restricting our

ability to serve the financial needs of

citizens in those states. The granddaddy

of all was intended to be the Consumer

Financial Protection Bureau established

by the Dodd-Frank Act. Fortunately,

the formation of this bureau has been

sufficiently delayed long enough to

allow prosperity to regain momentum

and temper the public zeal for social

engineering. The ultimate impact of

the Bureau on our business remains

uncertain, but at least the aggressive

rhetoric from Washington has softened

since last November’s election.

The tailwinds propelling the

E-Commerce Segment stem from two

distinct developments…one driven

by the marketplace and one of our

own making. The marketplace factor

finds us as the beneficiary of the

massive contraction of consumer credit

unleashed by a combination of changing

bank policies and new regulatory reform

of federally insured financial institutions

(Dodd-Frank, Card Act, etc.). Simply

stated, I believe this contraction has

forced previously “banked” consumers

into the ranks of the unbanked. In today’s

world of instant fingertip access, the first

step these disenfranchised customers

will take is a step online to look for

alternatives. When they go online, they

are likely to find us, and many have.

The second factor, of our making,

has been a successful international

expansion campaign generating

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$0.0

10

Q -1 Q -2 Q -3 Q -4

08 09

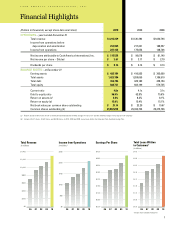

Quarterly Earnings Per Share

Continuing Operations

$120

$100

$80

$60

$40

$20

$0

After-Tax Income

from Continuing Operations

(in millions)

1006 07 08 09

3