Cash America 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

Management’s Discussion and Analysis of Results of Operations and Financial Condition

Allowance for losses on small consumer cash advances. The Company main-

tains an allowance for losses on small consumer cash advances at a level estimated

to be adequate to absorb future credit losses inherent in the outstanding advance

portfolio. The Company’s cash advance product primarily services a customer

base of non-prime borrowers. These advances are typically offered for a term of

7 to 31 days. Cash advances written during each calendar month are aggregated

and tracked for performance. The Company stratifies the outstanding portfolio by

age, delinquency, and stage of collection when assessing the adequacy of the

allowance for losses. Increased defaults and credit losses may occur during a

national or regional economic downturn, or could occur for other reasons, result-

ing in the need to increase the allowance. The Company believes it effectively

manages these risks by using a credit scoring system and by closely monitoring

the performance of the portfolio. Advances are charged off once they become

60 days past due or sooner, if deemed uncollectible.

Valuation of long-lived and intangible assets. The Company assesses the impair-

ment of long-lived and intangible assets whenever events or changes in circum-

stances indicate that the carrying value may not be recoverable. Factors consid-

ered important which could trigger an impairment review include the following:

significant underperformance relative to expected historical or projected future

cash flows; significant changes in the manner of use of the acquired assets or the

strategy for the overall business; and significant negative industry trends. When

management determines that the carrying value of long-lived and intangible

assets may not be recoverable, an impairment is measured based on the excess of

the assets’ carrying value over the estimated fair value.

Statement of Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and

Other Intangible Assets” is effective as of January 1, 2002, and as a result, the

Company will cease to amortize goodwill for fiscal 2002. In lieu of amortization,

the Company is required to perform an initial impairment review of goodwill and an

annual impairment review thereafter. The Company expects to complete the initial

review during the first six months of 2002. Management currently does not expect

to record an impairment charge upon completion of the initial impairment review.

However, there can be no assurance that at the time the review is completed an

impairment charge will not be recorded.

Income taxes. As part of the process of preparing the consolidated financial

statements, the Company is required to estimate income taxes in each of the

jurisdictions in which it operates. This process involves estimating the actual

current tax exposure together with assessing temporary differences in recognition

of income for tax and accounting purposes. These differences result in deferred

tax assets and liabilities, which are included within the Company’s consolidated

balance sheet. Management must then assess the likelihood that the deferred tax

assets will be recovered from future taxable income and, to the extent it believes

that recovery is not likely, it must establish a valuation allowance. An expense

must be included within the tax provision in the statement of operations for any

increase in the valuation allowance for a given period.

Management judgment is required in determining the provision for income

taxes, the deferred tax assets and liabilities and any valuation allowance recorded

against net deferred tax assets. The Company has recorded a valuation allowance

of $7.6 million as of December 31, 2001, due to uncertainties related to the abili-

ty to utilize a portion of the deferred tax assets resulting from capital losses. The

valuation allowance is based on Company estimates of capital gains expected to

be recognized during the period over which the capital losses may be used to off-

set such gains. In the event that the Company was to determine that it would

not be able to realize all or part of its net deferred tax assets in the future, an

adjustment to the deferred tax assets would be charged to income in the period

such determination was made. Likewise, should the Company determine that it

would be able to realize its deferred tax assets in the future in excess of its net

recorded amount, an adjustment to the deferred tax assets would increase income

in the period such determination was made.

RESULTS OF OPERATIONS

Year Ended 2001 Compared to Year Ended 2000

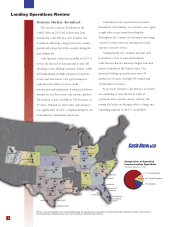

Consolidated Net Revenue. Consolidated net revenue increased 5.1%, or

$9.9 million, to $204.9 million during 2001 from $195.0 million during 2000.

The following table sets forth 2001 and 2000 net revenue results by operating

segment ($ in millions):

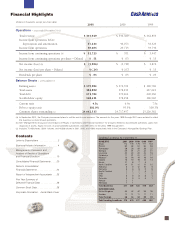

2001 2000 Increase (decrease)

Domestic lending $ 177.0 $ 167.6 $ 9.4 5.6%

Foreign lending 24.5 24.2 0.3 1.2%

Total lending 201.5 191.8 9.7 5.1%

Check cashing 3.4 3.2 0.2 6.3%

Consolidated $ 204.9 $ 195.0 $ 9.9 5.1%

The Company’s domestic lending operations generated the majority of the

increase in consolidated net revenue. Higher disposition of merchandise com-

bined with the continued improvement in the margin on disposition of merchan-

dise and the expansion of the Company’s small consumer cash advance product

accounted for the higher net revenue.

The components of net revenue are finance and service charges from pawn

loans, which decreased $.8 million; net revenue from the disposition of merchan-

dise, which increased $5.5 million; other domestic lending fees and franchise

royalties, which increased $5.0 million; and check cashing fees and royalties,

which increased $.2 million.

Finance and Service Charges. The following is a summary of finance and

service charges related to pawn loans by operating segment for 2001 and 2000

($ in millions):

2001 2000 Increase (decrease)

Domestic lending $ 92.7 $ 92.0 $ 0.7 0.8%

Foreign lending 21.2 22.7 (1.5) (6.6%)

Total $ 113.9 $ 114.7 $ (0.8) (0.7%)

Variations in finance and service charges on pawn loans are caused by

changes in the average balance of pawn loans outstanding, the annualized yield of

the pawn loan portfolio, and the effects of translation of foreign currency amounts

into United States dollars. The following table identifies the impact that each of

these factors had on the total change in finance and service charges ($ in millions):

Average Total Before

Balance Loan Foreign Foreign

Outstanding Yield Translation Translation Total

Domestic lending $ 1.9 $ (1.2) $ 0.7 $ — $ 0.7

Foreign lending (1.4) 1.5 0.1 (1.6) (1.5)

Total $ 0.5 $ 0.3 $ 0.8 $ (1.6) $ (0.8)

Excluding the negative effects of foreign currency translation adjustments,

the company-wide average balance of pawn loans outstanding was 1.1% lower

during 2001 than 2000. On a segment basis, the average balances of pawn loans

were 2.0% higher and 6.1% lower for the domestic and foreign lending opera-

tions, respectively. The increase in the average balance of domestic pawn loans

outstanding was driven by a 1.4% growth in the average number of pawn loans

outstanding during 2001 coupled with a 0.7% increase in the average amount

per loan. Management believes that the increase in the number of domestic