Cash America 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

he narrative pages of this annual report herald

Cash America’s return to the comfortable

familiarity of our traditional core lending

business, a theme we have discussed both

internally and externally during the course of

the past year. The broad-based diversification strategy

adopted in the mid-90s leading to unsuccessful

investments in both

innoVentry and Rent-A-

Tire has now been

abandoned in favor of

directing our full focus

on the core competency

of providing short-term

loans to that loyal and

friendly customer base

we have served since

inception. Johann von

Goethe, the eighteenth-

century poet and

philosopher, captured our sentiment when he wrote, “He

is happiest, be he king or peasant, who finds peace in his

home.” The renewed commitment toward our traditional

lending business is a homecoming of sorts, and we have

enjoyed an early taste of the peace it provides. The

ultimate happiness of this simpler approach will rest on

our ability to enhance the traditional business model and

craft a successful growth strategy for

increasing shareholder value.

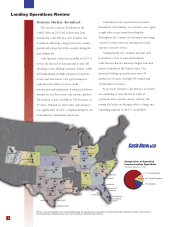

Refocusing management time and

energy in 2001 on meeting the loan

demands of our customers dovetailed

nicely with the slowdown of the U.S.

and European economies. After

watching loan demand wither during

the unprecedented prosperity of the late

1990s, we began to see our traditional

customers borrow at a brisker pace in

2001, reflecting a tightening in the job market and

weakening of consumer confidence. Remember, the

most profitable customer segment for Cash America is

employed blue-collar workers. We do not benefit from

wide-scale layoffs or extended periods of unemployment

for these customers over the long term. Our business

does benefit when these customers find themselves

working fewer hours per week. Fewer hours yield less

discretionary spending and interrupt the weekly family

budget. We provide a safety net for these customers to

handle an unexpected cash flow disruption until they can

either adjust their family budget or find an opportunity

to replace the lost hours. Those opportunities proved to

be ever more elusive for our customers throughout 2001.

The slowing global economy has also aided

earnings by precipitating interest rate cuts in all of our

credit markets. We not only enjoyed the benefits of lower

rates in 2001, but we also captured the savings from debt

levels that were reduced by the careful management of

earning assets. The operating efficiency of our earning

assets has been an early dividend of the sharper focus on

day-to-day competencies in all lending segments.

Perhaps the most exciting development of 2001

was the gathering momentum of our unsecured, short-

term cash advance product now offered in most of our

shops in the U.S. and England. This product, commonly

referred to as a payday advance in the U.S. and deferred

presentment in England, has exploded in popularity over

the past decade. Cash America first began offering this

product in late 1998 on a very limited basis in a handful

of locations. This limited launch provided us the

opportunity to learn the nuances of this product and

study the needs and habits of its customers. With a

firsthand working knowledge of a new

product, we gained the requisite

confidence in 1999 to begin developing

systems and training programs for a broad

distribution of payday advances

throughout our U.S. shop network. A

moderately paced rollout plan was

launched in mid-2000 and completed in

mid-2001.

We began to hit full stride with the

payday advance product in the fourth

quarter of 2001 registering weekly loan volumes as high

as $2 million in the weeks between pay periods. This

level of lending volume provided the scale we needed for

reaching profitability in the fourth quarter. Barring

interference from any regulatory or legislative body, our

payday advance volume in 2002 could approach $100

To All Fellow Shareholders:

T

Earnings per Share

Continuing Operations

(excluding unusual non-operating items)

0

$0.05

00

Q1 Q2 Q3 Q4

01 00 01 00 01 00 01

$0.15

$0.10

$0.20

$0.25