Cash America 2001 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2001 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

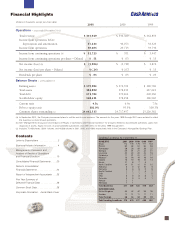

(Dollars in thousands, except per share data)

2001 2000 1999

Operations – years ended December 31 (a)

Total revenue $ 355,929 $ 346,360 $ 362,895

Income from operations before

depreciation and amortization 47,234 46,073 53,323

Income from operations 30,605 29,715 34,746

Income from continuing operations (b) $ 12,725 $ 701 $ 3,947

Income from continuing operations per share – Diluted $ .51 $ .03 $ .15

Net income (loss) (b) $ (5,906) $ (1,730) $ 3,876

Net income (loss) per share – Diluted $ (.24) $ (.07) $ .15

Dividends per share $ .05 $ .05 $ .05

Balance Sheets – at December 31

Earning assets $ 179,982 $ 176,799 $ 189,768

Total assets 382,890 378,233 417,623

Total debt 171,782 170,464 202,366

Stockholders’ equity 168,431 178,458 186,940

Current ratio 4.5x 6.9x 7.5x

Debt to equity ratio 102.0% 95.5% 108.3%

Common shares outstanding (c) 24,662,315 24,717,457 25,226,382

(a) In September 2001, the Company announced plans to exit the rent-to-own business. The amounts for the years 1999 through 2001 were restated to reflect

this business as discontinued operations.

(b) See “Management’s Discussion and Analysis of Results of Operations and Financial Condition” for amounts related to discontinued operations, gains from

disposals of assets, equity in losses of unconsolidated subsidiaries and other items for the years 1999 through 2001.

(c) Includes 70,469 shares, 59,611 shares, and 46,388 shares in 2001, 2000, and 1999, respectively, held in the Company’s Nonqualified Savings Plan.

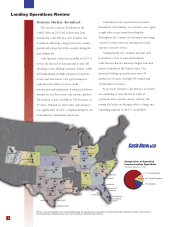

Lending Locations As of December 31,

DOMESTIC 2001 2000 1999 1998 1997

Texas 174 178 179 177 144

Florida 62 62 61 60 58

Tennessee 28 28 28 28 22

Georgia 20 21 21 22 21

Louisiana 20 20 20 20 19

Oklahoma 17 21 21 21 17

Missouri 16 16 16 16 16

Indiana 13 16 16 14 14

Illinois 11 8 7 5

North Carolina 10 11 11 11 10

Alabama 9 9 10 10 9

Kentucky 9999 9

South Carolina 7778 7

Utah 7777 5

Ohio 6666 1

Colorado 5555 1

Kansas 2 1

Nebraska 1 1

Total Domestic 417 426 424 419 353

INTERNATIONAL

United Kingdom 45 42 42 39 38

Sweden 11 11 11 11 11

Total Foreign 56 53 53 50 49

Total Lending Locations 473 479 477 469 402

Financial Highlights

Letter to Shareholders . . . . . . . . . . . . . . 2

Business/Industry Information . . . . . . . . . 4

Management’s Discussion and

Analysis of Results of Operations

and Financial Condition . . . . . . . . . . . . 10

Consolidated Financial Statements . . . . 20

Notes to Consolidated

Financial Statements . . . . . . . . . . . . . . . 24

Report of Independent Accountants . . . 35

Five Year Summary of

Selected Financial Data . . . . . . . . . . . . 36

Common Stock Data . . . . . . . . . . . . . . . 36

Corporate Information . .Inside Back Cover

Contents