BP 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

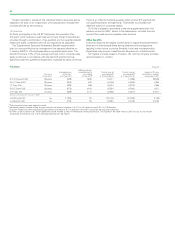

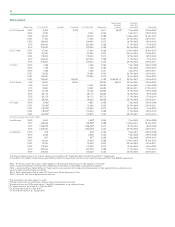

Service contracts

------------------------------------------------------------------------------------------------------------------------------------------------

Director Contract date Salary as at 31 Dec 2007

------------------------------------------------------------------------------------------------------------------------------------------------

Dr A B Hayward 29 Jan 2003 £950,000

Dr D C Allen 29 Jan 2003 £510,000

I C Conn 22 Jul 2004 £650,000

Dr B E Grote 7 Aug 2000 $1,300,000

A G Inglis 1 Feb 2007 £650,000

Service contracts are expressed to expire at a normal retirement age of

60 (subject to age discrimination). The contracts have a notice period of

one year.

The service contracts of UK directors may be terminated by the

company at any time with immediate effect on payment in lieu of notice

equivalent to one year’s salary or the amount of salary that would have

been paid if the contract had terminated on the expiry of the remainder

of the notice period.

Dr Grote’s contract is with BP Exploration (Alaska) Inc. He is seconded

to BP p.l.c. under a secondment agreement of 7 August 2000, which

expires on 31 March 2010. The secondment can be terminated by one

month’s notice by either party and terminates automatically on the

termination of Dr Grote’s service contract.

There are no other provisions for compensation payable on early

termination of the above contracts. In the event of the early termination

of any of the contracts by the company, other than for cause (or under

a specific termination payment provision), the relevant director’s then-

current salary and benefits would be taken into account in calculating

any liability of the company.

Since January 2003, new service contracts include a provision to allow

for severance payments to be phased, when appropriate. The committee

will also consider mitigation to reduce compensation to a departing

director, when appropriate to do so.

Directors leaving the board

2007

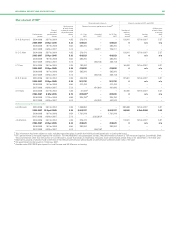

Both Lord Browne and Mr Manzoni, who were employed by the

company under service contracts dated 11 November 1993 and

29 January 2003 respectively, left the company during the year. Lord

Browne, who left on 1 May 2007, was eligible for an ex gratia lump

sum superannuation payment equal to one year’s salary (£1,575,000)

but, in light of his resignation, did not receive the compensation for

loss of office previously notified to shareholders. Mr Manzoni, who

left on 31 August 2007, was entitled to one year’s salary (£485,000)

as compensation on termination in accordance with his contractual

entitlement. Both individuals were eligible for a pro-rata bonus for 2007,

reflecting achievement of bonus targets and their period of employment

during the year. As regards long-term incentives, both individuals retain

their performance awards under the EDIP in respect of 2005-2007 and

2006-2008 share element and these will vest at the normal time to the

extent the performance targets are met. Both individuals forfeited their

participation in the 2007-2009 share element. Further details of these

awards are set out in the table on page 69. Both individuals retained their

outstanding share options, as set out in the table on page 70.

In connection with the shareholder derivative actions brought in the US

against the directors of the company, the company has agreed with the

plaintiffs in the Alaska action, with the consent of Lord Browne and

Mr Manzoni, to defer the release of certain amounts and preserved share

awards to those individuals (other than Lord Browne’s ex gratia

superannuation payment) pending resolution of the action. The company

has agreed to pay the individuals simple interest at the rate of 6.5% in

respect of the period of deferral.

2008

As has been announced, Dr Allen will leave the company at the end

of March 2008. He will be entitled to one year’s salary (£510,000) as

compensation in accordance with his contractual entitlement, as well

as a pro-rata bonus for 2008 and continued full participation in the

2006-2008 and 2007-2009 share elements, according to the normal

rules of the plan.

Executive directors – external appointments

The board encourages executive directors to broaden their knowledge

and experience by taking up appointments outside the company. Each

executive director is permitted to accept one non-executive appointment,

from which they may retain any fee. External appointments are subject

to agreement by the chairman and must not conflict with a director’s

duties and commitments to BP.

During the year, the fees received by executive directors for external

appointments were as follows:

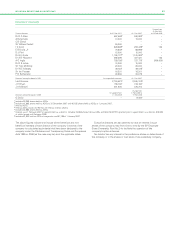

------------------------------------------------------------------------------------------------------------------------------------------------

Executive director Appointee company Total fees

------------------------------------------------------------------------------------------------------------------------------------------------

Dr A B Hayward Corus £62,250

Tata Steel £177

------------------------------------------------------------------------------------------------------------------------------------------------

I C Conn Rolls Royce £57,166

------------------------------------------------------------------------------------------------------------------------------------------------

Dr B E Grote Unilever Unilever PLC £31,000

Unilever NV E45,000

------------------------------------------------------------------------------------------------------------------------------------------------

A G Inglis BAE Systems £39,661

Remuneration committee

All the members of the committee are independent non-executive

directors. Throughout the year, Dr Julius (chairman), Mr Davis,

Sir Tom McKillop and Sir Ian Prosser were members. Mr Bryan retired

as a member in April 2007. The group chief executive at the time was

consulted on matters relating to the other executive directors who report

to him and on matters relating to the performance of the company;

he was not present when matters affecting his own remuneration

were discussed.

Tasks

The remuneration committee’s tasks are:

– To determine, on behalf of the board, the terms of engagement and

remuneration of the group chief executive and the executive directors

and to report on these to the shareholders.

– To determine, on behalf of the board, matters of policy over which

the company has authority regarding the establishment or operation

of the company’s pension scheme of which the executive directors

are members.

– To nominate, on behalf of the board, any trustees (or directors of

corporate trustees) of the scheme.

– To review the policies being applied by the group chief executive in

remunerating senior executives other than executive directors to

ensure alignment and proportionality.

Constitution and operation

Each member of the remuneration committee is subject to annual re-

election as a director of the company. The board considers all committee

members to be independent (see page 75).

They have no personal financial interest, other than as shareholders,

in the committee’s decisions.

The committee met six times in the period under review. There was a

full attendance record. Mr Sutherland, as chairman of the board, attended

all the committee meetings.

The committee is accountable to shareholders through its annual

report on executive directors’ remuneration. It will consider the outcome

of the vote at the AGM on the directors’ remuneration report and

take into account the views of shareholders in its future decisions.

The committee values its dialogue with major shareholders on

remuneration matters.

BP ANNUAL REPORT AND ACCOUNTS 2007 71