Cash America 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

Management’s Discussion and Analysis of Results of Operations and Financial Condition

GENERAL

The Company is a provider of specialty financial services to individuals in the

United States, United Kingdom and Sweden. The Company offers secured non-

recourse loans, commonly referred to as pawn loans, to individuals through its

lending operations. The pawn loan portfolio generates finance and service charges

revenue. A related but secondary source of revenue is the disposition of merchan-

dise, primarily collateral from unredeemed pawn loans. As an alternative to a

pawn loan, the Company offers small consumer cash advances in selected lending

locations and on behalf of a third-party financial institution in other locations.

The Company also provides check cashing services through its franchised and

company owned Mr. Payroll®manned check cashing centers.

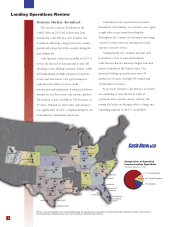

The Company expanded its lending operations during the three years ended

December 31, 2001, by adding a net 4 locations. It acquired 10 operating units,

established 7 locations, and combined or closed 18 locations. In addition, 12 fran-

chise units were opened, including 3 company owned locations that were sold to a

franchisee, and 4 units were closed. As of December 31, 2001, the Company’s

lending operations consisted of 473 lending units (404 owned units and 13 fran-

chised units in 18 states in the United States, 45 jewelry-only units in the United

Kingdom, and 11 loan-only and primarily jewelry-only units in Sweden).

As of December 31, 2001, Mr. Payroll operated 127 franchised and 7 com-

pany owned manned check cashing centers in 20 states. In March 1999, the

Company disposed of a majority interest in innoVentry Corp. (“innoVentry”), its

automated check cashing machine business. The Company deconsolidated

innoVentry and began using the equity method of accounting for its investment

and its share of the results of innoVentry’s operations. In February 2001,

innoVentry sold additional voting preferred stock, reducing the Company’s own-

ership and voting interest to 19.3%. Thereafter, the Company began using the

cost method of accounting for its investment in innoVentry. innoVentry ceased

business operations in September 2001 due to its inability to raise additional

financing. Since the Company’s investment in and advances to innoVentry were

written down to zero in 2000, innoVentry’s decision to cease operations had no

effect on the Company’s consolidated financial position or results of operations.

DISCONTINUED OPERATIONS

In September 2001, the Company announced plans to exit the rent-to-own busi-

ness in order to focus on its core business of lending activities. The Company’s

subsidiary, Rent-A-Tire, Inc. (“Rent-A-Tire”) provides new tires and wheels under a

rent-to-own format to customers seeking this alternative to a direct purchase. The

Company initiated the plan to close 21 Rent-A-Tire operating locations and sell the

remaining 22 units. It expects the plan to be completed before September 2002.

Pursuant to Accounting Principles Board Opinion No. 30 “Reporting the

Results of Operations — Reporting the Effects of Disposal of a Segment of a

Business, and Extraordinary, Unusual and Infrequently Occurring Events and

Transactions,” the consolidated financial statements of the Company have been

reclassified to reflect the planned disposal of the rental business segment.

Accordingly, the revenues, costs and expenses, assets, and cash flows of Rent-A-

Tire have been segregated in the Consolidated Balance Sheets, Consolidated

Statements of Operations and Consolidated Statements of Cash Flows. The net

operating results, net assets and net cash flows of this business segment have

been reported as “Discontinued Operations” in the accompanying consolidated

financial statements. The loss from discontinued operations does not include any

interest expense since the Company does not anticipate that debt will be

assumed by the buyer.

The Company recorded an $18.6 million loss from discontinued operations

(net of a tax benefit of $9.0 million) during 2001. The 2001 net loss includes

$11.0 million of net loss from discontinued operations for the period prior to

September 1, 2001 (the effective date of the exit plan), $3.0 million of estimated

net operating losses during the phase-out period, and a $4.6 million estimated

net loss on the sale of remaining assets. The estimated net losses during the

phase-out period reflect various costs associated with the closure of 21 Rent-A-

Tire locations as well as the estimated net earnings of the rental business segment

prior to the sale of its remaining units.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Management’s Discussion and Analysis of Results of Operations and Financial

Condition are based upon the Company’s consolidated financial statements,

which have been prepared in accordance with accounting principles generally

accepted in the United States. The preparation of these financial statements

requires management to make estimates and assumptions that affect the reported

amounts of assets, liabilities, revenues and expenses, and related disclosure of

contingent assets and liabilities. On an on-going basis, management evaluates its

estimates and judgments, including those related to revenue recognition, mer-

chandise held for disposition, allowance for losses on advances, long-lived and

intangible assets, income taxes, contingencies and litigation. Management bases

its estimates on historical experience and on various other assumptions that are

believed to be reasonable under the circumstances, the results of which form the

basis for making judgments about the carrying values of assets and liabilities that

are not readily apparent from other sources. Actual results may differ from these

estimates under different assumptions or conditions.

Management believes the following critical accounting policies affect its

more significant judgments and estimates used in the preparation of its consoli-

dated financial statements.

Revenue recognition. The Company accrues finance and service charges revenue

on all pawn loans that the Company deems collectible based on historical loan

redemption statistics. Pawn loans written during each calendar month are aggre-

gated and tracked for performance. Loan transactions terminate upon redemp-

tion, renewal, or forfeiture of the loan collateral and are tracked by the number

of days the loan was outstanding. The gathering of this data allows the Company

to analyze the characteristics of its outstanding pawn loan portfolio and estimate

the expected collection of finance and service charges. In the event the perfor-

mance of the loan portfolio differs significantly, positively or negatively, from

expectations, revenue for the next reporting period would be likewise affected.

Merchandise held for disposition. Merchandise held for disposition consists pri-

marily of forfeited collateral from pawn loans not repaid. The carrying value of

the forfeited collateral is stated at the lower of cost (cash amount loaned) or mar-

ket. Management provides an allowance for shrinkage and valuation based on its

evaluation of the merchandise. Because pawn loans are made without the bor-

rower’s personal liability, the Company does not investigate the creditworthiness

of the borrower, but evaluates the pledged personal property as a basis for its

lending decision. The amount the Company is willing to finance is typically

based on a percentage of the pledged personal property’s estimated disposition

value. The sources for the Company’s determination of the estimated disposition

value are numerous and include the Company’s automated product valuation sys-

tem as well as catalogues, blue books, newspapers and previous experience with

similar items. The Company performs a physical count of its merchandise in each

location on a cyclical basis and reviews the composition of inventory by category

and age in order to assess the adequacy of the allowance. Adverse changes in the

disposition value of the Company’s merchandise may result in the need to

increase the valuation allowance.