BP 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

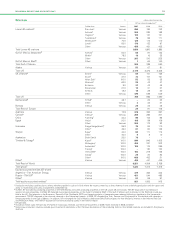

through our interests in the Sanga-Sanga PSA (BP 38%), which supplies

natural gas to the Bontang LNG plant, and Tangguh PSA (BP 37.2%),

which is under construction; and in Australia through our share of LNG

from the NWS natural gas development (BP 16.7% infrastructure and oil

reserves and 15.8% gas and condensate reserves).

Assets and activity during 2007 included:

– In Trinidad, the Atlantic LNG Train 4 (BP 37.8%) is the largest

producing LNG train in the world and is designed to produce 5.2

million tonnes (253,000mmcf) per year of LNG. BP expects to

continue to supply at least two-thirds of the gas to the train. The

Atlantic LNG Trains 2, 3, and 4 facilities are operated under a tolling

arrangement, with the equity owners retaining ownership of their

respective gas. The LNG is sold in the US, Dominican Republic and

other destinations. BP’s net share of the capacity of Atlantic LNG

Trains 1, 2, 3 and 4 is 6.5 million tonnes (310,000mmcf) of LNG per

year.

– In Indonesia, BP is involved in two of the three LNG centres in the

country. BP participates in Indonesia’s LNG exports through its

holdings in the Sanga-Sanga PSA (BP 38%). Sanga-Sanga currently

delivers around 14% of the total gas feed to Bontang, one of the

world’s largest LNG plants. The Bontang plant produced 18.4 million

tonnes (831,000mmcf) of LNG in 2007, compared with 19.5 million

tonnes in 2006.

– Also in Indonesia, BP has interests in the Tangguh LNG joint venture

(BP 37.2% and operator) and in each of the Wiriagar (BP 38% and

operator), Berau (BP 48% and operator) and Muturi (BP 1%) PSAs in

north-west Papua that are expected to supply feed gas to the

Tangguh LNG plant. During 2007, construction continued on two

trains, with commercial delivery planned in early 2009. Tangguh will

be the third LNG centre in Indonesia, with an initial capacity of 7.6

million tonnes (388,000mmcf) per year. Tangguh has signed sales

contracts for delivery to China, Korea and North America’s west coast.

– In Australia, we are one of seven partners in the NWS venture. Six

partners (including BP) hold an equal 16.7% interest in the

infrastructure and oil reserves and an equal 15.78% interest in the gas

and condensate reserves, with a seventh partner owning the

remaining 5.32% of gas and condensate reserves. The joint venture

operation covers offshore production platforms, an FPSO, trunklines,

onshore gas and LNG processing plants and LNG carriers.

Construction continued during 2007 on a fifth LNG train that is

expected to process 4.7 million tonnes of LNG per year and is

expected to increase the plant’s capacity to 16.6 million tonnes per

year. The train is expected to be commissioned during the second half

of 2008. NWS produced 1.96 million tonnes (102,000mmcf) of LNG,

equal to 2006 production.

– We have a 10% equity shareholding in the Abu Dhabi Gas

Liquefaction Company, which in 2007 supplied 5.6 million tonnes

(272,710mmcf) of LNG, up 4.2% on 2006.

– BP has a 13.6% share in the Angola LNG project, which is expected

to receive approximately one billion cubic feet of associated gas per

day from offshore producing blocks and produce 5.2 million tonnes

per year of LNG, as well as related gas liquids products, with first LNG

expected in 2012. With the completion of the necessary agreements

and the approval of the Angolan government, the project investors

have authorized Angola LNG Limited to proceed with the construction

and implementation of the project.

26