Cash America 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

I suspect the receipt of this

2010 annual report and Shareholders

Message finds most of you in a more

relaxed state of mind than did the

timing of our reports of 2008 and

2009. The last three years have indeed

been challenging to all of us in many

ways. But now the world finally looks

level again and business optimism has

regained its energy despite nagging

unemployment levels, stifling new

regulations and very troubling budget

deficits throughout most developed

economies. Commercial credit markets

have strengthened considerably, thereby

encouraging business expansion and

new investment. Even the struggling

consumer has begun to peek above the

water line and demonstrate a renewed,

albeit cautious, appetite for small-dollar

credit and new consumption. From my

vantage point as the CEO of a mid cap

consumer-oriented business, the current

outlook may not compare to the heady

days preceding 2008, but I have at least

revoked my directive to keep all sharp

objects out of reach.

I also hope your overall investment

portfolio has regained value at least in

step with the recovery posted by most

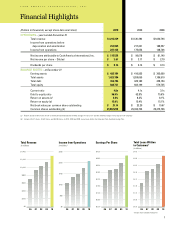

major indices. The Cash America share

value entered the recession with a 2008

beginning price of approximately $31,

hit a three-year low of $12 in March of

2009 and recovered to approximately

$37 at the end of 2010. By comparison,

the S&P 500 Index began with a value

of 1,447, dropped to 677 and recovered

in 2010 to 1,257 at year-end, which was

below the 2008 beginning value. So I

would conclude our shareholders have

fared comparatively well over the three-

year period. I will have more to say about

share valuation later.

The financial services industry

was particularly hard hit by the global

recession, with many venerable

institutions finding themselves in the

once unfathomable predicaments of

bankruptcies and government bailouts.

Now with new rules and regulations –

for better or worse – it is hard to imagine

that most of these institutions will be

able to regain their previous positions

of prominence. A few of the most fit

and coddled will undoubtedly eclipse

their previous standing as they reap the

benefits of economic expansion with far

fewer competitors.

As a player in the financial services

industry, Cash America fared much

better than most. We have dealt with

our own set of struggles these past

three years, but most have been

dealt to us by misguided regulatory

changes rather than disruptions in

marketplace fundamentals. Even with

these challenges, our long-standing

trend of annually posting new records

for revenues and earnings remains

intact. A few of our direct competitors

also extended their strings of record

earnings, while most prestigious financial

institutions struggled for survival.

That fact alone exemplifies the value

of owning a business that serves the

needs of low-to-moderate income

consumers with small-dollar transactional

services and very limited exposure to

concentrations of loss. Successfully

operating such a business requires a

respectful customer service orientation,

disciplined execution and a resistance

to ideological assault…all principles we

have both honored and honed over the

past quarter of a century.

Interestingly, the two segments

of our business have experienced

different dynamics over the past three

years. As you know, our two segments

are organized around channels of

distribution. Our Retail Services

Segment represents the approximately

1,100 physical storefront units in the

U.S. and Mexico. The E-Commerce

Segment is our online platform that

delivers loan products to customers

in the U.S., UK, Australia and Canada.

The customer profile in these two

segments varies slightly, but all the

customers have historically fit within the

broad definition of the low-to-moderate

income consumer, alternatively referred

to as the unbanked or underbanked

customer. The product offerings also

vary slightly within the two segments.

But the core products of both segments

are all small, short-term loans designed

to help our customers bridge the gap of

unexpected but frequent disruptions in

their bi-weekly or monthly cash flows.

Admittedly, one apparent key difference

is that most of the loan portfolio in our

Retail Services Segment is secured

by tangible personal property, while

2