BP 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

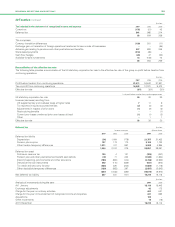

BP ANNUAL REPORT AND ACCOUNTS 2007 127

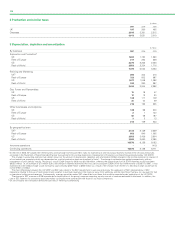

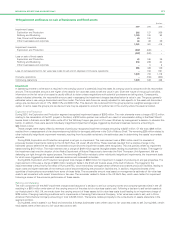

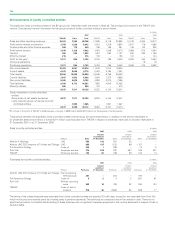

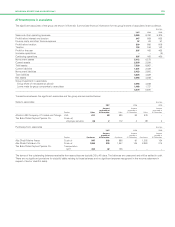

The group has entered into a number of structured operating leases for ships and in most cases the lease rental payments vary with market interest

rates. The variable portion of the lease payments above or below the amount based on the market interest rate prevailing at inception of the lease is

treated as contingent rental expense, but the amounts of such contingent rentals are not significant for the years presented. The group also routinely

enters into bareboat charters, time-charters and spot-charters for ships on standard industry terms.

The most significant items of plant and machinery hired under operating leases are drilling rigs used in the Exploration and Production segment. In

some cases, drilling rig lease rental rates are adjusted periodically to market rates that are influenced by oil prices and may be significantly different

from the rates at the inception of the lease. Differences between the rate paid and rate at inception of the lease are treated as contingent rental

expense.

Commercial vehicles hired under operating leases are primarily railcars. Retail service station sites and office accommodation are the main items in

the land and buildings category.

The terms and conditions of these operating leases do not impose any significant financial restrictions on the group. Some of the leases of ships

and buildings allow for renewals at BP’s option.

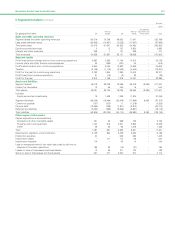

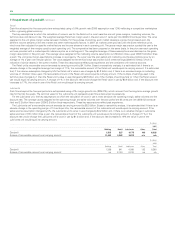

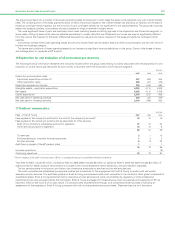

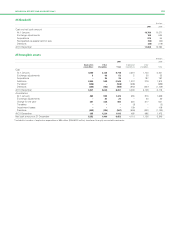

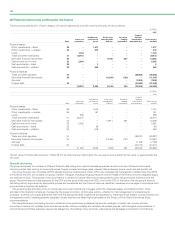

16 Exploration for and evaluation of oil and natural gas resources

The following financial information represents the amounts included within the group totals relating to activity associated with the exploration forand

evaluation of oil and natural gas resources. All such activity is recorded within the Exploration and Production segment.

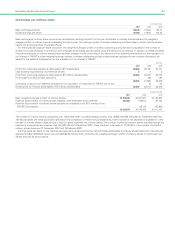

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Exploration and evaluation costs

Exploration expenditure written off 347 624 305

Other exploration costs 409 421 379

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Exploration expense for the year 756 1,045 684

Intangible assets – exploration expenditure 5,252 4,110 4,008

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net assets 5,252 4,110 4,008

Capital expenditure 2,000 1,537 950

Net cash used in operating activities 409 421 379

Net cash used in investing activities 2,000 1,498 950

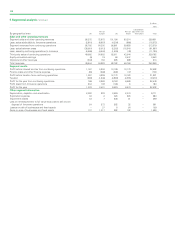

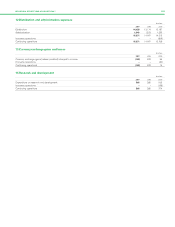

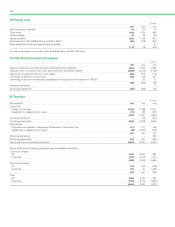

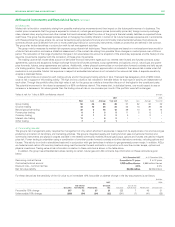

17 Auditors’ remuneration

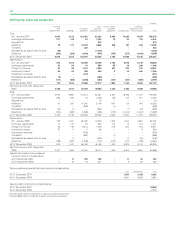

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fees – Ernst & Young 2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fees payable to the company’s auditors for the audit of the company’s accountsa18 15 19

Fees payable to the company’s auditors and its associates for other services

Audit of the company’s subsidiaries pursuant to legislation 31 31 34

Other services pursuant to legislation 14 15 6

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

63 61 59

Tax services 211

Services relating to corporate finance transactions 12

All other services 892

Audit fees in respect of the BP pension plans 1–

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

75 73 96

Innovene operations –– (9)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Continuing operations 75 73 87

aFees in respect of the audit of the accounts of BP p.l.c. including the group’s consolidated financial statements.

Total fees for 2007 include $7 million of additional fees for 2006 (2006 includes $5 million of additional fees for 2005 and 2005 includes $4 million of

additional fees for 2004). Auditors’ remuneration is included in the income statement within distribution and administration expenses.

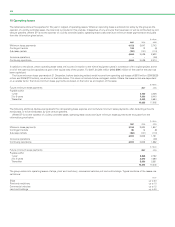

The tax services relate to income tax and indirect tax compliance, employee tax services and tax advisory services.

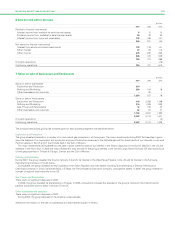

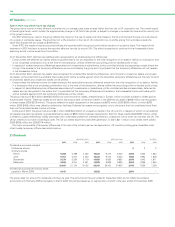

The audit committee has established pre-approval policies and procedures for the engagement of Ernst & Young to render audit and certain

assurance and tax services. The audit fees payable to Ernst & Young are reviewed by the audit committee in the context of other global companies for

cost-effectiveness. Ernst & Young performed further assurance and tax services that were not prohibited by regulatory or other professional

requirements and were pre-approved by the committee. Ernst & Young is engaged for these services when its expertise and experience of BP are

important. Most of this work is of an audit nature. Tax services were awarded either through a full competitive tender process or following an

assessment of the expertise of Ernst & Young compared with that of other potential service providers. These services are for a fixed term.

0

3

3

1