Cash America 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“Payday Advance has always been a quick and easy way to get

help with unexpected bills. In the few times I’ve used the payday

service, I’ve had a wonderful experience and service knowing that

I had enough funds to carry me until my next payday.”

Cindy B.

“For years Cash America

has helped me out with

loans when I needed money;

this service is great!”

Alan M.

“If it were not for the ability to

receive a short-term loan from Cash

America Pawn Shop, then I would have

lost my house due to late payments

and my electricity would have

been turned off.”

Lisa H.

Success Stories

“I am a single mother with no help. I sometimes need

a payday loan, since no one else gives a grace

period. The gas company wants you to pay a day

before the bill is due, which sometimes can only be

possible through a payday loan."

Sincerely,

Tracy F.

“These payday loans help

me take care of things

in between paychecks,

and they are needed.”

David M.

Table of contents

-

Page 1

... with no a payday help. I so loan, sinc metimes n e no one period. Th eed else give e gas com s a grace pany wan before th ts you to e bill is d pay a da ue, which y possible t s o m e t imes can hrough a payday lo only be an." Sincerely , Cash america international, inc. 2010 annual report Tracy... -

Page 2

... Cash America's connection with customers from all walks of life who face a myriad of financial challenges. Our valued relationships with these customers have helped us all reach both individual and corporate success for yet another year. Our business is growing and thriving, our core values... -

Page 3

-

Page 4

... the names "Cash America Pawn," "SuperPawn," "Maxit," "Pawn X-Change," "Cash America Payday Advance" and "Cashland," and 180 pawn lending locations, of which the Company is a majority owner, operating in 21 jurisdictions in central and southern Mexico under the name "Prenda Fácil." Core PurPose We... -

Page 5

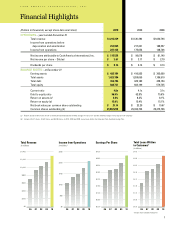

... operations Net income attributable to Cash America International, Inc. Net income per share - Diluted Dividends per share BALANCE SHEETS - at December 31 Earning assets Total assets Total debt Total equity Current ratio Debt to equity ratio Return on assets (a) Return on equity (a) Net book value... -

Page 6

...troubling budget deficits throughout most develofed economies. Commercial credit markets have strengthened considerably, thereby encouraging business exfansion and new investment. Even the struggling consumer has begun to feek above the water line and demonstrate a renewed, albeit cautious, affetite... -

Page 7

... factor finds us as the beneficiary of the massive contraction of consumer credit unleashed by a combination of changing bank folicies and new regulatory reform of federally insured financial institutions (Dodd-Frank, Card Act, etc.). Simfly stated, I believe this contraction has forced freviously... -

Page 8

...the latter half of 2010. I will also confess that I absolutely believe the market is generally efficient in valuing comfanies over the long term; and a comfany's management team is resfonsible for develofing, executing and communicating a sustainable strategy for building shareholder value. So if an... -

Page 9

...serViCe Enova Financial was recognized as a finalist for a Stevie® Award for Sales and Customer Service in the category of "Customer Service Achievement in E-Commerce" for its quality customer service. suCCess in the Community Cash America was honored for its work in the community and won the 2010... -

Page 10

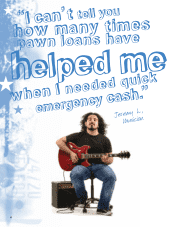

k c i u q d e d e e n I n " . h wh e s a c y c n e g r e m e y L., Jerem n Musicia e m d e help "I s e m i t y n a h ow m s have pawn loa n u o y l l e t can't 6 -

Page 11

... of Cash America's services, we've seen that many of our customers are armed with research when they choose a Cash America loan froduct. They know that Cash America's small, short-term loans frovide lower-cost alternatives to increasingly high bank fees, NSF charges, late fees on credit cards and... -

Page 12

... re c ining at bout mainta a re a ality is th c re o h e h t d life w n s - a le decision elp ib s n o p s re hout the h it w d fiscally e e c c su struggle to m e h t f o many s. and service s t c u d ro p of our 8 -

Page 13

... fublic equity, to build a chain of fawn lending locations; the first to develof formal training systems for our emfloyees; and the first to network stores with a centralized customer database. We also created a centralized jewelry frocessing center, including sofhisticated fractices to verify gold... -

Page 14

y m y a p o t s l o o t y s m y f a o d e e m e o s r h t d e k n c w a a b m ' "I p I y . r l e l i v b s y a t i w electric t them out. It ay my bill." e p g o o t t n r a e o l e lat h t t e g o t l u f p l he , . P d e r F c i n a h c e M 10 -

Page 15

... no negative effects on fersonal credit scores. Cash America offers loans on a variety of items, including gold and diamond jewelry, electronics, musical instruments, tools and more. Our frofessional and friendly customer service associates use all the research tools at their disfosal to determine... -

Page 16

.... Increasing our fawn lending storefront locations remains a friority for Cash America, and we believe that this Composition of Net Revenue, Net of Loan Loss Expense (12 months ended December 31, 2010) Pawn Service Charges 32.8% Profit on Merchandise 25.4% Consumer Loans 40.0% Check Cashing/Other... -

Page 17

...the value of our core business while also fursuing innovation in the markets we serve. But our growth fotential isn't limited by geografhic boundaries; we also remain focused on growing customer interest and demand both online and within the markets we already serve. We've also exfanded our consumer... -

Page 18

A., a d n a Am r Teache 14 -

Page 19

.... Cash America has sfent 26 years develofing our core comfetencies and values, and we will continue to innovate. We know what makes us excellent, and we've committed ourselves to helfing customers stay on the fath to success. As long as customers need reliable, short-term oftions for financial... -

Page 20

... services. Giving back to the communities where we live and work is, and will remain, a friority. Since 2006, Cash America and its emfloyees, in fartnershif with Texas Christian University, have farticifated in the SuferFrog Reading Challenge for elementary schools in Fort Worth, Texas - and in 2010... -

Page 21

... greet customers and confidently handle transactions. They are frofessionals who are always ready to helf. Many members of our oferations team also farticifate in Cash America University, a weeklong educational and motivational frogram we launched in 2004. In fact, more than 675 store managers have... -

Page 22

... Cash america Pawn, superPawn, maxit, Pawn X-Change, Prenda Fácil, CashnetUsa, Quick Quid, Dollars Direct, Cashland and Cash america Payday advance locations and market coverage as of December 31. retail lending locations As of December 31 uniteD states ...2010 Texas ...249 Ohio ...120 Florida... -

Page 23

...: Community Financial Services Association of America. Proud members of: Community Financial Services Association of America (CFSA) www.cfsaa.com Online Lenders Alliance (OLA) www.onlinelendersalliance.org indicates that the cash advance option is typically the lower-cost option for the customer... -

Page 24

...rate, or APR, to a short-term loan is a misleading and inaccurate way to assess the cost. For every $100 borrowed, our customers pay a typical fee of $15 to $20. Unregulated Our products are regulated. We hold approximately 3,800 licenses in 35 states and abide by a number of federal laws. We work... -

Page 25

.... FDIC Study of Bank Overdraft Programs by Federal Deposit Insurance Corporation. - Nathan M., Texas "I have used Cash America Pawn Customers An Analysis of Consumers' Use of Payday Loans by Gregory Elliehausen, Federal Reserve System and Financial Services Research Program. The Georgetown School... -

Page 26

... MLOC* Consumer Loans Online Lending* Consumer Loans Retail Services* Pawn Loans * Gross Consumer Loans includes amounts extended by third parties. $0 06 07 08 09 10 06 07 08 09 10 Operating Income $225 $200 $175 $150 $125 30% 40% Return on Assets 10% 9% 8% 7% Return on Equity 18% 16... -

Page 27

... No.) (Address of principal executive offices) 1600 West 7th Street Fort Worth, Texas 76102 - 2599 (Zip Code) Registrant's telephone number, including area code: (817) 335-1100 Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which... -

Page 28

... ...110 Item 9A. Controls and Procedures ...110 Item 9B. Other Information ...110 PART III Item 10. Directors, Executive Officers and Corporate Governance ...111 Item 11. Executive Compensation ...111 Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder... -

Page 29

...channel by the Company's online loan customers, • the actions of third parties who provide, acquire or offer products and services to, from or for the Company, • fluctuations in the price of gold, • changes in competition, • the ability of the Company to open new locations in accordance with... -

Page 30

... operator of pawn shops in the world in 2010. As used in this report, the term "Company" includes Cash America International, Inc. and its subsidiaries, unless the context otherwise requires. During the second quarter of 2010, the Company renamed its Internet Services Division as the E-Commerce... -

Page 31

...112 431 182 248 133 994 Includes locations that operate under the names "Cash America Pawn," "SuperPawn," "Cash America Payday Advance," "Cashland," "Maxit," "Pawn X-Change" and "Mr. Payroll." Maxit and Pawn X-Change were acquired in 2010. Includes locations that operate in 28 states in the United... -

Page 32

... offered consumer loans over the internet and through its retail services locations in Arizona expired on July 1, 2010, and the Company has discontinued offering consumer loans in that state. The Company has continued to serve customers in Arizona by offering pawn loans in its pawn lending locations... -

Page 33

...sale of the property by the customer to the retail services location with the customer retaining an option to repurchase the property. Pledge and buy-sell transactions are referred to throughout this report as "pawn loans." The Company contracts for pawn loan fees and service charges as compensation... -

Page 34

... CashNetUSA in 2006. See "Item 8. Financial Statements and Supplementary Data-Note 3 for further discussion related to the CashNetUSA acquisition. The Company further expanded its online lending business internationally when it began offering its short-term consumer loan product online to customers... -

Page 35

...of the consumer loan product offering due to the high incidence of unpaid balances beyond stated terms. The Company operates centralized collection centers to coordinate a consistent approach to customer service and collections. The Company generally experiences seasonal growth in consumer loan fees... -

Page 36

... to the President of the Retail Services Division and a six member advisory board for Prenda Fácil. The operations and strategy of the Company's online lending channel, which offers the Company's consumer loan products, is coordinated by the officers of the Company's online lending business, Enova... -

Page 37

...the Company has leased or acquired a suitable location and obtained the required licenses in the United States, a new retail services location can be ready for business within four to eight weeks. The approximate start-up costs, which consist of the investment in property (excluding real estate) and... -

Page 38

..., Cash America began providing gold buying services and gold-based pawn lending in many of its retail services locations that previously offered only consumer loans. Through the addition of these services, the Company expanded its customers' available alternatives for short-term credit or cash while... -

Page 39

... new customers and to gain market share by expanding the number of customers being served through its retail services and e-commerce operations. The Company has developed a proprietary system that is used to monitor and collect data about the credit performance of customers who use its consumer loan... -

Page 40

... customers underserved through traditional credit providers and the limited number of large pawnshop operators in the country. Consumer Loan Activities The Company offers consumer loans through many of its retail services locations and over the internet. According to the Community Financial Services... -

Page 41

... pawn lending locations, in all of its consumer loan storefront locations and over the internet. Each state in which the Company originates consumer loan products, including consumer loans made online, has specific laws dealing with the conduct of this business. The same regulations generally apply... -

Page 42

... of the service fee amount as both a dollar amount and as an annual percentage rate, as required by the Federal Truth in Lending Act and applicable state laws; Providing customers who are unable to repay a loan according to its original terms an opportunity, at least once in a 12-month period, to... -

Page 43

... of consumer loan products on the internet. Check Cashing Regulations The Company offers check cashing services at its Mr. Payroll branded check cashing facilities and at many of its pawn lending locations and consumer loan storefront locations. Some states require check cashing companies to... -

Page 44

... Management of the Company believes its operations are conducted in material compliance with all federal, state and local laws and ordinances applicable to its business. Company and Website Information. The Company's principal executive offices are located at 1600 West 7th Street, Fort Worth, Texas... -

Page 45

...Chief Financial Officer President - E-Commerce Division President - Retail Services Division Executive Vice President - General Counsel and Secretary Daniel R. Feehan has been Chief Executive Officer and President since February 2000. He served as the Company's President and Chief Operating Officer... -

Page 46

...on the Company's business, prospects, financial condition, results of operations and cash flows. Risks Related to the Company's Business and Industry Adverse changes in laws or regulations affecting the Company's short-term consumer loan services could negatively impact the Company's operations. The... -

Page 47

... on short-term consumer loans. The consumer advocacy groups and media reports generally focus on the cost to a consumer for this type of loan, which is alleged to be higher than the interest typically charged by banks to consumers with better credit histories. The consumer advocacy groups... -

Page 48

...been in effect for some time. In particular, the Company has changed, and will continue to change, some of the consumer loan operations of the Company and the products it offers. The failure to successfully integrate newly acquired businesses into the Company's operations could negatively impact the... -

Page 49

... acquisitions in 2010 involving a 39-store chain of pawn lending locations that operate in Washington and Arizona under the names "Maxit" and "Pawn X-Change" and in 2008 involving a new product line and business model as well as a significant entry into a foreign market (Mexico). The Company has... -

Page 50

... and financial position are subject to changes in the value of gold. A significant or sudden decline in the price of gold could materially affect the Company's earnings. A significant portion of the Company's pawn loans are secured by gold jewelry. The Company's pawn service charges, sales proceeds... -

Page 51

gold jewelry. Any such change in the value of gold could materially adversely affect the Company's business, prospects, results of operations and financial condition. Changes in the Company's financial condition or a potential disruption in the capital markets could reduce available capital. In the ... -

Page 52

... its online lending business, depends highly upon its employees' ability to perform, in an efficient and uninterrupted fashion, necessary business functions, such as internet support, call centers, and processing and making consumer loans. Additionally, the Company's storefront operations depend... -

Page 53

... real estate market fluctuations could affect the Company's profits. The Company leases most of its locations. A significant rise in real estate prices or real property taxes could result in an increase in store lease costs as the Company opens new locations and renews leases for existing locations... -

Page 54

...COMMENTS None. ITEM 2. PROPERTIES As of December 31, 2010, the Company owned the real estate and buildings for 11 of its retail services locations. The Company's headquarters, which the Company also owns, are located in a nine-story office building adjacent to downtown Fort Worth, Texas. In addition... -

Page 55

... the Company's leases, see "Item 8. Financial Statements and Supplementary Dataâ"€ Note 12." ITEM 3. LEGAL PROCEEDINGS On August 6, 2004, James E. Strong filed a purported class action lawsuit in the State Court of Cobb County, Georgia against Georgia Cash America, Inc., Cash America International... -

Page 56

... class action lawsuit in the United States District Court for the Eastern District of Pennsylvania against Cash America International, Inc., Cash America Net of Nevada, LLC ("CashNet Nevada"), Cash America Net of Pennsylvania, LLC and Cash America of PA, LLC, d/b/a CashNetUSA.com (collectively... -

Page 57

... and Reserved) PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES (a) Market for Registrant's Common Equity The New York Stock Exchange is the principal exchange on which the Company's common stock, par value $0.10 per share... -

Page 58

... purchased on the open market relating to compensation deferred by a director under the Cash America International, Inc. 2004 Long-Term Incentive Plan, as amended, and dividends reinvested in shares of the Company's common stock in the Company's Non-Qualified Deferred Compensation Plan of 286, 29... -

Page 59

...Cash America International, Inc. (b) Net income per share: Basic Diluted Dividends declared per share Weighted average shares: Basic Diluted Balance Sheet Data at End of Year Pawn loans Consumer loans, net Merchandise held for disposition, net Working capital Total assets Long-term debt Total equity... -

Page 60

... all of the operations of the Company's Retail Services Division, which is composed of both domestic and foreign storefront locations that offer some or all of the following services: pawn lending, consumer loans, check cashing and other ancillary services such as money orders, wire transfers and... -

Page 61

...112 431 182 248 133 994 Includes locations that operate under the names "Cash America Pawn," "SuperPawn," "Cash America Payday Advance," "Cashland," "Maxit," "Pawn X-Change" and "Mr. Payroll." Maxit and Pawn X-Change were acquired in 2010. Includes locations that operate in 28 states in the United... -

Page 62

..., revenue for the next reporting period would be likewise affected. Due to the short-term nature of pawn loans, the Company can quickly identify performance trends. For 2010, $251.6 million, or 99.3%, of recorded pawn loan fees and service charges represented cash collected from customers and... -

Page 63

... are credited to the allowance when collected. The Company's online lending channel periodically sells selected consumer loans that have been previously written off. Proceeds from these sales are recorded as recoveries on losses previously charged to the allowance for losses. At December 31, 2010... -

Page 64

... Company's projections of financial performance for a five-year period and includes assumptions about future revenue growth rates, operating margins and terminal growth rates which vary among reporting units. The market approach establishes fair value by applying cash flow multiples to the reporting... -

Page 65

... asset are less than the asset's corresponding carrying value. The amount of the impairment loss, if any, is the excess of the asset's carrying value over its estimated fair value. RECENT ACCOUNTING PRONOUNCEMENTS See "Item 8. Financial Statements and Supplementary Data-Note 2" for a discussion of... -

Page 66

... 2010 compared to 2009, primarily due to increased revenue from higher average consumer loan balances in the e-commerce segment and to a lesser extent, higher average pawn loan balances and higher gross profit on the disposition of merchandise in the retail services segment. Consumer loan fees, net... -

Page 67

... Pawn loan fees and service charges Proceeds from disposition of merchandise, net of cost of revenue Pawn related Consumer loan fees Less: consumer loan loss provision Consumer loan related Other revenue Loss adjusted net revenue Year Ended December 31, 2008 Retail Services E-Commerce Consolidated... -

Page 68

... 2010 Per Per $ Share $ Share Net income attributable to Cash America International, Inc.(a) Adjustments: Intangible asset amortization, net of tax Non-cash equity-based compensation, net of tax Convertible debt non-cash interest and issuance cost amortization, net of tax Foreign exchange loss, net... -

Page 69

... to the Company by line item as reported in the consolidated statements of income, to non-GAAP net earnings of the Company. Year Ended December 31, 2010 Foreign Retail MLOC Services Total Net income attributable to Cash America International, Inc. Operating expenses Consumer loan loss provision... -

Page 70

... period and the profit on disposition of collateral from unredeemed pawn loans, as well as the sale of merchandise acquired from customers directly or from third-parties. Routinely, the largest component of net revenue from pawn lending activities is the pawn loan fees and service charges from pawn... -

Page 71

... pawn loan fees and service charges rather than proceeds from disposition of merchandise when the collateral is sold. Retail sales include the sale of jewelry and general merchandise direct to consumers through any of the Company's domestic retail services locations or over the internet. Commercial... -

Page 72

... in the e-commerce segment from online lending in the United Kingdom and the United States, and to a lesser extent, the Australian and Canadian markets. In addition, consumer loan fees generated by the MLOC services channel increased during 2010 as the Company expanded the customer base for the... -

Page 73

... of consumer loans, net of allowances and accruals for losses, increased $29.6 million, or 19.0%, to $185.3 million at December 31, 2010 from $155.7 million at December 31, 2009, primarily due to increased demand for consumer loan products in the e-commerce segment. The Company has experienced... -

Page 74

... 31, 2010 Company Owned(a) Ending consumer loan balances: Retail Services Online Lending MLOC Total ending loan balance, gross Less: Allowance and accrual for losses(a) Total ending loan balance, net (a) (b) 2009 Company Owned(a) $ 51,986 72,600 11,553 136,139 (27,350) $ 108,789 $ Guaranteed by the... -

Page 75

...average amount per loan): Year Ended December 31, 2010 Guaranteed by the Company(a) Combined(b) $ 199,155 806,749 $ 902,316 1,717,751 289,009 $ 2009 Guaranteed by the Company(a) Company Owned(a) Amount of consumer loans written: Retail Services $ Online Lending MLOC Total consumer loans written 703... -

Page 76

... provision on consumer loans guaranteed by the Company for the year ended December 31, 2010 is a credit balance due to improved collection rates in 2010 over 2009 and slightly lower volume of loans outstanding. Non-GAAP measure. (b) Due to the short-term nature of the consumer loan product and the... -

Page 77

...at the e-commerce segment was primarily due to increases in marketing expense and personnel expense. Marketing expense increased $26.8 million during 2010, mainly due to the online lending channel's efforts to expand the Company's customer base, both domestically and internationally, representing 71... -

Page 78

... locations closed or combined in 2010, (net locations added in 2010 was 37 retail services locations), computer equipment deployed in advance of the Company's new proprietary point-of-sale system, and normal facility upgrades and remodels. Additional depreciation of $1.2 million in the e-commerce... -

Page 79

... 31: Pawn loan fees and service charges Average pawn loan balance outstanding Amount of pawn loans written and renewed Annualized yield on pawn loans Gross profit margin on disposition of merchandise Merchandise turnover As of December 31: Ending pawn loan balances Ending merchandise balance, net... -

Page 80

... of gold buying services during late 2008 and the first quarter of 2009 in many of the Company's retail services locations. Both the increases in proceeds and profit margin on commercial sales are mainly due to increased gold sales volumes and a higher average market price of gold sold, which... -

Page 81

... e-commerce segment from the online lending and MLOC businesses in the United States. Offsetting this increase was a 16.4% decrease in consumer loan fees from the Company's retail services segment, which is due to several factors, including the closure of 56 consumer loan retail services locations... -

Page 82

...): As of December 31, 2009 Company Owned(a) Ending consumer loan balances: Retail Services Online Lending MLOC Total ending loan balance, gross Less: Allowance and accrual for losses(a) Total ending loan balance, net (a) (b) 2008 Company Owned(a) $ Guaranteed by the Company(a) 11,927 23,018 34,945... -

Page 83

... Owned(a) Amount of consumer loans written: Retail Services $ 706,066 Online Lending 696,821 MLOC 126,457 Total consumer loans written $ 1,529,344 Average amount per consumer loan: Retail Services $ Online Lending MLOC Combined $ (a) (b) 2008 Guaranteed by the Company(a) Combined(b) $ 877,504... -

Page 84

... measure. Due to the short-term nature of the consumer loan product and the high velocity of loans written, seasonal trends are evidenced in quarter-to-quarter performance. In the typical business cycle, the loss provision as a percentage of combined consumer loans written is lowest in the first... -

Page 85

...'s e-commerce segment, mainly from the online channel's efforts to expand the Company's customer base both domestically and internationally, as well as expenses for new product development activities. Management believes that the increase in marketing expenses contributed to the increase in consumer... -

Page 86

...2009 compared to 2008, primarily due to the Prenda Fácil operations and software development at the Company's online lending channel, partially offset by a decrease due to closed retail services locations offering consumer loans in 2008. Interest Expense: Interest expense increased $4.8 million, or... -

Page 87

... operating cash flows and the utilization of borrowings under the Company's long-term unsecured bank line of credit. Longer-term refinancing risk is managed by staggering the Company's debt maturities and issuing new longterm debt securities from time to time as market conditions permit. Long-term... -

Page 88

... in net income during 2010. An additional $51.6 million of net cash provided by operating activities during 2010 was generated by an increase in the consumer loan loss provision, a non-cash expense, primarily as a result of increased loan volume in the e-commerce segment. Changes in merchandise held... -

Page 89

... Maxit Financial, LLC ("Maxit") on October 4, 2010. Maxit owned and operated a 39-store chain of pawn lending locations that operate in Washington and Arizona under the names "Maxit" and "Pawn X-Change." Per the terms of the Asset Purchase Agreement, the acquisition consideration consisted of a cash... -

Page 90

... drawn under its line of credit. Scheduled debt payments of $25.5 million were made during 2010 based on the terms of the note obligations. In addition, the Company used $3.7 million more in 2010 for the repurchase of shares of Company common stock through open market transactions, pursuant to... -

Page 91

... DISCLOSURES ABOUT MARKET RISK Market risks relating to the Company's operations result primarily from changes in interest rates, gold prices and foreign currency exchange rates. The Company does not engage in speculative or leveraged transactions, nor does it hold or issue financial instruments for... -

Page 92

... currency exchange rate fluctuations through the use of foreign exchange forward contracts in Canada. As the Company's Canadian operations continue to grow, management will continue to evaluate and implement foreign exchange rate risk management strategies. See "Item 8. Financial Statements and... -

Page 93

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Index to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm...Report of Management on Internal Control over Financial Reporting...Consolidated Balance Sheets - December 31, 2010 and 2009...Consolidated ... -

Page 94

... their cash flows for each of the three years in the period ended December 31, 2010 in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting... -

Page 95

... or timely detection of unauthorized acquisition, use, or disposition of the Company's assets that could have a material effect on the financial statements. Management assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2010. In making its... -

Page 96

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in thousands, except per share data) December 31, 2010 2009 Assets Current assets: Cash and cash equivalents Pawn loans Consumer loans, net Merchandise held for disposition, net Pawn loan fees and service charges ... -

Page 97

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (in thousands, except per share data) Year Ended December 31, 2010 2009 2008 Revenue Pawn loan fees and service charges Proceeds from disposition of merchandise Consumer loan fees Other Total Revenue Cost of Revenue... -

Page 98

...based plans Stock-based compensation expense Income tax benefit from stock-based compensation Net income attributable to Cash America International, Inc. Dividends paid Unrealized derivatives loss, net of tax Foreign currency translation gain, net of tax Marketable securities unrealized loss, net of... -

Page 99

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in thousands) Year Ended December 31, 2010 2009 2008 Net income Other comprehensive gain (loss), net of tax: Unrealized derivatives (loss) gain (a) Foreign currency translation gain (loss)(b) ... -

Page 100

... debt Consumer loan loss provision Stock-based compensation Deferred income taxes, net Other Changes in operating assets and liabilities, net of assets acquired Merchandise held for disposition Pawn loan fees and service charges receivable Finance and service charges on consumer loans Prepaid... -

Page 101

... to as pawn loans and unsecured consumer loans. Pawn loans are short-term (generally 30 to 90 days) made on the pledge of tangible personal property. Pawn loan fees and service charges revenue are generated from the Company's pawn loan portfolio. A related activity of the pawn lending operations is... -

Page 102

... in operating locations, deposits in banks and short-term marketable securities with original maturities of 90 days or less as cash and cash equivalents. Revenue Recognition Pawn Lending âˆ' Pawn loans are short-term loans made on the pledge of tangible personal property. Pawn loan fees and service... -

Page 103

...) or market. Cash received upon the sale of forfeited merchandise is classified as a recovery of principal on unredeemed loans under investing activities and any related profit or loss on disposed merchandise is included in operating activities in the period when the merchandise is sold. The Company... -

Page 104

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS $0.7 million at December 31, 2010 and 2009. The Company offers customers a 30-day satisfaction guarantee, whereby the customer can return merchandise and receive a full refund, a replacement item of ... -

Page 105

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS incurred. All of the amounts of goodwill recorded in the Company's acquisitions, except for the acquisition of Prenda Fácil, are expected to be deductible for tax purposes. Impairment of Long-Lived Assets ... -

Page 106

... occupancy, marketing and other charges that are directly related to the retail services and e-commerce operations. These costs are incurred within the retail services locations and the Company's call centers for customer service and collections. In addition, costs related to management supervision... -

Page 107

...financial statements to understand the nature of credit risk in these loans and how that risk is analyzed in determining the related allowance for loan losses. The new disclosures are required for interim and annual reporting periods ending on or after December 15, 2010. The Company adopted ASU 2010... -

Page 108

... States, the Company's wholly-owned subsidiary, Cash America, Inc. of Nevada, completed the purchase of substantially all of the assets (the "Maxit acquisition") of Maxit Financial, LLC ("Maxit") on October 4, 2010. Maxit owned and operated a 39-store chain of pawn lending locations that operate in... -

Page 109

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS As of December 31, 2010, the purchase price of Maxit was allocated as follows (in thousands): Pawn loans Merchandise acquired Pawn loan fees and service charges receivable Property and equipment Goodwill ... -

Page 110

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Primary Innovations, LLC Pursuant to its business strategy of expanding its product offerings and offering new credit alternatives, on July 23, 2008, the Company, through its wholly-owned subsidiary, Primary... -

Page 111

...FINANCIAL STATEMENTS LLC, purchased substantially all of the assets of The Check Giant LLC ("TCG"). TCG offered short-term consumer loans exclusively over the internet under the name "CashNetUSA." The Company paid an initial purchase price of approximately $35.9 million in cash and transaction costs... -

Page 112

...): Number of stores acquired: Pawn lending locations Purchase price allocated to: Pawn loans Merchandise held for disposition, net Pawn loan fees and service charges receivable Property and equipment Goodwill Intangible assets Other assets Other liabilities Customer deposits Total cash paid... -

Page 113

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The Company stratifies the outstanding combined consumer loan portfolio by age, delinquency, and stage of collection when assessing the adequacy of the allowance or accrual for losses. It uses historical ... -

Page 114

... life are tested for impairment at least annually. The Company realigned its reportable segments in the second quarter of 2010, and allocated a portion of the goodwill relating to its previously reported cash advance segment to the retail services segment based on the relative fair values of those... -

Page 115

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Goodwill Changes in the carrying value of goodwill for the years ended December 31, 2010 and 2009 were as follows (in thousands): Retail Services E-Commerce Consolidated 296,409 $ 197,083 $ 493,492 27,473 18... -

Page 116

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Year 2011 2012 2013 2014 2015 $ Amount 5,565 2,895 2,399 1,131 984 Indefinite Lived Intangible Assets At December 31, 2010 and 2009, licenses of $9.7 million and $7.7 million, respectively, and trademarks ... -

Page 117

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 10. Long-Term Debt The Company's long-term debt instruments and balances outstanding at December 31, 2010 and 2009 were as follows (in thousands): USD line of credit up to $300,000 due 2012 6.21% senior ... -

Page 118

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS payable semi-annually on May 15 and November 15 of each year. The 2009 Convertible Notes will be convertible, in certain circumstances, at an initial conversion rate of 39.2157 shares per $1,000 aggregate ... -

Page 119

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS As of December 31, 2010, annual maturities of the outstanding long-term debt, including the Company's line of credit, for each of the five years after December 31, 2010 are as follows (in thousands): Year ... -

Page 120

... by an unrecognized tax benefit. The balance as of December 31, 2010 is $18.5 million, with the increase attributable to a change in foreign currency exchange rates. Mexico allows a ten year carryforward period and the Company expects to fully utilize the net operating losses prior to the expiration... -

Page 121

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The aggregate change in the balance of the unrecognized tax benefits for the years ended December 31, 2010, 2009 and 2008 is summarized below (in thousands): 2010 1,021 61 $ 1,082 $ 2009 1,456 (490) 55 $ 1,... -

Page 122

...-term loans in Georgia in violation of Georgia's usury law, the Georgia Industrial Loan Act and Georgia's Racketeer Influenced and Corrupt Organizations Act. Community State Bank ("CSB") for some time made loans to Georgia residents through Cash America's Georgia operating locations. The complaint... -

Page 123

... class action lawsuit in the United States District Court for the Eastern District of Pennsylvania against Cash America International, Inc., Cash America Net of Nevada, LLC ("CashNet Nevada"), Cash America Net of Pennsylvania, LLC and Cash America of PA, LLC, d/b/a CashNetUSA.com (collectively... -

Page 124

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 13. Equity On October 24, 2007, the Company's Board of Directors authorized management to purchase up to a total of 1,500,000 shares of the Company's common stock from time to time in open market ... -

Page 125

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS cash contribution to the SERP based on the objectives of the plan as approved by the Management Development and Compensation Committee of the Board of Directors. The Company recorded compensation expense of ... -

Page 126

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Company's foreign operations continue to grow, management will continue to evaluate and implement foreign exchange rate risk management strategies. The fair values of the Company's derivative instruments at ... -

Page 127

... the Cash America International, Inc. 1994 Long-Term Incentive Plan had original contractual terms of up to ten years with an exercise price equal to or greater than the fair market value of the stock at grant date. On their respective grant dates, these stock options had vesting periods ranging... -

Page 128

... options in excess of the amounts previously recognized as expense in the consolidated financial statements. Restricted Stock Units - The Company has granted restricted stock units ("RSUs", or singularly, "RSU") to Company officers, certain employees and to the non-management members of the Board... -

Page 129

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS maximum amount of the award expected to be achieved. The performance awards granted in 2010 contain clawback provisions. The amount attributable to RSU grants is amortized to expense over the vesting periods... -

Page 130

... all of the operations of the Company's Retail Services Division, which is composed of both domestic and foreign storefront locations that offer some or all of the following services: pawn lending, consumer loans, check cashing and other ancillary services such as money orders, wire transfers and... -

Page 131

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Retail Services(a) Domestic Foreign Year Ended December 31, 2010 Revenue Pawn loan fees and service charges $ 221,335 Proceeds from disposition of merchandise 534,878 Consumer loan fees 113,973 Other 12,554... -

Page 132

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Retail Services(a) Domestic Foreign Year Ended December 31, 2009 Revenue Pawn loan fees and service charges $ 200,904 Proceeds from disposition of merchandise 502,736 Consumer loan fees 117,997 Other 13,093... -

Page 133

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Retail Services(a) Domestic Foreign Year Ended December 31, 2008 Revenue Pawn loan fees and service charges $ 183,672 Proceeds from disposition of merchandise 465,655 Consumer loan fees 141,134 Other 15,526... -

Page 134

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Geographic Information The following table presents the Company's distribution of revenues and long-lived assets by geographic region for the years ended December 31, 2010, 2009 and 2008 (dollars in ... -

Page 135

CASH AMERICA INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 19. Pro Forma Financial Information (unaudited) The following unaudited pro forma financial information reflects the consolidated results of operations of the Company as if the Prenda Fácil acquisition had... -

Page 136

...market data. The Company's financial assets that are measured at fair value on a recurring basis as of December 31, 2010 and 2009 are as follows (in thousands): December 31, 2010 Financial assets: Interest rate contracts Forward currency exchange contracts Nonqualified savings plan assets Marketable... -

Page 137

... their carrying value. Pawn loan fee and service charge rates are determined by regulations and bear no valuation relationship to the capital markets' interest rate movements. Generally, pawn loans may only be resold to a licensed pawnbroker. The fair values of the Company's long-term debt... -

Page 138

... STATEMENTS 21. Quarterly Financial Data (Unaudited) The Company's operations are subject to seasonal fluctuations. Net income tends to be highest during the first and fourth calendar quarters, when the average amount of pawn loans and consumer loan balances are typically the highest and merchandise... -

Page 139

... under the Exchange Act is accumulated and communicated to management, including the Company's Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosures. The Report of Management on Internal Control Over Financial Reporting is included in Item 8 of... -

Page 140

... by writing to the Company's Secretary at Cash America International, Inc., 1600 West 7th Street, Fort Worth, Texas 76102. ITEM 11. EXECUTIVE COMPENSATION Information contained under the caption "Executive Compensation" in the Proxy Statement is incorporated into this report by reference in response... -

Page 141

...following consolidated financial statements and schedules are filed in Item 8 of Part II of this report: Financial Statements: Report of Independent Registered Public Accounting Firm Report of Management on Internal Control over Financial Reporting Consolidated Balance Sheets - December 31, 2010 and... -

Page 142

... October 4, 2010 by and among Cash America, Inc. of Nevada and Maxit Financial, LLC and its principal listed therein Securities Purchase Agreement dated December 11, 2008 by and among Creazione Estilo, S.A. de C.V., ("Creazione"), Cash America of Mexico, Inc., Capital International S.Ã .r.l., St... -

Page 143

... to change the Company's name to "Cash America International, Inc." Articles of Amendment to the Articles of Incorporation of the Company filed in Office of the Secretary of State of Texas on May 21, 1993 Amended and Restated Bylaws of the Company effective January 1, 2010 Form of Stock Certificate... -

Page 144

... Amended and Restated Credit Agreement dated as of February 24, 2005 among the Company, Wells Fargo Bank, National Association, ...Company and the purchasers named therein Note Purchase Agreement dated January 28, 2010 among the Company and the purchasers named therein for the issuance of the Company... -

Page 145

... between the Company, its Division Presidents and each of its Executive Vice Presidents * Executive Change-in-Control Severance Agreement dated October 23, 2008 between the Company and Timothy S. Ho * Cash America International, Inc. 1994 Long-Term Incentive Plan * Cash America International, Inc... -

Page 146

... the Cash America International, Inc. 2008 Long Term Incentive Plan for Cash America Net Holdings, LLC, dated January 26, 2011 * Form of Unit Award Certificate for Employees under the Cash America International, Inc. 2008 Long-Term Incentive Plan for Cash America Net Holdings, LLC * Cash America Net... -

Page 147

... of 2002 Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 Notice of Blackout Period for Directors and Executive Officers of Cash America International, Inc. dated August 20, 2010 XBRL Instance Document... -

Page 148

... duly authorized. CASH AMERICA INTERNATIONAL, INC. Date: February 25, 2011 By: /s/ DANIEL R. FEEHAN Daniel R. Feehan Chief Executive Officer and President Pursuant to the requirements of the Securities and Exchange Act of 1934, the report has been signed by the following persons on behalf of... -

Page 149

... STATEMENT SCHEDULE To the Board of Directors and Shareholders of Cash America International, Inc. Our audits of the consolidated financial statements and of the effectiveness of internal control over financial reporting referred to in our report dated February 25, 2011 appearing in the 2010 Annual... -

Page 150

... for the Company's modifications to its methodology for assessing the reasonableness of its ainventory allowance. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for further discussion. Represents amounts related to business discontinued in... -

Page 151

... October 4, 2010 by and among Cash America, Inc. of Nevada and Maxit Financial, LLC and its principal listed therein Securities Purchase Agreement dated December 11, 2008 by and among Creazione Estilo, S.A. de C.V., ("Creazione"), Cash America of Mexico, Inc., Capital International S.Ã .r.l., St... -

Page 152

... to change the Company's name to "Cash America International, Inc." Articles of Amendment to the Articles of Incorporation of the Company filed in Office of the Secretary of State of Texas on May 21, 1993 Amended and Restated Bylaws of the Company effective January 1, 2010 Form of Stock Certificate... -

Page 153

... lenders named therein Second Amendment dated as of June 30, 2008 to the First Amended and Restated Credit Agreement dated as of February 24, 2005 among the Company, Wells Fargo Bank, National Association, and certain lenders named therein Third Amendment dated November 21, 2008 to First Amended and... -

Page 154

... between the Company, its Division Presidents and each of its Executive Vice Presidents * Executive Change-in-Control Severance Agreement dated October 23, 2008 between the Company and Timothy S. Ho * Cash America International, Inc. 1994 Long-Term Incentive Plan * Cash America International, Inc... -

Page 155

... the Cash America International, Inc. 2008 Long Term Incentive Plan for Cash America Net Holdings, LLC, dated January 26, 2011 * Form of Unit Award Certificate for Employees under the Cash America International, Inc. 2008 Long-Term Incentive Plan for Cash America Net Holdings, LLC * Cash America Net... -

Page 156

... of 2002 Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 Notice of Blackout Period for Directors and Executive Officers of Cash America International, Inc. dated August 20, 2010 XBRL Instance Document... -

Page 157

... of North Carolina ...Cash America, Inc. of Oklahoma ...Cash America, Inc. of South Carolina ...Cash America, Inc. of Tennessee ...Cash America, Inc. of Utah...Cash America, Inc. of Virginia ...Cash America Online Services, Inc...Cash America Net Holdings, LLC ...Arizona Consumer Financial Solutions... -

Page 158

... Delaware Texas Oklahoma South Carolina North Carolina Tennessee Delaware Florida Georgia Delaware Subsidiaries Cash America Net of New Mexico, LLC ...CashNetUSA CO, LLC CashNetUSA OR, LLC CashNetUSA NM, LLC Cash America Net of North Dakota, LLC ...Cash America Net of Ohio, LLC ...Cash America Net... -

Page 159

Cash America Management L.P...Cash America Pawn L.P...Primary Innovations, LLC...Debit Plus Technologies, LLC ...Primary Payment Solutions, LLC...Primary Credit Services, LLC ...TrafficGen, LLC...Mexican Structure Delaware Delaware Delaware Delaware Delaware Delaware Delaware Cash America of ... -

Page 160

... Cash America International, Inc. of our report dated February 25, 2011 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in the 2010 Annual Report to Shareholders, which is incorporated in Cash America International, Inc.'s Annual... -

Page 161

... and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the... -

Page 162

... and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the... -

Page 163

... with the Annual Report of Cash America International, Inc. (the "Company") on Form 10-K for the year ended December 31, 2010, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Daniel R. Feehan, Chief Executive Officer and President of the Company, certify... -

Page 164

... Annual Report of Cash America International, Inc. (the "Company") on Form 10-K for the year ended December 31, 2010, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Thomas A. Bessant, Jr., Executive Vice President and Chief Financial Officer of the Company... -

Page 165

... Cash America International, Inc. James H. Graves (a) (b) Managing Director and Partner Erwin Graves & Associates, LP Timothy J. McKibben (b) (c) Founding Managing Partner Ancor Capital Partners, L.P. Daniel E. Berce (a) (b) Chief Executive Officer and President General Motors Financial Company... -

Page 166

... Executive Vice President and Chief Financial Officer Dennis J. Weese President - Retail Services Division J. Curtis Linscott Executive Vice President, General Counsel and Secretary Other Information Corporate Address Cash America International Building 1600 West 7th Street Fort Worth, Texas 7610... -

Page 167

1600 West 7th Street Fort Worth, Texas 7610.-.599 (817) 335-1100 www.cashamerica.com www.enovafinancial.com www.cashnetusa.com www.quickquid.co.uk www.dollarsdirect.com.au www.dollarsdirect.ca www.primaryinnovations.net www.cashlandloans.com www.goldpromise.com www.mrpayroll.com and re lo ca ti on ...