BP 2007 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144

34 Derivative financial instruments continued

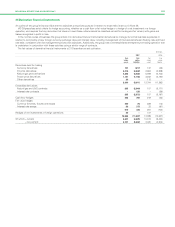

Derivatives held for trading

The group maintains active trading positions in a variety of derivatives. The contracts may be entered into for risk management purposes, to satisfy

supply requirements or for entrepreneurial trading. Certain contracts are classified as held for trading, regardless of their original business objective,

and are recognized at fair value with changes in fair value recognized in the income statement. Trading activities are undertaken by using a range of

contract types in combination to create incremental gains by arbitraging prices between markets, locations and time periods. The net of these

exposures is monitored using market value-at-risk techniques as described in Note 28.

The following tables show further information on the fair value of derivatives and other financial instruments held for trading purposes. The fair

values at the year end are not materially unrepresentative of the position throughout the year.

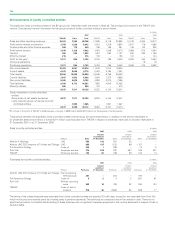

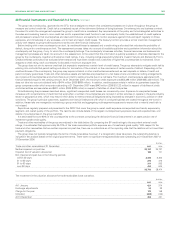

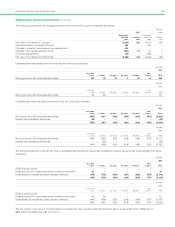

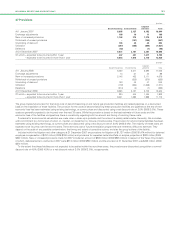

Changes during the year in the net fair value of derivatives held for trading purposes were as follows.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Oil Natural gas Power

Currency price price price Other

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair value of contracts at 1 January 2007 105 296 855 42 113

Contracts realized or settled in the year (109) (289) (602) (68) (83)

Fair value of options at inception – 28 168 36 –

Fair value of other new contracts entered into during the year ––1–

Changes in fair values relating to price (167) (253) (58) (20) –

Exchange adjustments 1 – 2 (9) –

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair value of contracts at 31 December 2007 (170) (218) 366 (19) 30

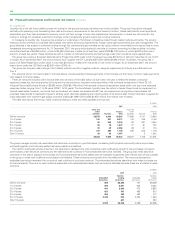

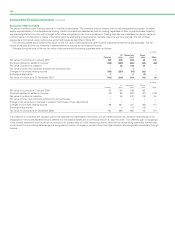

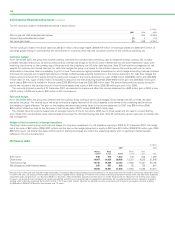

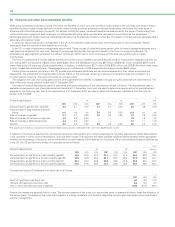

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Oil Natural gas Power

Currency price price price Other

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair value of contracts at 1 January 2006 23 (61) 529 183 –

Contracts realized or settled in the year (16) 85 (327) (37) (106)

Fair value of options at inception – 36 247 (70) 45

Fair value of other new contracts entered into during the year ––21

Change in fair value due to changes in valuation techniques or key assumptions –1––

Changes in fair values relating to price 98 231 421 (22) 174

Exchange adjustments – 4 (17) (13) –

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair value of contracts at 31 December 2006 105 296 855 42 113

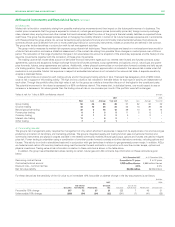

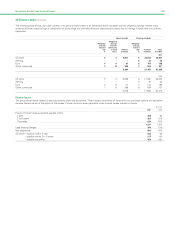

If at inception of a contract the valuation cannot be supported by observable market data, any gain determined by the valuation methodology is not

recognized in the income statement but is deferred on the balance sheet and is commonly known as ‘day-one profit’. This deferred gain is recognized

in the income statement over the life of the contract until substantially all of the remaining contract term can be valued using observable market data

at which point any remaining deferred gain is recognized in income. Changes in valuation from this initial valuation are recognized immediately through

income.

–

–

–