BP 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

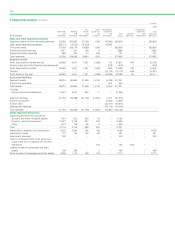

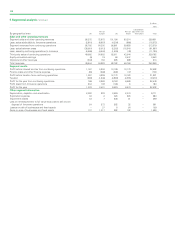

3 Non-current assets held for sale and discontinued operations

Non-current assets held for sale

On 5 December 2007, BP announced it had signed a memorandum of understanding with Husky Energy Inc. to form an integrated North American oil

sands business. BP will contribute its Toledo refinery to a US joint venture in return for Husky contributing its Sunrise field to a Canadian joint venture.

The transaction is expected to be completed by the end of March 2008. At 31 December 2007, certain Toledo refinery assets and associated liabilities

were classified as a disposal group held for sale. No impairment loss has been recognized in relation to this disposal group.

On 27 June 2006, BP announced its intention to sell the Coryton refinery in the UK, following a review of its European refinery portfolio, that

concluded that the group would optimize its value by focusing on a smaller, but more advantaged, refining portfolio in Europe. In addition, given the

integrated nature of the operations, the bitumen business in the UK was also included with the divestment, along with the Coryton bulk terminal

(together ‘the Coryton disposal group’).

At 31 December 2006, negotiations for the sale were in progress and the assets and associated liabilities were classified as a disposal group held

for sale. No impairment loss was recognized at the time of reclassification of the Coryton disposal group as held for sale nor at 31 December 2006.

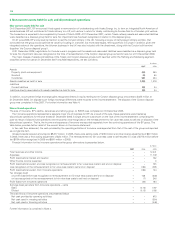

The major classes of assets and liabilities of the Toledo and Coryton disposal groups, both reported within the Refining and Marketing segment,

classified as held for sale at 31 December 2007 and 2006 respectively, are set out below.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Assets

Property, plant and equipment 635 564

Goodwill 90 60

Inventories 561 454

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Assets classified as held for sale 1,286 1,078

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Liabilities

Current liabilities 163 54

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Liabilities directly associated with assets classified as held for sale 163 54

In addition, accumulated foreign exchange gains recognized directly in equity relating to the Coryton disposal group amounted to $122 million at

31 December 2006. On disposal such foreign exchange differences were recycled to the income statement. The disposal of the Coryton disposal

group was completed in May 2007. For further information see Note 4.

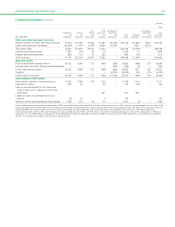

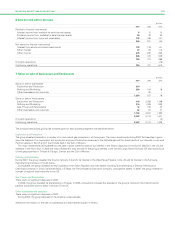

Discontinued operations

The sale of Innovene, BP’s olefins, derivatives and refining group, to INEOS was completed on 16 December 2005.

The Innovene operations represented a separate major line of business for BP. As a result of the sale, these operations were treated as

discontinued operations for the year ended 31 December 2005. A single amount was shown on the face of the income statement comprising the

post-tax result of discontinued operations and the post-tax loss recognized on the remeasurement to fair value less costs to sell and on disposal of the

discontinued operation. That is, the income and expenses of Innovene are reported separately from the continuing operations of the BP group. The

table below provides further detail of the amount shown in the income statement.

In the cash flow statement, the cash provided by the operating activities of Innovene was separated from that of the rest of the group and reported

as a single line item.

Gross proceeds received amounted to $8,477 million. In 2005, there were selling costs of $120 million and initial closing adjustments of $43 million.

In 2006, there was a final closing adjustment of $34 million. The remeasurement to fair value less costs to sell resulted in a loss of $775 million before

tax ($184 million recognized in 2006 and $591 million in 2005).

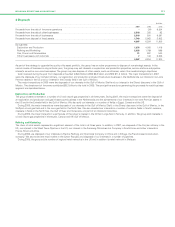

Financial information for the Innovene operations after group eliminations is presented below.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total revenues and other income –– 12,441

Expenses –– 11,709

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit (loss) before interest and taxation ––732

Other finance income (expense) ––

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit (loss) before taxation and loss recognized on remeasurement to fair value less costs to sell and on disposal ––735

Loss recognized on the remeasurement to fair value less costs to sell and on disposal –(184) (591)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit (loss) before taxation from Innovene operations –(184) 144

Tax (charge) credit

on profit (loss) before loss recognized on remeasurement to fair value less costs to sell and on disposal –166 (306)

on loss recognized on the remeasurement to fair value less costs to sell and on disposal –(7) 346

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit (loss) from Innovene operations –(25) 184

Earnings (loss) per share from Innovene operations – cents

Basic –(0.13) 0.87

Diluted –(0.12) 0.86

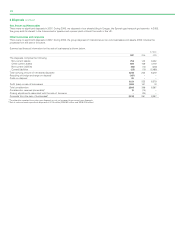

The cash flows of Innovene operations are presented below

Net cash provided by operating activities ––970

Net cash used in investing activities –– (524)

Net cash used in financing activities –– (446)

Further information is contained in Note 4.

3