BP 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

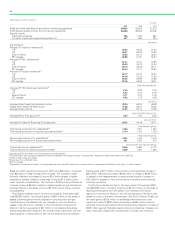

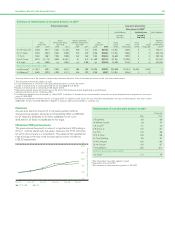

Contractual commitments

The following table summarizes the group’s principal contractual obligations at 31 December 2007. Further information on borrowings and finance

leases is given in Financial statements – Note 35 on page 148 and further information on operating leases is given in Financial statements – Note 15

on page 126.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Payments due by period

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Expected payments by period under contractual 2013 and

obligations and commercial commitments Total 2008 2009 2010 2011 2012 thereafter

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Borrowingsa33,142 16,293 7,910 3,410 1,339 2,273 1,917

Finance lease future minimum lease payments 1,291 268 101 105 108 79 630

Operating leasesb16,938 3,780 3,016 1,975 1,445 1,224 5,498

Decommissioning liabilities 13,416 455 342 438 195 244 11,742

Environmental liabilities 2,260 448 424 326 245 202 615

Pensions and other post-retirement benefitsc23,743 1,134 1,127 883 717 718 19,164

Purchase obligationsd164,943 105,922 16,739 9,446 5,986 4,711 22,139

aExpected payments include interest payments on borrowings totalling $2,990 million ($1,145 million in 2008, $767 million in 2009, $401 million in 2010, $247 million in

2011, $191 million in 2012 and $239 million thereafter).

bThe future minimum lease payments are before deducting related rental income from operating sub-leases. Where an operating lease is entered into solely by the group as

the operator of a jointly controlled asset, the total cost is included irrespective of any amounts that will be reimbursed by joint venture partners. Where operating lease

costs are incurred in relation to the hire of equipment used in connection with a capital project, some or all of the cost may be capitalized as part of the capital cost of the

project.

cRepresents the expected future contributions to funded pension plans and payments by the group for unfunded pension plans and the expected future payments for other

post-retirement benefits.

dRepresents any agreement to purchase goods or services that is enforceable and legally binding and that specifies all significant terms. The amounts shown include

arrangements to secure long-term access to supplies of crude oil, natural gas, feedstocks and pipeline systems. In addition, the amounts shown for 2008 include purchase

commitments existing at 31 December 2007 entered into principally to meet the group’s short-term manufacturing and marketing requirements. The price risk associated

with these crude oil, natural gas and power contracts is discussed in Financial statements – Note 28 on page 136.

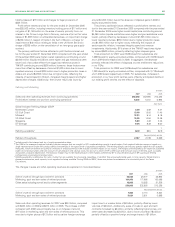

The following table summarizes the nature of the group’s unconditional purchase obligations.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Payments due by period

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2013 and

Purchase obligations Total 2008 2009 2010 2011 2012 thereafter

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Crude oil and oil products 82,830 66,391 4,333 3,156 2,012 1,477 5,461

Natural gas 41,064 21,314 5,757 2,893 1,926 1,520 7,654

Chemicals and other refinery feedstocks 13,564 4,694 2,078 1,490 900 643 3,759

Power 14,662 10,929 3,079 648 1 5 –

Utilities 1,545 182 135 119 118 116 875

Transportation 3,921 1,116 615 452 330 266 1,142

Use of facilities and services 7,357 1,296 742 688 699 684 3,248

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total 164,943 105,922 16,739 9,446 5,986 4,711 22,139

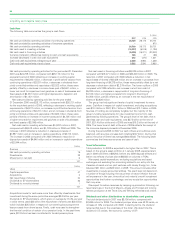

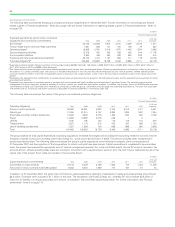

The group expects its total capital expenditure, excluding acquisitions and asset exchanges and excluding the accounting related to our entry into the

Canadian oil sands via two joint ventures with Husky Energy Inc., to be around $21-22 billion in 2008. This amount includes other investments in

equity-accounted entities. The following table summarizes the group’s capital expenditure commitments for property, plant and equipment at

31 December 2007 and the proportion of that expenditure for which contracts have been placed. Capital expenditure is considered to be committed

when the project has received the appropriate level of internal management approval. For jointly controlled assets, the net BP share is included in the

amounts shown. Where operating lease costs are incurred in connection with a capital project, some or all of the cost may be capitalized as part of the

capital cost of the project. Such costs are included in the amounts shown.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2013 and

Capital expenditure commitments Total 2008 2009 2010 2011 2012 thereafter

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Committed on major projects 24,013 5,329 3,799 1,646 742 1,403 11,094

Amounts for which contracts have been placed 8,263 5,200 1,999 747 187 57 73

In addition, at 31 December 2007, the group had committed to capital expenditure relating to investments in equity-accounted entities amounting to

$4.5 billion. Contracts were in place for $1.1 billion of this total. The transaction with Husky Energy Inc., whereby BP will contribute $2.5 billion in

return for an interest in an equity-accounted joint venture, is included in the committed capital expenditure. For further information, see Financial

statements – Note 3 on page 110.