Cash America 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

million, a small part of the estimated $15 billion volume of the entire

payday advance industry in the U.S. However, this volume is certainly

significant to Cash America, as it would represent approximately 20%

to 25% of total loan volume in our U.S. shops.

One of the most encouraging aspects of this program has been

the introduction of scores of new customers to Cash America. We

have experienced some crossover from our traditional pawn loan

product to payday advances, but our data shows the majority of

payday advance customers are faces we have not seen before. These

new faces are being introduced to our other products and services.

Our expertise in the payday advance business has not yet matched

the skill level of pawn lending, but we are confident it will rise to the

level of a core competency for Cash America by the end of 2002.

Further reflection upon our activities in 2001 will ultimately

wind its way back to the failed ventures mentioned in the opening

paragraph. While I find no need to rehash the travails of bold

expectations and dashed dreams, I do believe you have a right to

demand an explanation of what your management team has learned

from these diversions beyond the roots of our core business. I have

reached further back into the archives for another quote summarizing

the simplicity of that lesson. The ancient Chinese philosopher Lao-tzu

is quoted in the sixth-century B.C. as having said, “He or she who

knows enough is enough will always have enough.” Loosely applied,

we have learned our fortunes lie within the hard-earned expertise of

offering capital alternatives to the under-banked segment of the

population and not within the lure of new businesses that are never

quite as simple as they seem. Fortunately, we concluded we had

enjoyed “enough” of these new ventures at a point in time when we

still had “enough” of our old business to reshape our goals on a solid

foundation.

Retrenchment to our traditional lending business should not be

viewed as a retreat from new ideas and opportunities. We have not

lost our spirit for growth, or our appetite for risk. The renewed focus

only sharpens our vision of what opportunities best fit our core

expertise, and therefore what opportunities are most likely to succeed.

The payday advance product is a great example of a new idea closely

aligned with our core expertise. So are the expansion of retail activity

at Harvey & Thompson and the introduction of variable loan terms at

Svensk Pantbelåning. None of these ideas are immune to risk. But

these are risks we know how to manage. Risks, if manifested, should

only result in lost opportunity, not a loss of capital.

So, do we believe a “return to our roots” strategy can drive

long-term share appreciation? Will the traditional pawn business

continue growing within the neighborhoods we now dominate? Are

there enough new opportunities aligned with our core expertise to

provide sustainable earnings growth at a rate coveted by value

investors? Is our story exciting enough to energize new institutional

investors recently stung by two years of widespread portfolio

declines?

These are questions you

should be asking us —

questions we are definitely

asking ourselves. The answers

are not easy and the future is

not crystal clear. What we can

tell you with certainty is that our

story has been simplified by

narrowing the breadth of

business activities and reducing the number of moving parts. The

market we serve and the products we provide are easy to grasp — no

fancy technology, no revolutionary business ideas. We operate a cash

flow business demanding focus and everyday execution.

Demand for pawn loans should strengthen as the economy

readjusts to more traditional GDP growth rates. New opportunities for

additional products and services are clearly within our reach. Money

transfer, check cashing, bill payment, prepaid telephone service and

refund anticipation loans are all included in a growing list of

opportunities. The goal is to subtly transform the image of our

operating unit from a pure pawnshop outlet to a neighborhood

financial service center.

Strengthening loan demand and new products alone will not

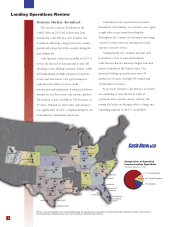

drive the growth we need. We must also extend our geographic reach

into markets not currently served by Cash America. Options for

expansion include opening new units, further consolidation within

the pawnshop industry and even the acquisition of independent

payday advance companies. We will be considering all these options

in 2002.

The excitement in our story will come with execution and

performance. We are clear about the challenges ahead of us.

Thanks for your continuing support.

Daniel R. Feehan

Chief Executive Officer

“The renewed focus

only sharpens our

vision of what

opportunities best fit

our core expertise.”