BP 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP board performance report

Letter from the chairman

Dear Shareholder

During the past year, the board has carefully considered the role it plays

and its method of working. Central to this is the board’s review of its

system of governance. This has been timely – BP adopted its prior

governance framework for the board more than 10 years ago. This

approach has stood the board in good stead and has been robust when

judged against the standards of governance that have developed over

time. This framework will continue to underpin our approach.

It has, however, been important for the board to consider the position

of the company in the markets in which it operates and to ensure that

the manner in which the board works will meet the challenges that BP

will face in the future. As part of the review, each board member

discussed their evaluation of the existing policies and proposed their

views on the role and challenges for the BP board going forward. The

review process also involved benchmarking, identifying examples of

governance best practice and a legal review of US and UK board policies.

The board clearly needs to focus on its unique tasks and these are

described in the company’s ‘board governance principles’, which were

approved in November and can now be found on our website.

The board will keep its work and performance under regular review

and will revisit the governance principles annually. Set out below is a

description of the board and its committees and an account of the work

that they have done during the year.

Peter Sutherland

Chairman

22 February 2008

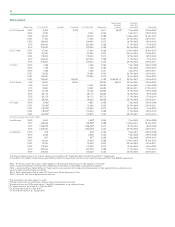

Board governance principles

The board governance principles describe the board’s relationship with

shareholders and executive management, the conduct of board affairs

and the tasks and requirements for board committees. They outline

the board’s focus on activities that enable it to promote shareholders’

interests, specifically the active consideration of strategy, the

monitoring of executive action and ongoing board and executive

management succession.

The board believes that the governance of BP is best achieved by the

delegation of its authority for executive management to the group chief

executive, subject to monitoring by the board and the limitations defined

in the board governance principles. These ‘executive limitations’ require

that any executive action taken in the course of business takes specific

issues into consideration, including health, safety and the environment,

risk and internal controls and financing.

BP’s board governance principles can be viewed on the ‘governance’

section of bp.com at www.bp.com/corporategovernance.

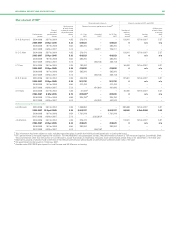

Operating the principles

The group chief executive describes to the board in the annual business

plan how the strategy is to be delivered, together with an assessment

of the group’s risks. During the year, the board monitors progress and

keeps the strategy under regular review.

The group chief executive is obliged to review and discuss with the

board all strategic projects or developments and all material matters

currently or prospectively affecting the company and its performance.

The board governance principles further set out how the group chief

executive’s performance will be monitored during the year.

The board’s engagement with shareholders

The board is accountable to shareholders for the performance and

activities of the BP group. The board takes steps to engage with

shareholders and to evaluate the relevant financial, social, environmental

and ethical matters that may influence or affect the business. The board

recognizes that, in conducting its business, BP should be responsive to

other relevant constituencies.

During the year, the chairman met with institutional shareholders to

discuss issues relating to the board, governance and high-level strategy

and the remuneration committee consulted with larger shareholders on

elements of the executive remuneration plan.

The group chief executive, other executive directors and senior

management, company secretary’s office, investor relations and other

teams within BP also engage with a broad range of shareholders on

wider issues relating to the group, including in particular its safety,

operations and financial performance. Presentations given by the

company to the investment community are available to download from

the ‘investors’ section of www.bp.com, as are speeches on topics of

broad interest to shareholders made by the group chief executive and

other senior members of the management team.

BP’s AGM

Shareholders are encouraged to attend the AGM and use the

opportunity to ask questions and hear the resulting discussion about

BP’s performance. However, given the size and geographical diversity

of the company’s shareholder base, attendance may not always be

practical and shareholders are encouraged to use proxy voting on the

resolutions put forward. Every vote cast, whether in person or by proxy

at shareholder meetings, is counted, because votes on all matters

except procedural issues are taken by a poll.

Copies of speeches and presentations given at the AGM are available

to download from the BP website after the event, together with the

outcome of voting on the resolutions.

Both the chairman and board committee chairmen were present

during the 2007 AGM. Board members met shareholders on an informal

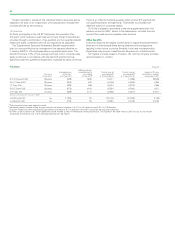

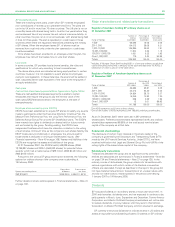

basis after the main business of the meeting. In 2007, voting levels at

the AGM showed a slight decrease to 61%, compared with 64% in

2006. It is proposed that the AGM in 2008 will also be webcast.

Director elections

All directors stand for re-election by shareholders each year, with new

directors being subject to election at the first opportunity following

their appointment. All the names submitted to shareholders for

election are accompanied by a biography and a description of the

skills and experience that the company feels are relevant in

proposing each director for election.

Voting levels at the 2007 AGM demonstrated continued support

for all BP directors.

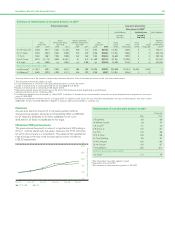

Board composition, skills and renewal

The board governance principles require the majority of the board to be

composed of independent non-executive directors and the size of the

board not normally to exceed 16 directors. The board is composed of

the chairman, 10 non-executive and five executive directors; in total,

four nationalities are represented.

Lord Browne resigned as group chief executive on 1 May 2007 and

was succeeded by Dr Anthony Hayward, who had been appointed group

74